There's almost no presidential election scenario that market forecasters don't like: Morning Brief

Monday, October 26, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Stocks will either go up or present a buying opportunity, experts say

We’ve been writing for a while about how investors should be thinking about the presidential election and its short-term uncertainties and longer-term risks.

For the most part, experts informed by historical evidence continue to agree: Stocks will either go up or present a buying opportunity.

It’s been almost exactly a year since my colleague Myles wrote for us that “Most presidents are great for the market.”

And just last Friday, the Wall Street Journal similarly published “Stocks Typically Climb, Regardless of Who’s in the White House,” a headline that got memed.

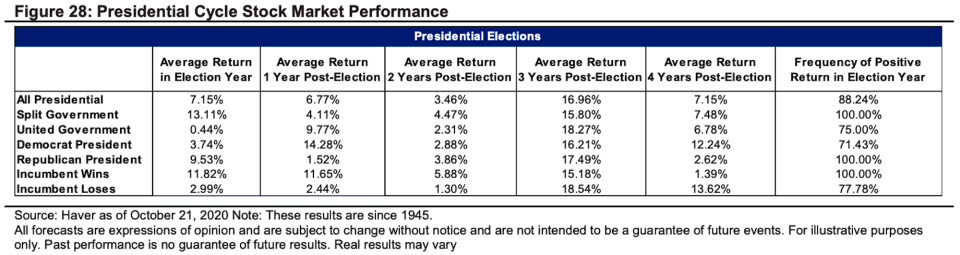

In a note to clients on Thursday, Citi Private Bank’s Steven Wieting shared how stocks performed under various scenarios throughout history.

“Historically, the stock market has performed far better the year after elections when the incumbent party candidate wins but also when the winner is a Democrat, a combination that clearly cannot happen in 2021,” Wieting observed.

On average, an incumbent win was followed by a 14.28% return and a Democrat win was followed by an 11.65% return.

We also can’t help but point out that every number in Wieting’s table is positive. Sure, some of the numbers are only barely positive. But it’s yet another reminder that stocks usually go up.

Of course, like Wieting’s disclaimer reads: “Past performance is no guarantee of future results.” And nothing we’re saying here suggests investors shouldn’t expect volatility.

But like we said earlier, the experts see two scenarios: Stocks will go up or present themselves as a buying opportunity.

“Election (and fiscal) uncertainty may continue to add volatility leading up to the 3 November election, offering entry points to establish long-term positions,” UBS CIO of Global Wealth Management Mark Haefele wrote on Friday.

Even some of the worst-case scenarios for the election may at worst present a buying opportunity.

“If the S&P 500 were to go down to 3,100 index points and we didn’t know what was going on with the election yet, we’re going to be adding to risk at that point no matter what,” Morgan Stanley’s Michael Wilson said to Bloomberg last week.

One thing to make clear is that presidents don’t drive the stock market. It’s the economy, business activity and everything else more closely tied to the prospect for earnings growth. And coming out of the pits of the COVD-19 crisis, most forecasters see much more growth ahead.

“In our view, the stock market will inevitably take its cues from the underlying fundamentals,” Wieting wrote, adding that Citi’s house view for U.S. GDP growth is 3.9% in 2021 and 3.2% in 2022. “If correct, S&P 500 earnings per share should reach a record $174 in 2022. Stay tuned!“

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: Chicago Fed National Activity Index, September (0.6 expected, 0.79 in August)

10:00 a.m. ET: New Home Sales month over month, September (1.3% expected, 4.8% in August)

10:00 a.m. ET: Dallas Fed Manufacturing Activity Index, October (13.3 expected, 13.6 in September)

Earnings

Pre-market

6:30 a.m. ET: Hasbro (HAS) is expected to report adjusted earnings of $1.60 per share on revenue of $1.74 billion

7:30 a.m. ET: HCA Healthcare (HCA) is expected to report adjusted earnings of $2.28 per share on revenue of $12.99 billion

Post-market

4:05 p.m. ET: Twilio (TWLO) is expected to report an adjusted loss of 4 cents per share on revenue of $406.7 million

4:05 p.m. ET: Chegg (CHGG) is expected to report adjusted earnings of 10 cents per share on revenue of $144.08 million

Top News

Stocks sink as COVID cases surge and restrictions tighten [Yahoo Finance UK]

Dunkin' Brands is said to be near an $8.8 billion deal to go private — why it's not a shock [Yahoo Finance]

Bayer acquires gene therapy firm AskBio in $4 billion deal [Yahoo Finance UK]

Oil prices slide 3% on record coronavirus cases and Libyan production [Yahoo Finance UK]

Join us for All Markets Summit

YAHOO FINANCE HIGHLIGHTS

How the 6 swing states will play in the election and in the markets

Santa Claus won't be coming to Macy's this holiday season

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay