Permanent business closures are on the rise: Morning Brief

Thursday, July 23, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

And restaurants are getting hit hardest.

During the early phases of this crisis, economists had emphasized the spike in temporary unemployment.

As of June, some 10.6 million workers were temporarily unemployed, down from 18 million in April. And after 7.4 million jobs were added back to the economy between April and June, the decline in this data is indicative of a labor market that is healing.

The number of job losers who see their unemployment as permanent, however, is also on the rise, climbing to 2.9 million in June and up from 1.3 million in February when the recession began.

The convergence of these data along with the troubling signal initial jobless claims and continuing jobless claims are sending about the state of the labor market paints an employment picture in the U.S. that is growing more grim.

And in keeping with this darkening outlook for the labor market, recent data on business re-openings has also been discouraging.

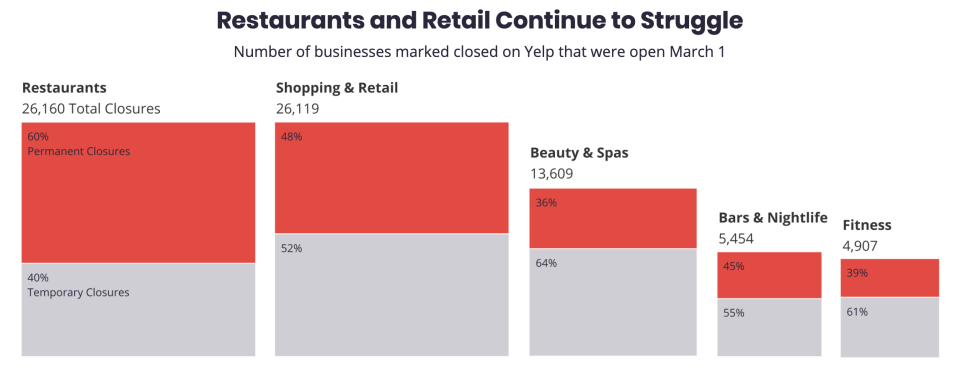

Data from Yelp published this month shows that 55% percent of business closures since March 1 are permanent. In June, Yelp’s data indicated that 41% of business closure were permanent.

“Even as total closures fall, permanent closures increase with 72,842 businesses permanently closed, out of the 132,580 total closed businesses, an increase of 15,742 permanent closures since June 15,” Yelp said in its report.

“This also means that the percentage of permanent to temporary business closures is rising, with permanent closures now accounting for 55% of all closed businesses since March 1, an increase of 14% from June when we reported 41% of closures as permanent. Overall, permanent closures have steadily increased since the peak of the pandemic with minor spikes in March, followed by May and June.”

And no industry has been hit harder than the restaurant business.

“The restaurant industry now reflects the highest total business closures, recently surpassing retail,” Yelp said in its report.

“As of July 10, there have been 26,160 total restaurant closures, an increase of 2,179 since June 15. Of the all closed restaurants in July, 15,770 have permanently closed (60%), accounting for 2,956 more permanent closures, a 23% increase since June 15.”

