SEHK Growth Companies With High Insider Ownership In October 2024

In October 2024, the Hong Kong market has experienced a notable surge, with the Hang Seng Index climbing 10.2% amid optimism about Beijing's support measures despite ongoing global tensions. As investors navigate these complex conditions, companies with high insider ownership often attract attention due to their potential alignment of interests between management and shareholders. In this context, growth companies in Hong Kong that demonstrate strong insider ownership can be particularly appealing as they may offer insights into confidence levels within their leadership teams.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

Akeso (SEHK:9926) | 20.5% | 53% |

Fenbi (SEHK:2469) | 33.1% | 22.4% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

DPC Dash (SEHK:1405) | 38.1% | 104.2% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Let's explore several standout options from the results in the screener.

ESR Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market cap of HK$52.05 billion.

Operations: The company's revenue segments include Fund Management at $627.98 million and New Economy Development at $113.33 million.

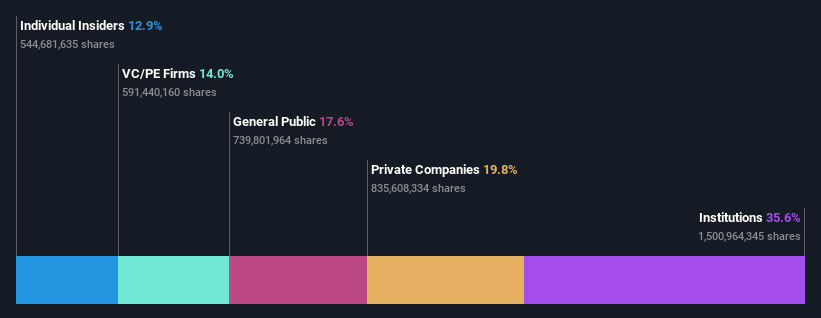

Insider Ownership: 13%

ESR Group, a growth-oriented company with significant insider ownership, is facing challenges despite its potential. The company forecasts annual revenue growth of 16.4%, surpassing the Hong Kong market average, yet it reported a net loss of US$218.72 million for H1 2024 due to non-cash asset revaluations and reduced promote fee income. Leadership changes include Brett Krause as interim chairman following Jeffrey Perlman's departure to Warburg Pincus, maintaining strategic continuity amidst current market conditions.

Lianlian DigiTech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$10.56 billion.

Operations: The company's revenue is derived from three main segments: Global Payment (CN¥722.95 million), Domestic Payment (CN¥309.92 million), and Value-Added Services (CN¥153.01 million).

Insider Ownership: 19.7%

Lianlian DigiTech is experiencing robust growth, with revenue forecasted to increase by 22.3% annually, outpacing the Hong Kong market. The company reported H1 2024 sales of CNY 617.39 million, up from CNY 440.59 million a year ago, while reducing its net loss to CNY 351.29 million from CNY 383.18 million previously. Despite low projected return on equity at 14.3%, it is expected to achieve profitability within three years, reflecting strong growth potential without recent insider trading activity impacting sentiment.

Laopu Gold

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$29.43 billion.

Operations: The company's revenue primarily comes from its Jewelry & Watches segment, which generated CN¥5.28 billion.

Insider Ownership: 36.4%

Laopu Gold demonstrates substantial growth potential, with earnings anticipated to grow 33.2% annually, significantly outpacing the Hong Kong market. Recent half-year results show sales of CNY 3.52 billion and net income of CNY 587.81 million, marking a notable increase from the previous year. The company trades at a significant discount to its estimated fair value and has recently updated its Articles of Association to align with regulatory changes, though no recent insider trading activity is noted.

Navigate through the intricacies of Laopu Gold with our comprehensive analyst estimates report here.

Seize The Opportunity

Get an in-depth perspective on all 47 Fast Growing SEHK Companies With High Insider Ownership by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1821 SEHK:2598 and SEHK:6181.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]