SEHK Dividend Stocks With Yields Ranging From 3.3% To 5.2%

Amidst a backdrop of global economic shifts and market adjustments, the Hong Kong stock market has shown resilience, with the Hang Seng Index seeing modest gains in a holiday-shortened week. In such an environment, dividend stocks remain a focal point for investors seeking steady income streams from their portfolios. A good dividend stock typically combines reliable payouts with strong business fundamentals, making it potentially attractive especially in times of economic uncertainty or fluctuating markets.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.98% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.41% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.91% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.97% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.20% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.56% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 9.18% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.31% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.29% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.50% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top SEHK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

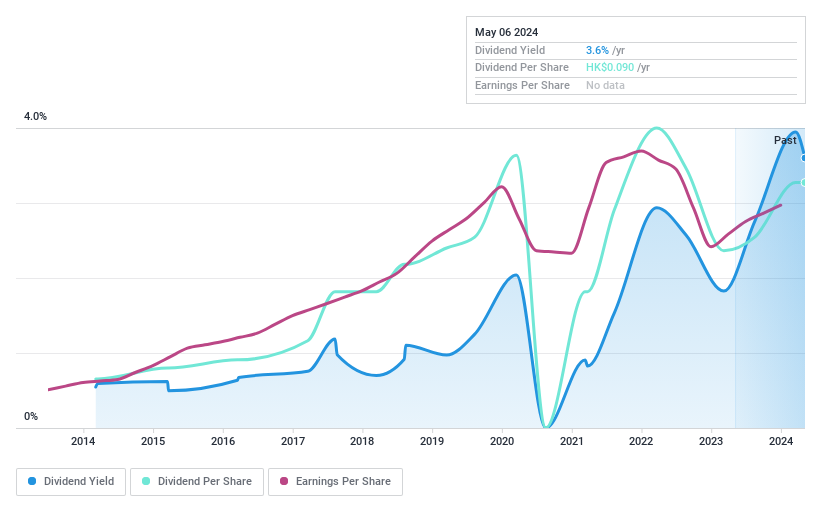

Essex Bio-Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that focuses on developing, manufacturing, distributing, and selling bio-pharmaceutical products primarily in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$1.39 billion.

Operations: Essex Bio-Technology Limited generates revenue primarily from two segments: Surgical (HK$953.16 million) and Ophthalmology (HK$753.39 million).

Dividend Yield: 3.7%

Essex Bio-Technology has exhibited a mixed dividend profile. While the company's dividends have increased, as seen with a recent declaration of HK$0.045 per share, they have also been notably volatile with drops exceeding 20% annually. Despite this instability, both earnings and cash flows sufficiently cover the dividends, reflected in low payout ratios of 18.6% and 24.2%, respectively. However, its dividend yield of 3.67% is modest compared to Hong Kong’s top dividend payers at 7.98%.

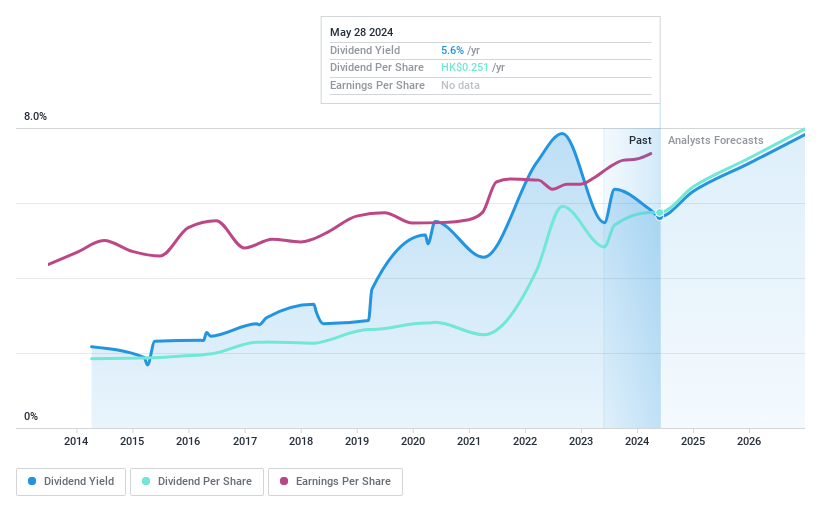

China Telecom

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited operates primarily in the People’s Republic of China, offering wireline and mobile telecommunications services through its subsidiaries, with a market capitalization of approximately HK$584.17 billion.

Operations: China Telecom Corporation Limited generates revenue primarily from its Integrated Telecommunications Business, which amounted to CN¥512.75 billion.

Dividend Yield: 5.2%

China Telecom has demonstrated a shaky dividend history over the past decade, with payments showing significant fluctuations. Recent financials indicate a first quarter net income of CNY 8.60 billion, up from CNY 7.98 billion year-over-year, on revenues of CNY 135.49 billion. Despite these earnings, its dividend yield stands at a modest 5.24%, lower than many top Hong Kong dividend stocks at 7.98%. However, both earnings and cash flows—payout ratios standing at 68.7% and cash payout ratio at 52.9% respectively—adequately cover the dividends, suggesting sustainability from a cash management perspective.

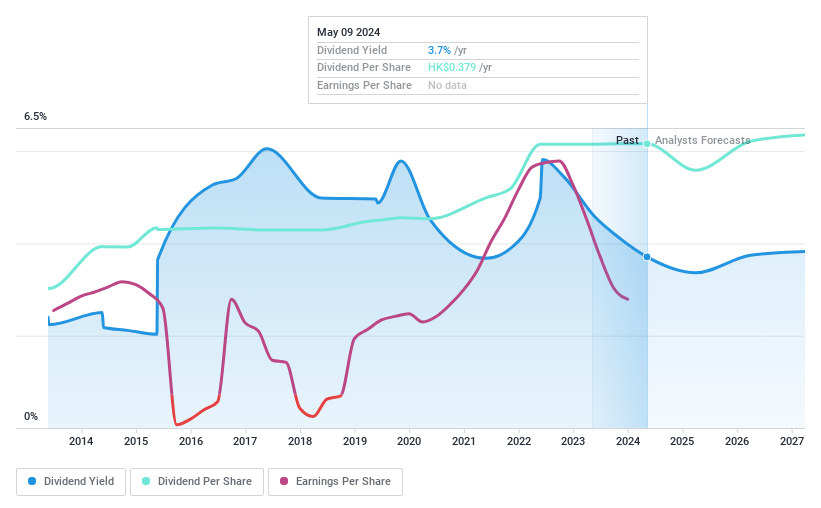

Lenovo Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of approximately HK$139.92 billion.

Operations: Lenovo Group's revenue is generated primarily through three segments: Intelligent Devices Group (IDG) which earned $44.60 billion, Solutions and Services Group (SSG) with $7.47 billion, and Infrastructure Solutions Group (ISG) contributing $8.92 billion.

Dividend Yield: 3.4%

Lenovo Group's recent advancements in AI and strategic initiatives underscore its potential as a dividend stock, despite not being top-tier in Hong Kong. The company's focus on integrating AI across various sectors through products like the Lenovo Tab Plus and enterprise AI solutions, coupled with substantial investments in infrastructure such as the new regional headquarters in Saudi Arabia, highlight its growth-oriented strategy. However, investors should note Lenovo's modest dividend yield of 3.36% compared to higher yielding peers and a payout ratio of 57.8%, suggesting reasonable earnings coverage but less attractive relative to top dividend payers in the market.

Delve into the full analysis dividend report here for a deeper understanding of Lenovo Group.

Our valuation report here indicates Lenovo Group may be undervalued.

Key Takeaways

Gain an insight into the universe of 90 Top SEHK Dividend Stocks by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1061 SEHK:728 and SEHK:992.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]