Worst retail sales drop in 9 years is 'every bit as bad as it looks'

The retail sector took a blow in the final month of 2018, adding to a list of consumer economic casualties amid year-end turmoil in the financial markets and a protracted U.S. government shutdown.

Retail sales dropped 1.2% month-over-month in December, the largest drop since September 2009, according to data from the Census Bureau released Thursday. The dip was broadly unexpected – consensus estimates had foreseen a 0.1% increase in retail sales for the month, according to Bloomberg data. Excluding autos and gas, which can be volatile, core retail sales plunged 1.8%.

“[The] fall in retail sales in December was every bit as bad as it looks,” Capital Economics’ Michael Pearce said bluntly.

The weakness was broad-based. Sporting goods stores sales fell 4.9%, miscellaneous store retailers fell 4.1%, non-store retailers — which includes online retailers — dropped 3.9%, department stores fell 3.3%, and health & personal care stores fell 2.0%.

Economists said that the decline in the “official” Census Bureau figures is easily explained in the context of broader financial market volatility and uncertainty over a partial government shutdown, which saw about 800,000 federal employees either furloughed or working without pay. Both of these factors had also contributed to weaker readings for consumer sentiment, with a reading from January capturing the residual impact of December’s market performance and government shutdown registering at the lowest level since October 2016.

“It was all bad news hitting the consumer in December from the stock market’s collapse and the federal government shutdown,” Chris Rupkey managing director for MUFG, wrote in an email. “The consumer voted by walking away from the shops and malls and leaving their money in their pockets and purses.”

Does the data lack credibility?

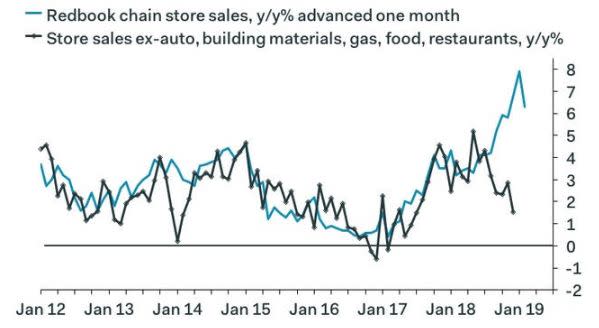

The largest drop in headline retail sales was especially surprising given that previously released data from other institutions had suggested that retail sales had risen for the month. According to a Mastercard SpendingPulse study released at the end of December, the holiday shopping season had been the best in six years. A Johnson Redbook report, likewise, showed that December sales rose over last year, though the firm draws results from a smaller sample.

The release of the Census Bureau’s retail sales figures – along with a host of other economic data – was delayed due to the government shutdown.

The Census Bureau’s retail sales numbers “are astonishing, and impossible to square with the Redbook chainstore sales survey, which reported surging sales in December and a record high in the week of Christmas, on the back of the plunge in gasoline prices,” Ian Shepherdson of Pantheon Macroeconomics wrote in an email Thursday.

“These data are so wild that we have to expect hefty upward revisions, but if they stand, they are very unlikely to be representative of the trend over the next few months,” Shepherdson added. “The consumer is no longer enjoying tax cuts or falling gas prices, but that’s no reason to expect a rollover.”

Other economists echoed these sentiments.

“In short, much weaker than expected, but so much so that the data lose credibility,” Jim O’Sullivan, chief U.S. economist at High Frequency Economics, said of the Census Bureau’s data. “The trend may be slowing, but a sudden collapse is at odds with other evidence. To some extent, the weakness may just be payback for exaggerated strength in Oct/Nov., but the net result is less spending growth in Q4 as a whole than expected.”

The economy may be in worse shape than we think

The decline in retail sales could portend slower growth in the impending print on fourth-quarter gross domestic product, said Michael Pearce, senior U.S. economist with Capital Economics. Household consumption, encapsulated both through retail sales and personal incoming and spending reports, comprise about 70% of the U.S. economy.

“The unexpected plunge in control group retail sales in December means that fourth-quarter GDP growth was probably nearer 2.5% annualized than the 3.1% we had penciled in,” Pearce said. “It suggests the economy entered 2019 with much less momentum than anticipated.”

A Morgan Stanley economist also noted the impact on their GDP forecasts.

“On the back of this morning’s data... our 4Q real GDP tracking estimate likewise took a big hit, down to 3.1% from 3.7%,” Morgan Stanley’s Ellen Zentner wrote. “The report also has negative implications for consumption growth in the first quarter... Based on this morning’s results, we estimate that 1Q GDP tracking could come in as low as 1%.”

This doesn’t necessarily mean the economy is falling into a recession, however, especially amid recent strength in other areas including the labor market. But coupled with Thursday’s report of weaker-than-anticipated producer price data, “it strengthens the case for the Fed to remain ‘patient’ in the months ahead,” Pearce said.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

What Wall Street strategists forecast for the S&P 500 in 2019

Beer sales are lukewarm and pot could be part of the problem

Consumer sentiment plunges to its lowest level since Trump’s election