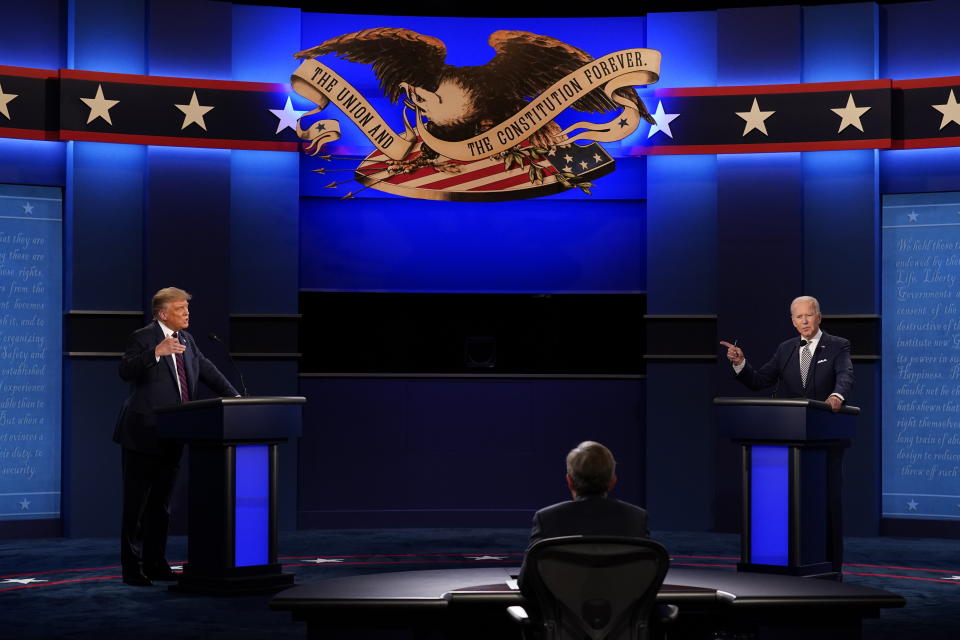

Presidential debate: Investors' biggest concern after the Trump vs. Biden debacle

The market is surprisingly showing a bit of spunk the day after the debacle that was the first presidential election between President Trump and challenger and former vice president Joe Biden.

But don’t be fooled by the morning after reaction, Wall Street strategists warn. Smart money investors are growing very worried about the markets in the lead-up to the election on Nov. 3 in large part because it’s anyone’s guess when the winner will be known. With that unknown will come uncertainty on the public policy that shapes the bottom lines of Corporate America and by extension, stock prices.

“When I talked to investors here, their number one concern is not necessarily who wins the election but when we will know,” said Raymond James Washington policy analyst Ed Mills on Yahoo Finance’s The First Trade. “That kind of conversation last night extends the probability — or increases the probability — of extended uncertainty after the election. From that perspective alone, the market will not like those answers.”

At least for today, the concerns of investors about the election outcome are being pushed aside on hope for a new round of COVID-19 stimulus from lawmakers.

The Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all reversed steep pre-market drops to trade nicely in the green by the early afternoon. Investors nibbled at some of the riskier names in the market despite the debate spectacle. Often volatile momentum stocks such as high-end retailer Canada Goose, electric car maker Nio, cruise line Norwegian Cruise Lines and Chinese tech company Baidu caught solid bids, according to Yahoo Finance’s Trending Ticker tool.

But strategists other than Mills say the lack of decorum on the stage Tuesday night matters to markets.

For one, the bitter back and forth between Trump and Biden could mean a new round of fiscal stimulus will not be passed before the election. That could put further pressure on a U.S. economic recovery that is losing steam as the COVID-19 pandemic rages on. Meanwhile, Trump’s refusal to condemn white supremacy raises the prospect of further chaos in streets across the country in the days leading up to the election and immediately after.

Take all of this together, and it spells uncertainty for investors and businesses. And traditionally, the stock market detests uncertainty.

“What the market is responding to is really a sense that we have no clarity on either side. The process of the election itself, regardless of who the ultimate winner is, it’s the risk in the process,” explained BNY Mellon chief strategist Alicia Levine during Wednesday’s early morning selloff. “You’re going to start seeing sectors react to pricing in an eventual winner here. I think last night Biden had a better night and the market is going to start pricing in a Biden victory.”

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

What’s hot this week from Sozzi:

Watch Yahoo Finance’s live programming on Verizon FIOS channel 604, Apple TV, Amazon Fire TV, Roku, Samsung TV, Pluto TV, and YouTube. Online catch Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance