The 'broken' public service student loan forgiveness system is particularly brutal for military veterans

A new investigation by the Student Borrower Protection Center found that members of the military are facing several obstacles when it comes to getting student loan forgiveness.

Along with teachers, firefighters, and first responders, current and former military members are entitled to the Public Service Loan Forgiveness (PSLF) program that wipes out debt in exchange for 10 years of service made under a qualifying payment plan.

But, the SBPC asserted, the PSLF program is broken. Using public records filed in 2018, the group found that while 200,000 service members hold $3 billion in student loan debt, only 17,534 had submitted the right paperwork. And within that group, only around 40% were actually on track for debt relief.

“Unfortunately, we have quite a history documenting how the promise of public service loan forgiveness has been broken for borrowers around the country,” Seth Frotman, executive director of the Student Borrower Protection Center, told Yahoo Finance. “But the failures of the student loan administration have in particular harmed military borrowers, both service members and veterans.”

In a statement to Yahoo Finance, the Department of Education (ED) noted that Congress, not ED, sets the requirements to qualify for the PSLF program.

“The Department is following the law as it is written while working with the Department of Defense to help service members and their families successfully navigate the program,” ED Spokeswoman Angela Morabito said. “At the same time, we are making major improvements to the borrower experience.”

‘The promise of PSLF is broken’

The PSLF program was set up a decade ago, allowing borrowers who were public sector employees with federal loans to apply for loan forgiveness if they made 120 monthly payments under a qualifying repayment plan.

Members of the military who are “willing to serve our country,” Frotman stressed, have “really borne the brunt of this broken system.”

Frotman, a former assistant director and student loan ombudsman for the Consumer Financial Protection Bureau, previously noted that “the average soldier stays in the military for seven years, putting them more than halfway towards meeting the requirements to receive student loan forgiveness.”

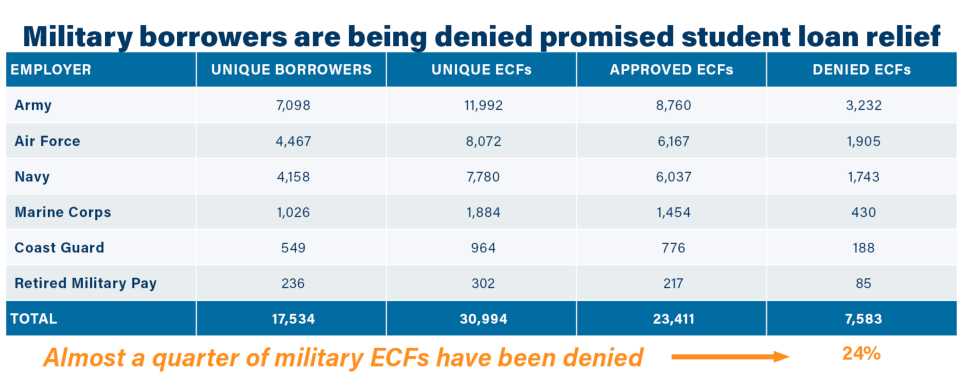

Examining data from the ED, the SBPC looked at how military borrowers submitted their Employer Certification Forms (or ECFs), the approval rate, as well as how employer information was being transmitted.

The report found that even though 200,000 service members have student loan debt, only 17,534 had actually submitted their information, which is a “staggeringly low number given the potential debt relief offered through PSLF,” the authors stated.

And out of this group, nearly a quarter of applications were denied.

Eventually only 6,800 military borrowers actually made it to be on track for PSLF in 2018, they found. That number was also confirmed by a note from the Department of Defense in 2018.

“With only 2% of applicants successfully receiving loan forgiveness, the promise of PSLF is broken,” the authors noted.

‘A slap in the face to all veterans’

The SBPC’s analysis of complaints from service members found the key reason for these low numbers is primarily due to “shoddy servicing practices.”

For instance, borrowers were given inaccurate or even misleading information on how to make sure their student loan payments count for PSLF.

Others were told they didn’t have the right type of loans, as the borrower alluded to, and were only told when it was too late.

“I graduated in 2003 and accrued substantial loans,” one anonymous veteran wrote to his representative in 2015. “In 2006, I resumed my active duty military service. My service ended in October of 2011, following a deployment-related injury and surgeries.”

When he submitted his paperwork to get on PSLF, he “was told my loans needed to be consolidated with a different organization to qualify.” After that, he was told again in 2012 to consolidate his loans again.

But he was then told that “none of my active military service, including deployments to Afghanistan, would count for PSLF purposes,” adding: “This is a slap in the face to all veterans.”

Other applications were denied on the basis that the right supervisor didn’t sign off on the paperwork.

This is an exceptional burden, SBPC military affairs fellow Michael Saunders stressed.

“It's not like they give lower ranking service members a directory of people to call, saying this is the person who's in charge of you,” he explained. Going up the chain of command to identify who is properly authorized to sign off on your employer certification form is tough, because “that's not what they care about, and that's not what they're there for,” he added.

And for those deployed, some in hostile areas, since it’s a 24/7 job, getting the right paperwork done is nearly impossible because as “people often say you are on Uncle Sam's time — it's not your time,” Saunders said. “You don't have hours to spend on the phone talking to your student loan servicer.”

A department official told Yahoo Finance that some changes will be made soon to how the PSLF Help Tool works, improving the way borrowers fill out their certification forms and possibly making it easier to submit these forms.

Frotman was skeptical that these changes will help.

“What you continue to see is a tinkering around the edges for a program that has failed teachers, nurses, first responders, service members,” he said. “Improving the customer interface doesn't even scratch the surface…. What they need to be spending time using the authority that they currently have to help those families get their end of the bargain.”

How to fix it

According to Frotman, there is one immediate solution.

The Higher Education Relief Opportunities for Students in 2003, enacted by Congress, allows the education secretary to modify student loan programs — including waivers — for military service members, the SBPC authors noted.

This means that they can not just take immediate action to make sure those who served on active duty get credit for their time, but also forgive loans for those who had already completed at least 10 years of service (military and civilian).

Furthermore, ED could also use the Defense Manpower Data Center to help verify employment information to fast-track the process, the report suggested, noting that the data already exists and servicers use it to cross reference accounts. SBPC is asking ED to do the same.

On Wednesday, California Attorney General Xavier Becerra said he had sent a letter to ED asking whether this has been implemented.

“We are seeking information on whether the Department of Education and Department of Defense have instituted the new data-matching program... [which they are] by law are obligated to provide student debt relief to combat veterans,” Becerra stated in a press conference on Wednesday.

—

Aarthi is a reporter for Yahoo Finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Read more:

Election 2020 'has enormous implications for student loan debt'

Student debt cancellation already in focus amid President-elect Biden transition

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.