The scariest phrase for investors right now: 'Since 2016'

2019 is here.

But for investors, the scariest year isn’t the one that lies ahead but a bygone year that keeps popping up in discouraging economic reports — 2016.

On Wednesday, U.S. manufacturing activity data from IHS Markit showed the pace of expansion in the sector hit a 15-month low in December while job creation hit its slowest pace in 18 months.

Optimism among businesses in the manufacturing business, however, erased all of its post-election gains and slid to the lowest since October 2016. “Output and order books grew at the slowest rates for over a year and optimism about the outlook slumped to its gloomiest for over two years,” said Chris Williamson, chief business economist at IHS Markit.

Earlier this week, we noted that some of the last rounds of survey data for 2018 were showing the best year for economic growth since the crisis was coming to an end with a whimper. In the last month, manufacturing surveys from the New York, Philadelphia, Richmond, and Dallas Federal Reserve banks all disappointed, while The Conference Board’s reading on consumer confidence in December also missed expectations.

In several of these reports, the year 2016 came up as a reference point for various “worst since” readings, indicating that the post-election, post-tax cut world of economic growth and booming stock prices is coming to an end.

The Richmond Fed’s manufacturing reading went into negative figures for the first time since 2016 in December. Meanwhile, consumers’ expectations for the economy fell to the lowest since 2016 in December, according to The Conference Board. And the Dallas Fed’s December reading on business activity hit its lowest level since 2016.

Economic data is a lagging indicator. It tells you what has happened while financial markets are trying to price in what will happen.

The S&P 500 fell just under 14% in the fourth quarter, the worst fourth quarter for the market since 2008 and the worst overall quarter for the benchmark index since the third quarter of 2011. The behavior of financial markets during the fourth quarter indicates that many investors were bracing for these kinds of negative data points in the months ahead.

As Neil Dutta at Renaissance Macro noted last week, the decline in markets over the last quarter indicates that incoming economic data has already been discounted by investors. In other words, markets are prepared for a run of bad data. Hearing “since 2016” over and over might not be the sort of bad economic news to really push the market even lower.

But it should remind investors that the current cycle that is often benchmarked to the post-crisis era — “second-longest expansion on record,” “longest bull market on record,” and so on — is really a smaller period of economic growth and stock gains that began after Trump’s election.

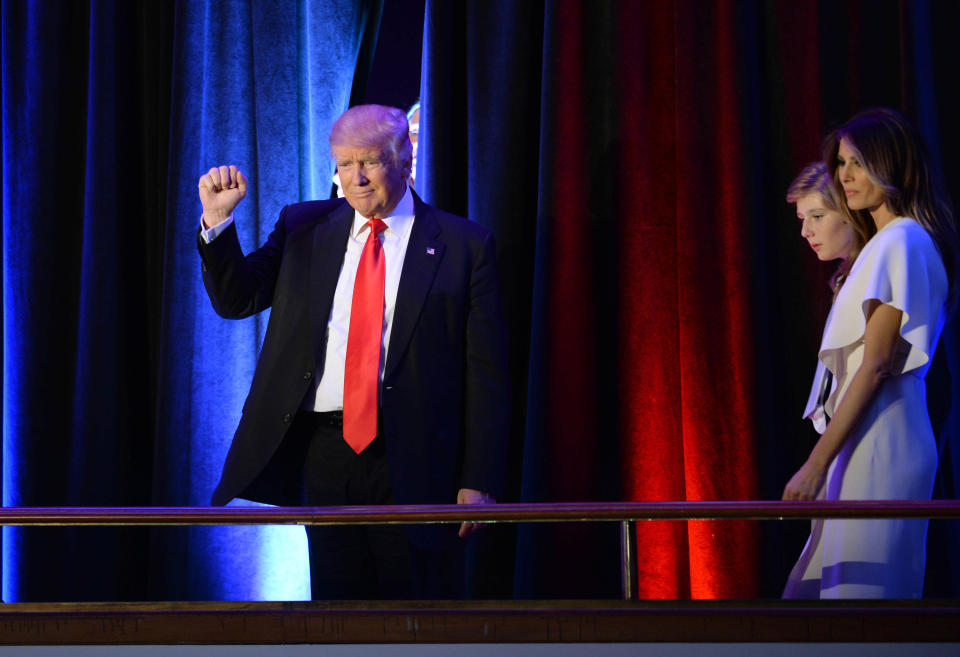

Business confidence, consumer confidence, and investor confidence all surged after Trump’s surprise win. Through the ups and downs of his presidency, many of these indicators remained near their post-election highs. At least until the final quarter of 2018.

The stock market is clearly in a downtrend. The economy is going to grow at a slower pace in the year ahead. And the question for investors is whether the entire post-Trump phase in markets and the economy that defined the last 26 months for investors has come completely undone.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland