Powell’s Pivot Leaves Traders Debating Size, Path of Rate Cuts

(Bloomberg) -- Now that Federal Reserve Chair Jerome Powell has made it crystal clear that interest-rate cuts are coming next month, bond traders are focusing in on bets over the size of that first reduction and the future path of easing.

Most Read from Bloomberg

Sydney Central Train Station Is Now an Architectural Destination

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

How the Corti?os of S?o Paulo Helped Shelter South America’s Largest City

Powell, speaking Friday at the US central bank’s annual symposium in Wyoming, said the “time has come” for the Fed to lower benchmark rates from their two-decade high, his clearest signal yet that long-awaited rate cuts are imminent.

While the Fed chair gave no indication on the size of cuts or the path of easing, he noted progress on inflation and said central bankers will be keeping a close eye on the health of the labor market as a guide for where to take policy. His words were enough to send US Treasury yields and the dollar lower and stocks higher on Friday as investors perceived a green light to take on risk.

“Markets need to digest this speech and remind themselves they — and the Fed — are still data dependent,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. Although Powell struck a dovish tone, “now the data has to back it up.”

That was, however, before conflict in the Middle East that saw Israel attack Hezbollah sites in southern Lebanon as the Iran-backed militant group began what it said was its initial response to last month’s killing of its military chief.

The upheaval stands to muddy traders’ game plan when markets reopen in Asia on Monday, particularly in terms of demand for safe havens, such as Treasuries and the dollar.

As of Friday, the next big wagers on rate cuts were already coming into focus. Traders added to bets on a half-point of rate cuts in September. And the increasingly weak greenback was emerging as the currency of choice for a new wave of so-called carry trades involving risky bets made with borrowed money.

As Treasuries advanced following Powell’s speech, yields of all maturities fell, with the benchmark 10-year rate ending the day at 3.8%, shedding 8 basis points on the week. The gains added to positive returns for US government debt this month, which were already at 1.44% through Thursday, according to a Bloomberg index.

Treasuries are now on course to book gains for a fourth straight month, the longest string of positive returns in three years. The outlook for lower Fed policy rate has the S&P 500 index up 18% so far in 2024. The Bloomberg dollar index has shed over 4% since late June.

While a prolonged heightening of geopolitical risk in the Middle East would also boost demand for US debt — the ultimate safe haven — it could prompt the S&P 500 to pare gains and bolster the greenback.

‘Direction of Travel’

At Jackson Hole on Friday, Powell said “the direction of travel is clear,” but that “the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

What this means for September is, “the 25 basis points versus 50 basis points is still an open debate,” John Velis, a foreign-exchange and macro strategist at BNY Mellon.

Powell’s comments put immense importance on the next monthly US labor report, which is due Sept. 6. The most recent jobs data came in softer than expected, and if the next set follows suit, “then 50 basis points could come into the picture,” Velis said.

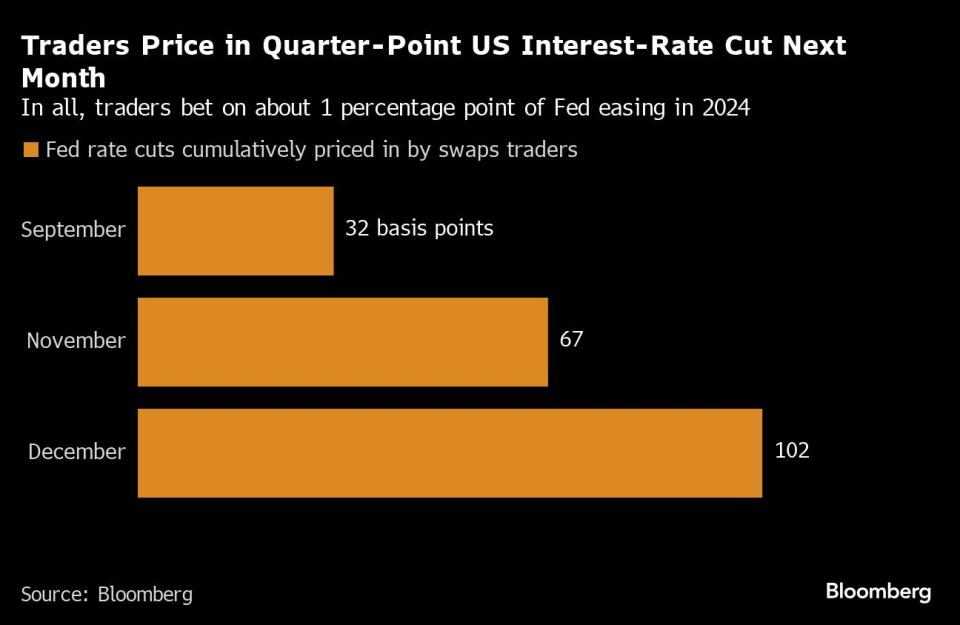

For all of 2024, rates on swaps contract tied to central bank policy meetings signal a total of about 1 percentage point worth of reduction. With only three Fed gatherings left this year, that suggests traders see a solid chance that one reduction is super-sized.

What Bloomberg strategists say ...

Jerome Powell ultimately told us what we already knew, albeit perhaps a little more forcefully than some of his colleagues. It all throws the focus squarely upon the next payroll figure in a couple of weeks, and beyond that, of course, next month’s FOMC announcement.

— Cameron Crise, strategist. Read more on MLIV.

Well ahead of next month’s reading on August job creation will be a slew of data to parse next week. Key on the docket is the July personal consumption expenditures price index, the Fed’s preferred inflation measure, which will be released on Aug. 30. The annual PCE figures are forecast, for both headline and core measures, to be slightly higher than June’s levels.

Whatever trajectory rate cuts take, the pivot to cuts is seen as a negative for the dollar, making it a potentially appealing currency for use in carry trades, where traders could borrow in the greenback to invest in higher-yielding currencies and assets. To work, though, those trades rely on low volatility, particularly in the funding currency — something that could be in doubt if fighting in the Middle East escalates.

“Asia and the rest of emerging markets will likely see this as an open bar paid by US dollars,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors in Singapore, after Powell’s remarks on Friday. “Grab a pint of carry or a cocktail of risk and let the sober worry about tomorrow.”

Global investors had poured into carry trades involving borrowed yen to buy assets in higher-yielding currencies until July 31, when the Bank of Japan raised interest rates for a second time this year. That sparked a jump in the yen that caused the trade to unravel and sent reverberations across global markets.

Citigroup Inc. flagged last week that it’s seen a revival of the strategy, with dollars used to fund the trade rather than the yen.

“All eyes will be on the yen when Asia starts trading on Monday,” said Shoki Omori, chief desk strategist at Mizuho Securities in Tokyo said Friday, following Powell’s speech. “The dollar was in freefall against everything from the yen to the Brazilian real Friday — investors here might echo the sentiment that beaten-down currencies like the yen are worth buying against the dollar finally, with Powell now saying it’s time for policy to adjust.”

The Japanese currency ended the week at 144.39 per dollar late in New York Friday, gaining 0.7% on the day and up 2.2% over the week.

The yen had already moved higher ahead of Powell’s speech Friday on comments from Bank of Japan Governor Kazuo Ueda, who several hours earlier said the Japanese central bank was likely to continue to raise interest rates.

What to Watch

Economic data:

Aug. 26: Durable good; capital goods; Dallas Fed manufacturing activity; San Francisco Fed President Mary Daly will appear on Bloomberg Television

Aug. 27: FHFA house price index; house price index; S&P CoreLogic; Conference Board consumer confidence; Richmond Fed manufacturing index and business conditions; Dallas Fed services activity

Aug. 28: MBA mortgage applications

Aug. 29: GDP (Q2); personal consumption; GDP price index; core price index; advance goods trade balance; wholesale inventories; retail sales; initial jobless claims; pending home sales

Aug. 30: Personal income and spending; PCE deflator; MNI Chicago PMI; U. of Michigan sentiment and inflation expectations

Fed calendar:

Aug. 28: Atlanta Fed President Raphael Bostic

Aug. 29: Bostic

Auction calendar:

Aug. 26: 13-, 26-week bills

Aug. 27: 2-year notes; 42-day cash management bill

Aug. 28: 17-week bills; 2-year floating-rate notes; 5-year notes

Aug 29: 4-, 8-week bills; 7-year notes

--With assistance from Michael Mackenzie.

Most Read from Bloomberg Businessweek

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

?2024 Bloomberg L.P.