Sam Adams founder Jim Koch says the Dogfish Head merger is about more than beer

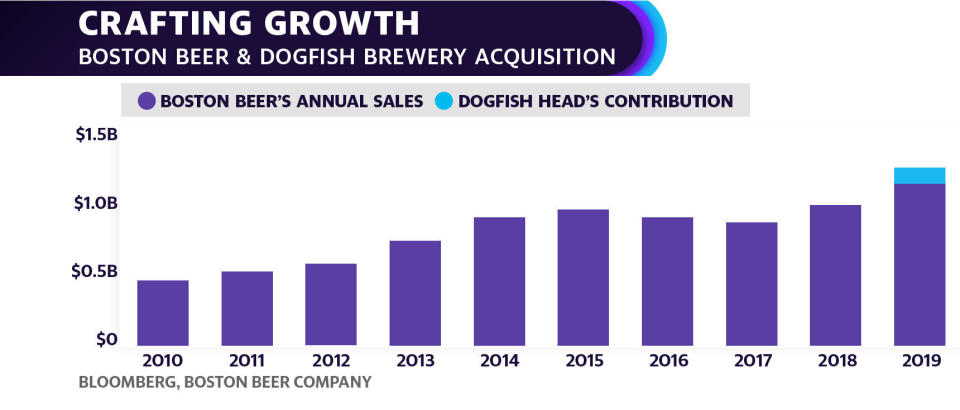

At face value, the $300 million decision by Sam Adams maker Boston Beer Company (SAM) to buy Delaware craft beer leader Dogfish Head might just look like another opportunistic move to snag a growing craft brand at a time when beer’s overall popularity in the U.S. continues to sag — but there’s much more to the merger than that.

With beer in general losing national market share to wine and hard liquor, according to a recent Beer Institute report, beer makers like Boston Beer have turned to hard seltzer and ciders to help counter the trend. Its spiked seltzer brand Truly and Angry Orchard cider have both done just that for Boston Beer co-founder Jim Koch as sales of its flagship Boston Lager slipped by double digits in 2018, according to retail tracker IRI.

Scooping up a quickly growing competitor in Dogfish Head, which saw its popular IPAs and sour beers propel it to 9% growth last year, would be a much needed boost to Boston Beer’s core business, but perhaps even more than just that down the line, especially as Dogfish Head co-founder Sam Calagione grows his role in the merged company.

“I do believe that Sam, who’s shown this enormous creativity within beer, can bring some of that to [our offerings] beyond beer, which is kind of a wide open space in a lot of ways sort of like craft beer was 30 years ago,” Koch told Yahoo Finance YFi PM. “And you have more and more craft brewers thinking about what we did 30 years ago which was expanding.”

‘One best path forward’

Calagione, who has built up a reputation for expanding and experimenting since the 90’s when he started homebrewing with spoiled cherries in his New York City apartment, expressed his excitement at having the opportunity to continue doing so under the Boston Beer umbrella rather than taking the path some other craft brewers have taken, which involves being acquired by major beer conglomerates. In considering a merger, Calagione said he and his wife never even contemplated the latter.

“As we looked at our options and looked at how complementary our portfolios are it really became clear that it was not an option,” he said. “There was [only] one best path forward.”

The press release announcing the deal highlights that Calagione is expected to be named to Boston Beer’s board by 2020, joining Koch who serves as chairman. Current Boston Beer CEO David Burwick, 50, is expected to oversee the merged operation. However, industry insiders are already speculating that Calagione, 49, could at some point assume the role considering both founders share certain quirky entrepreneurial similarities and the fact the deal crowned the Calagiones the company’s largest non-institutional shareholders behind Koch by gaining more than 400,000 Boston Beer shares.

“I do see kind of that same kind of off-centered spirit in both of us,” Koch said about his new partner before making one last joke about Calagione’s background to finish his interview with Yahoo Finance. “I mean this is a guy who never graduated high school because he got kicked out.”

Reflecting on founding his company with his former Boston Consulting Group co-worker Rhonda Kallman, Koch laughed and turned to Calagione saying, “She never went to college, but she did get through high school, so she’s ahead of you.”

Cheersing his beer with Koch’s following the roughly $127 million windfall in shares from the merger, Calagione laughed, too.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Blue Moon's creator launched a cannabis beer that sold out in 4 hours

Constellation Brands shareholders are getting Canopy Growth almost for 'free': Canopy CEO

Yahoo Finance

Yahoo Finance