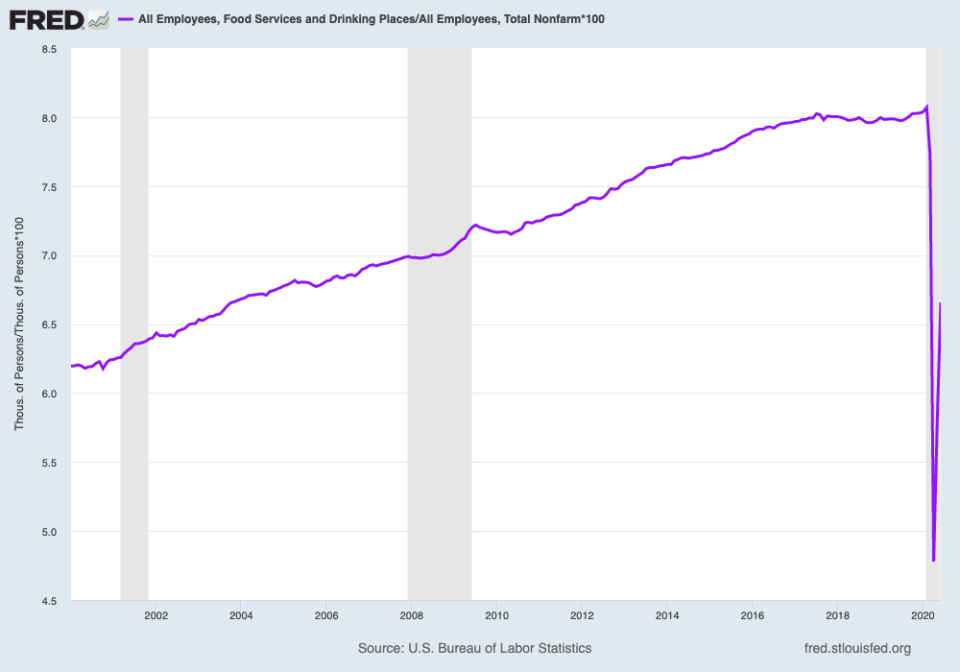

The permanent closure of restaurants should heighten efforts to maintain unemployment benefits and find additional measures to support those out of work. And particularly given the rise in employment we’ve seen from this sector over the last several decades.

As of February, employment at food and drinking places accounted for 8% of all employment in the U.S. In April, this proportion was cut in half, and even with some recovery in May and June, the sector accounts for a percentage of total employment last seen in October 2003. Looking at employment totals, food and drinking employment was north of 12 million in February and had recovered to just 9.17 million in June, a level not seen since November 2005.

In short, the pandemic wiped out almost two decades of employment gains for the sector in just a few months. A sector that grew employment faster than the overall economy over the last decade.

And so with more restaurants closing for good, the risk is that this recovery in employment stalls out or, even worse, declines in the coming months.

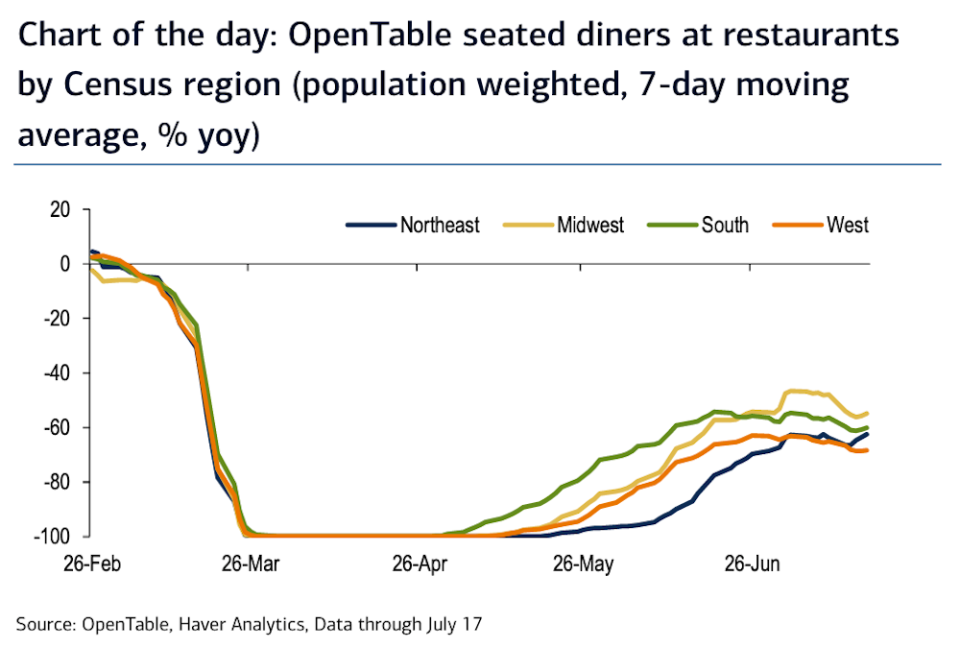

“The resurgence in the spread of COVID-19 since mid-June is weighing on economic activity,” said Bank of America economists Stephen Juneau and Michelle Meyer in a note to clients on Tuesday.

