Prop 22 explained: California voters embrace legal exemptions for Uber and Lyft

California voters Tuesday embraced a first of its kind ballot measure that allows app-based transportation and delivery drivers to remain classified as independent contractors, despite a state law known as AB5 that went into effect in January and says otherwise.

The Associated Press projected the measure to pass early Wednesday morning. As of 6:49 a.m. ET, The New York Times reported that it had received 58.4% of the vote.

Companies Uber and Lyft, as well as DoorDash, Uber’s Postmates, and Instacart, all at the center of a $200 million plus push for an exemption to the law, can celebrate a victory that’s expected to save the gig economy firms from major costs of doing business in the state.

On Wednesday just after 10 a.m. ET, Uber (UBER) stock was trading up nearly 12%, while Lyft (LYFT) stock was up over 10%.

“California voters sent a strong message to politicians in Tuesday’s historic election,” Lyft stated in a press release. “Don’t mess with the gig-economy.” The company went on to say that the “bluest” state in America could be credited with adopting the nation’s first law mandating health payments, disability insurance, and an earnings guarantee for gig workers.

“California voters have spoken, and they stood with more than a million drivers who clearly said they want independence plus benefits,” Lyft Chief Policy Officer and former U.S. Secretary of Transportation under President Obama Anthony Foxx said in a prepared statement.

DoorDash said voters recognized “the importance of flexible work and the critical need to extend new benefits and protections” in a statement to Yahoo Finance.

“Now, we’re looking ahead and across the country, ready to champion new benefits structures that are portable, proportional, and flexible,” the statement said. “We look forward to partnering with workers, policymakers, community groups, and more to make this a reality.”

Passage of Prop. 22 means more than a million Californians will be able to keep driving with Lyft and other rideshare and delivery platforms, and millions more will continue to have access to reliable, affordable transportation services while the nation continues to struggle with COVID-19. Most importantly, hundreds of thousands of Californians will now be able to earn healthcare and disability benefits through independent work.

Yahoo Finance reached out to Uber and did not receive an immediate response.

Gig workers who hoped to gain legal protections and benefits that would have come under AB5’s mandate that they be reclassified as employees, rather than independent contractors, came up disappointed.

Steve Gregg first started driving for Uber and Lyft three years ago. At the time, he considered it a temporary gig. The 52-year-old was coming off of disability leave, after he suffered a neck injury working for a city park maintenance department in the San Francisco Bay Area.

“When I got into it I thought it would just be transitional. I was curious about the technology. I thought I would just go back into my career, but I fell in love with it,” Gregg told Yahoo Finance, before the vote. “I just completely fell in love with the human race doing this. It was a journey for me every day.”

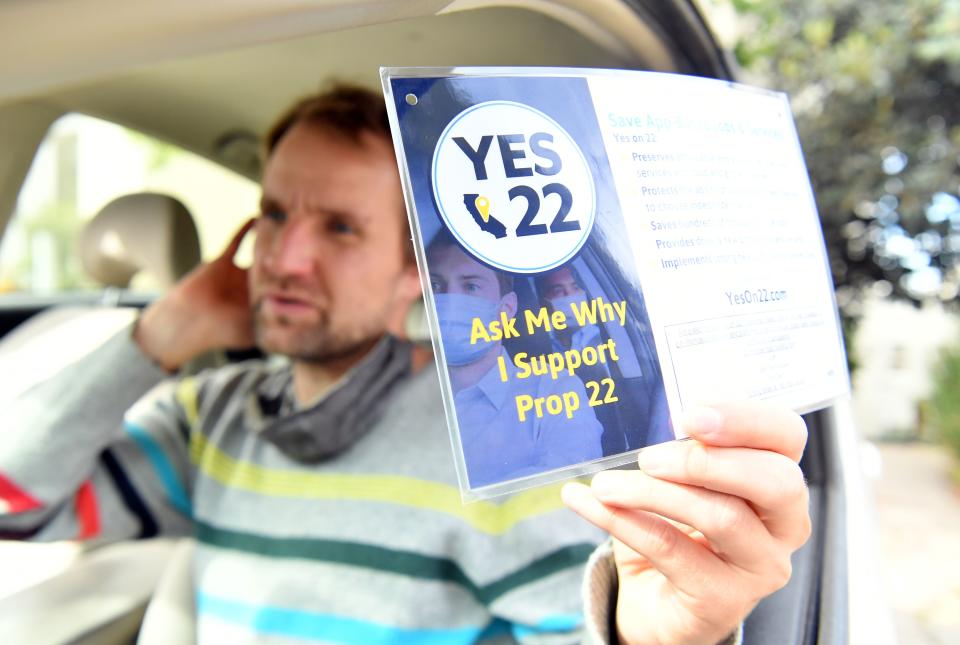

Yet, 16,000 rides later, Gregg campaigned against the ride-hailing companies, mobilizing voters against California’s Proposition 22 as an organizer for Gig Workers Rising. The measure will classify app-based transportation and delivery drivers as independent contractors, exempting companies from Assembly Bill 5, a California law passed last fall that forces certain companies to reclassify workers as employees, thereby granting them greater legal protections.

Uber and Lyft have been criticized for spending tens of millions of dollars apiece fighting implementation of AB5 given that they have yet to prove their business models can reach profitability. Tuesday’s vote in support of Proposition 22 also makes moot the decisions of two California counts that ruled against the app-based companies, saying that they must adhere to AB5.

Almost entirely funded by gig-economy giants like Uber, Lyft, Instacart, and DoorDash, the campaign in support of Proposition 22 has collectively spent more than $200 million, making it the most expensive ballot race in California. Opponents of the measure have spent around $14 million to defeat it.

“I've watched these companies turn a really good economy into an exploitative economy,” Gregg said. “I'm just tired of watching billionaires and corporations exploiting people and that's exactly what they're doing. Now they're just trying to make it legal.”

A last-ditch effort to escape Assembly Bill 5

The ballot measure was among the last-ditch scenarios under which the companies would be allowed to keep their workers classified as independent contractors. A California appellate court affirmed a lower court’s ruling last month mandating that the workers be reclassified as employees based on AB5.

Under AB5, the app-based transportation and delivery drivers would have gained entitlements that employers are required to offer their employees, including overtime pay, minimum wage, paid sick leave, and unemployment insurance.

But Uber and Lyft have argued that their drivers enjoy the independence of working as independent contractors, including choosing their own hours, as the Los Angeles Times reported in September. Uber and Lyft contended they would not be able to give drivers that flexibility unless they were exempted from AB5. Meanwhile, freelancers pushed back against the law, contending it could leave them without work entirely because companies can’t afford to hire them as regular employees.

Proposition 22 does have some benefits for workers: The ballot measure not only exempts app-based companies from that law — it entitles the gig-based transportation workers to some benefits typically not available to independent contractors.

Though the workers remain independent contractors in name, allowing the companies to avoid paying payroll taxes and providing full legal protections typically available to employees, workers will become eligible for limited employee-style benefits including a minimum wage for certain working hours equal to 120% of the state’s $13 per hour minimum (going up to $14 in 2021). Workers will also be given health care stipends to spend toward private employer-provided healthcare insurance, in addition to $1 million in insurance coverage to cover on the job accidents and illness, as well as lost wages.

Opponents of the ballot initiative, including the California Labor Federation, argued the initiative doesn’t go far enough and creates a “second class ranking” for gig-workers in terms of benefits and opportunities.

“I think that what's at issue here is an attempt by companies to circumvent the laws so as to have a greater profit margin,” said William Gould, a Law Professor at Stanford University, before Tuesday’s vote. “These proposals come along at a time when the pandemic has exposed the frailty of the social safety net, which we have in place for employees. The pandemic has exposed the need to bolster and expand employee rights at a very time that these companies are seeking to diminish them.”

Had the measure failed to pass in the companies’ favor, they would have had one last path to appeal the lower courts’ decisions to California’s Supreme Court. That effort, if needed, was expected to be an uphill battle given the court’s already cemented rulings that set forth a three-part test for determining worker classifications.

Under the “ABC” test, workers are presumed employees, unless an employer proves the worker is free from the control and direction of the hiring entity, that the worker performs work outside the usual course of the entity’s business, and that the worker is customarily engaged in an independently established trade, occupation, or business.

Prop 22 would be difficult to undo. A change to the law would require a seven-eighths majority in the California legislature.

‘Significant’ cost increases for customers

Uber CEO Dara Khosrowshahi has maintained that a vast majority of the platform’s drivers and delivery workers prefer the flexibility that comes with working as independent contractors, and operate less than 40 hours a week. He recently told the Wall Street Journal a Prop 22 defeat would lead to “significant” cost increases for customers, and more limited service, and that the company would consider “all options” including withdrawing from the state of California altogether.

The initiative has exposed a big divide among part-time and full-time drivers. Gregg, who relies on ride-sharing to make a living and drives 60 hours a week, says the payout simply isn’t enough to get by. While he brings in more than $1,000 a week, Gregg says he only takes home just over $600, after paying for gas, car insurance, and car payments. He has no health insurance, and hasn’t been able to drive since the pandemic began, because his diabetes and lung condition put him at high risk of COVID-19.

Jan Krueger, a 62-year-old retiree who drives roughly 15 hours a week, uses the money she makes from Lyft to help pay for vacations and veterinary bills. While she’s clocked 8,000 rides over a seven-year period, she said didn’t plan to keep driving if Prop 22 didn’t pass.

“There's no way I want a job, I don't want somebody telling me when to show up and be accountable for anything. There's just no interest in that,” Krueger said before Tuesday’s vote.

Results of California’s initiative have been billed as likely to have a ripple effect beyond the gig economy, and across state lines. Rebecca Henderson, CEO, Global Businesses and Executive Board Member at talent solutions company Randstad, says she is working closely with companies, who are reassessing the health benefits or sick leave they provide to independent contractors, as they look to maintain workers in a rapidly changing environment.

“That's an important part of filling in your worker population, and they need to be a strong employer of choice to do that. I think they're constantly looking at the social contract, benefits and [asking] how do I make this an attractive position for you, whether you’re a flex worker or a permanent worker,” Henderson said.

This story was updated on Wednesday, Nov. 4.

Read more:

Coronavirus stimulus: That’s the only way we actually survived

Elections 2020: Here’s who workers at America’s biggest employers are backing for president

What is Section 230, the controversial internet law Trump wants to dismantle?

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter @AkikoFujita

Alexis Keenan is a legal reporter for Yahoo Finance. Follow her on Twitter @alexiskweed.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay