Ex-JC Penney CEO: ‘Amazon should be having trouble sleeping at night’

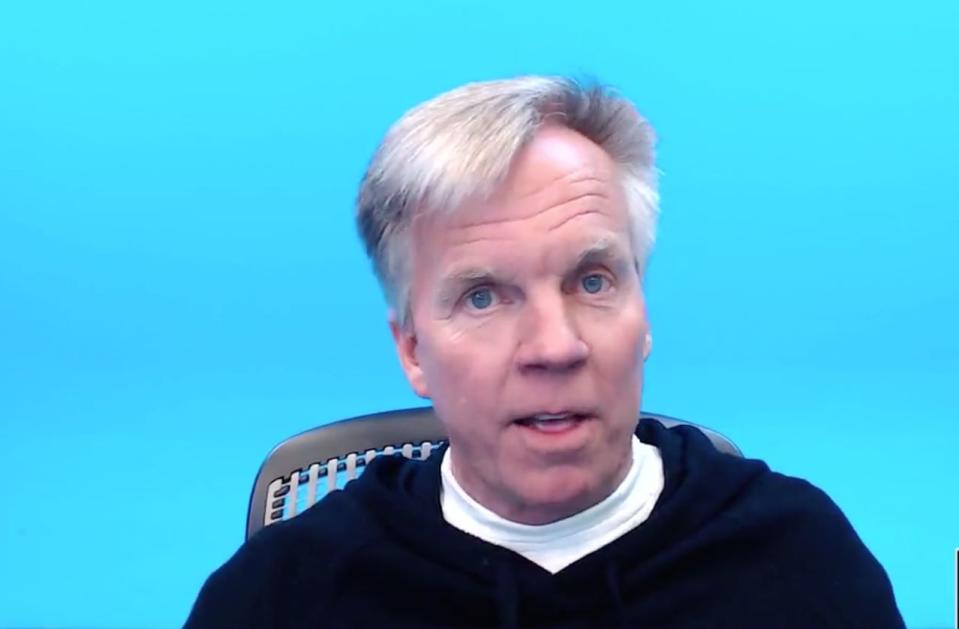

Despite the commonplace belief that Amazon (AMZN) is gobbling up retail, Enjoy CEO and former J.C. Penney chief executive Ron Johnson contends it’s Amazon — and not its competitors — that should be concerned.

“Amazon should be having trouble sleeping at night,” Johnson contended during Yahoo Finance’s “The Final Round” last week. “I mean, seriously. Amazon same-store sales in the U.S. are now single-digit. Target and Walmart, these big retailers have learned how to leverage their stores’ inventory to create a better shopping experience. That’s where customers are going right now.”

Walmart's (WMT) U.S.-owned e-commerce growth accelerated 43% year-over-year during the third quarter, while Target posted a record 49% year-over-year surge during the same period in e-commerce growth, according to Bank of America Merrill Lynch. Meanwhile, Amazon’s online store sales growth, which factors in product and digital sales, grew at a slower pace during the same period at 12.5% year-over. (The Seattle tech giant also reported a 3% year-over-year decline in physical stores sales — a statistic that included Amazon’s ownership of Whole Foods for the first time.)

Agree or not with Johnson’s argument, the 60-year-old executive certainly has his share of retail experience. After famously architecting Apple’s (AAPL) physical store experience as the tech giant’s senior vice president, Johnson attempted to bring that same level of innovation to J.C. Penney. But his aggressive attempts at revamping the aging retailer’s physical stores — changing floor merchandise, ditching coupons, introducing everyday low prices — led to a same-store sales drop-off of 25% during Johnson’s first year. Ousted from J.C. Penney after only 17 months, Johnson founded the startup Enjoy, which helps clients like AT&T (T) and Google (GOOG, GOOGL) offer same-day delivery and expert services to customers.

Johnson suggests Walmart and Target’s rapid e-commerce growth will continue, in part because both retailers have successfully expanded their online and in-store pick-up options.

Walmart, which has significantly ramped up its organic food offerings over the last five years, now offers in-store pick-up for online orders at roughly 2,100 out of its 4,300 locations, as well as online grocery delivery from more than 800 stores. (The retailer expects to add another 800 stores to the mix throughout 2019.) Walmart is also piloting a new program in partnership with Udelv, a Burlingame, California-based technology company, to have online orders delivered by self-driving vehicles to homes in Surprise, Arizona.

During the holiday months of November and December last year, Target processed 60% more items year-over-year via options like online order pickup, ship from store and “Drive Up,” where customers can drive to designated delivery pick-up spots at a physical Target (TGT) location.

“Up until now, it was easy to go to Amazon because they had delivery,” Johnson added. “But now Target can do that and do it better. So I think Amazon should be the one having trouble sleeping at night.”

More from JP: