Robo-advisor is taking the robo out of robo-advisor

Robo-advisor Betterment shook up its service this week by expanding the level of personalization available on the investing platform.

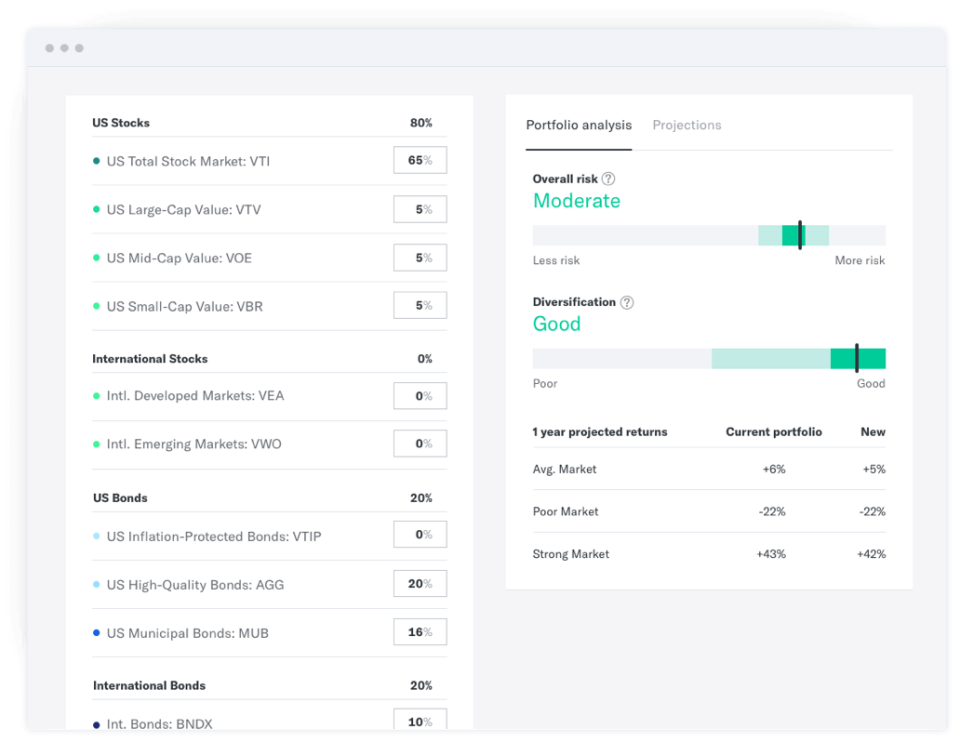

The new changes allow investors to control asset weights directly from categories like US Stocks (total market, large, medium, small cap), International stocks (developed, emerging), and an array of bonds. Previously, personalization was more limited to a set of ETFs Betterment would provide based on a survey.

According to Betterment CEO Jon Stein, this is the next step in a series of moves by the company to add more options for its investors.

“It’s great for people who have assets in multiple places,” Stein told Yahoo Finance. “Some people have multiple brokers or 401(k)s or IRAs they’re using, and they see Betterment as a part of the overall picture.”

Increased levels of personalization do mean that people could take on more risks than what Betterment advises. But the platform has behavioral bumpers to try to mitigate this. If the asset allocations are risky or not diversified, graphics on the right-hand side of the page lets the user know that the risk is too high or too low. There are also behavioral nudges built into the platform, and the option to talk to a real person by phone, Stein says.

This new functionality, called “Flexible Portfolios”, will only be available for now for customers with $100,000 invested through the platform. Stein said that the company was treating it as a “bit of a living laboratory” where they can see how people react to the personalization options and use advice.

“Do they want to answer more questions? Do they want personalization to happen automatically or more manual control? The more data we gather the better we can optimize and make the most of our customer,” Stein said.

(Given the news cycle, he stressed that Betterment never sells, shares, rents, or lends any data. “It’s only used to help us make more with your money.”)

The investment options are mostly Vanguard ETFs (VTI, VTV, VOE, VBR, VEA, VWO are the stock options) that carry only a few basis points of fees. Betterment receives no commissions for their sales, only a fee of 0.25% to manage the account, and has made no moves to create their own low-cost investment options.

Stein pointed to the importance of staying independent from the funds they recommend. “We don’t manufacture our own funds; we’re not getting paid for the funds we recommend,” he said. “It distinguishes us — those are bad moves from a fiduciary perspective.”

Betterment’s fiduciary pride comes at an interesting time for the adoption of a fiduciary rule, which would require financial advisors and brokers to give advice that’s in the best interests of clients instead of ones with higher commissions. The Department of Labor’s rule was struck down in federal court this month, but the SEC has indicated it will be promulgating a rule of its own.

As a fiduciary, Stein said that adoption of these rules would ultimately be better for Betterment.

—

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: FinanceTips[at]oath[.com].

Johnny Depp proves why we need a fiduciary rule

Passive investing has changed one of the biggest retirement debates