Sage Group (LSE:SGE) Sees 9% Revenue Growth in Q3 2024, Strategic Alliance with VoPay Enhances Payroll

The Sage Group (LSE:SGE) is navigating a dynamic period marked by both opportunities and challenges. Recent highlights include a notable 28.4% increase in earnings and innovative product launches, juxtaposed against a 16.7% drop in Q2 net sales and inflationary pressures. In the discussion that follows, we will explore Sage Group's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of Sage Group.

Strengths: Core Advantages Driving Sustained Success For Sage Group

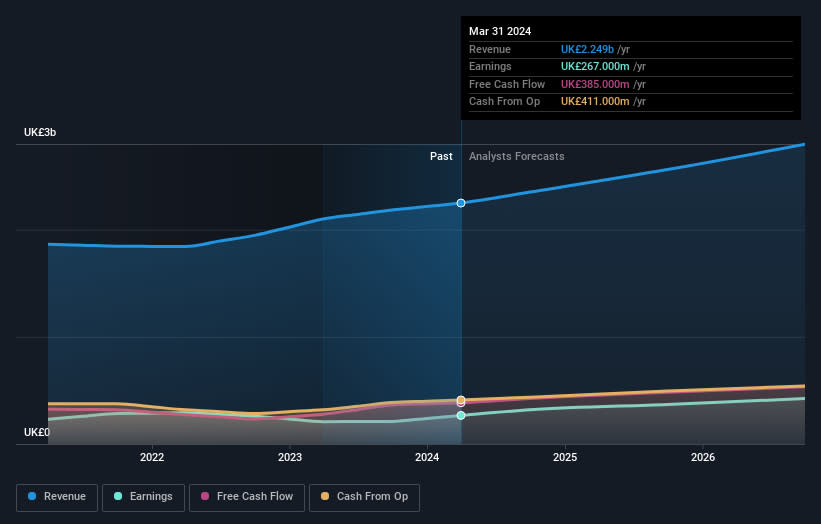

Sage Group has demonstrated strong revenue growth, with a notable 28.4% increase in earnings over the past year. This growth is supported by a diverse portfolio of cloud solutions and markets, as highlighted by CEO Stephen Hare in the latest earnings call. The company also achieved an operating profit margin expansion to 22%, reflecting efficient scaling of the business, according to CFO Jonathan A. Howell. Sage's high recurring revenue, now at 97%, underscores its resilient business model. Additionally, the company is trading at 22.7% below the estimated fair value of £13.13, indicating potential for appreciation despite its high Price-To-Earnings Ratio of 37.9x.

To gain deeper insights into Sage Group's historical performance, explore our detailed analysis of past performance.

Weaknesses: Critical Issues Affecting Sage Group's Performance and Areas For Growth

While Sage Group has notable strengths, it faces several challenges. The company's Price-To-Earnings Ratio of 37.9x is higher than the UK Software industry average of 37.4x and the peer average of 36.1x, suggesting it is relatively expensive. Additionally, Sage's earnings have declined by 6.3% per year over the past five years, despite recent improvements. The growth deceleration in Europe, from nearly 7% in the first quarter to 4% in the second quarter, as noted by Balajee Tirupati from Citi, is another concern. Furthermore, while the Return on Equity is high at 24.54%, it is skewed by the company's significant debt levels.

To dive deeper into how Sage Group's valuation metrics are shaping its market position, check out our detailed analysis of Sage Group's Valuation.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Sage Group has several opportunities to enhance its market position. The company's market insights reveal that less than half of SMBs in Europe currently use accounting and payroll software, indicating significant growth potential. The integration of AI and machine learning infrastructure, as mentioned by Stephen Hare, positions Sage to offer unique, customer-specific solutions. New product launches, such as Sage Construction Management, expand the company's cloud suite offerings. Additionally, the growing demand for digital solutions among SMBs to automate workflows presents a substantial opportunity for Sage to capture a larger market share.

Threats: Key Risks and Challenges That Could Impact Sage Group's Success

Sage Group faces several external threats that could impact its growth. Competitive pressures in the global software market remain intense, as noted by Adam Wood from Morgan Stanley. Economic factors, such as CFOs taking longer to make decisions, could slow down business growth, a concern highlighted by Stephen Hare. Regulatory changes, particularly the global push for E-Invoicing, require continuous adaptation and compliance efforts. Additionally, the company's high level of debt poses a financial risk, and significant insider selling over the past three months could signal potential concerns among stakeholders.

Conclusion

Sage Group's strong revenue growth and high operating profit margin demonstrate its effective business scaling and resilient model, with 97% recurring revenue providing stability. However, the company's high Price-To-Earnings Ratio of 37.9x, despite trading 22.7% below its estimated fair value of £13.13, suggests that it is relatively expensive compared to industry peers. While significant growth opportunities exist, particularly in the underpenetrated European SMB market and through AI integration, challenges such as earnings decline, growth deceleration in Europe, and high debt levels pose risks. These factors collectively indicate that while Sage Group has a promising outlook, careful consideration of its valuation and debt management is crucial for future performance.

Key Takeaways

Already own Sage Group? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks. Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.