“Mobility has stalled in July according to data from the Dallas Fed and Google. Consumers are becoming more hesitant to take part in activities that are difficult to do while socially distancing, specifically air travel and dining in at restaurants... OpenTable data shows that the Northeast —the region with the virus most under control — was the only Census Region to see an increase in the annual change in seated diners since our last update.”

“It is clear that the path of the economic recovery cannot be disentangled from the path of the virus. In response to this latest outbreak, there are 22 states that have reversed or paused their reopening, unchanged from last week, and 28 states with state-wide face masks mandates, up from 24 previously,” the firm adds.

“While these measures may mean more short-term economic pain — as revealed by the economic data tracked in this report — they should help lead to a more sustainable and predictable recovery.”

A recovery growing more precarious by the day for the tens of millions currently out of work.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Initial jobless claims, week ended July 18 (1.3 million expected, 1.3 million prior week)

8:30 a.m. ET: Continuing claims, week ended July 11 (17.1 million expected, 17.338 million prior)

10:00 a.m. ET: Leading Index, June (2.1% expected, 2.8% prior)

11:00 a.m. ET: Kansas City Fed Manufacturing Activity, July (5 expected, 1 prior)

Earnings

Pre-market

6:00 a.m. ET: Dow Inc. (DOW) is expected to report an adjusted loss of 30 cents per share on revenue of $7.93 billion

6:00 a.m. ET: Southwest Airlines (LUV) is expected to report an adjusted loss of $2.77 per share on revenue of $904.19 million

6:45 a.m. ET: Quest Diagnostics (DGX) is expected to report adjusted earnings of 80 cents per share on revenue of $1.68 billion

6:55 a.m. ET: AT&T (T) is expected to report adjusted earnings of 79 cents per share on revenue of $40.94 billion

6:55 a.m. ET: The Travelers Corp (TRV) is expected to report an adjusted loss of 20 cents per share on revenue of $7.66 billion

7:00 a.m. ET: Cintas (CTAS) is expected to report adjusted earnings of $1.22 per share on revenue of $1.56 billion

7:00 a.m. ET: Hershey (HSY) is expected to report adjusted earnings of $1.12 per share on revenue of $1.74 billion

7:00 a.m. ET: Twitter (TWTR) is expected to report an adjusted loss of 1 cent per share on revenue of $704.58 million

7:05 a.m. ET: Citrix Systems (CTXS) is expected to report adjusted earnings of $1.23 per share on revenue of $768.73 million

7:30 a.m. ET: American Airlines (AAL) is expected to report an adjusted loss of $7.95 of per share on revenue of $1.43 billion

7:30 a.m. ET: Kimberly-Clark (KMB) is expected to report adjusted earnings of $1.80 per share on revenue of $4.5 million

8:00 a.m. ET: Alaska Air Group (ALK) is expected to report an adjusted loss of $3.86 per share on revenue of $329.25 million

8:00 a.m. ET: Union Pacific (UNP) is expected to report adjusted earnings of $1.56 per share on revenue of $4.39 billion

Post-market

4:00 p.m. ET: Intel (INTC) is expected to report adjusted earnings of $1.12 per share on revenue of $18.54 billion

4:00 p.m. ET: Skyworks Solutions (SWKS) is expected to report adjusted earnings of $1.13 per share on revenue of $690.46 million

4:05 p.m. ET: E-Trade Financial (ETFC) is expected to report adjusted earnings of a 76 cents per share on revenue of $673.92 million

4:15 p.m. ET: Boston Beer Co. (SAM) is expected to report adjusted earnings of $2.45 per share on revenue of $430.36 million

Top News

Tesla earnings: Tesla posts surprise Q2 profit, ramping up cash despite coronavirus

Elon Musk says next Tesla Gigafactory will be near Austin, Texas

European stocks rise ahead of key vote on EU recovery plan

Microsoft blows past Wall Street estimates, earnings boosted by cloud revenue

Whirlpool beats Wall St estimates, CEO says staying at home during COVID-19 key driver

YAHOO FINANCE HIGHLIGHTS

Billionaire investor Bill Ackman looks 'to marry a unicorn' with record-breaking SPAC

Apple seeks to undercut antitrust arguments ahead of Congressional hearing with new study

Media mogul Byron Allen: 'I think President Trump is totally wrong'

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay