SEHK Value Stocks Estimated To Be Undervalued In August 2024

As global markets continue to navigate economic uncertainties, the Hong Kong stock market has shown resilience with the Hang Seng Index gaining 1.99% recently. In this environment, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on market inefficiencies. In this article, we will explore three stocks listed on the SEHK that are estimated to be undervalued as of August 2024. These selections are based on their strong fundamentals and potential for growth amid current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Best Pacific International Holdings (SEHK:2111) | HK$2.25 | HK$4.36 | 48.4% |

Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$6.73 | 41.4% |

ANTA Sports Products (SEHK:2020) | HK$68.10 | HK$135.25 | 49.6% |

BYD Electronic (International) (SEHK:285) | HK$29.90 | HK$53.07 | 43.7% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$28.60 | HK$55.84 | 48.8% |

Pacific Textiles Holdings (SEHK:1382) | HK$1.61 | HK$2.86 | 43.6% |

WuXi XDC Cayman (SEHK:2268) | HK$19.04 | HK$37.44 | 49.1% |

iDreamSky Technology Holdings (SEHK:1119) | HK$2.25 | HK$4.17 | 46.1% |

Weimob (SEHK:2013) | HK$1.22 | HK$2.19 | 44.3% |

MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.72 | HK$1.37 | 47.4% |

We're going to check out a few of the best picks from our screener tool.

ESR Group

Overview: ESR Group Limited, with a market cap of HK$48.14 billion, is involved in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and other international markets.

Operations: The company's revenue segments include Fund Management ($774.64 million) and New Economy Development ($105.48 million).

Estimated Discount To Fair Value: 22.5%

ESR Group is trading at HK$11.34, which is 22.5% below its estimated fair value of HK$14.64, making it highly undervalued based on discounted cash flow analysis. Despite a forecasted net loss of US$210 million for H1 2024 due to non-cash asset revaluations and lack of promote fee income, the company's earnings are expected to grow significantly at 26.3% per year over the next three years, outpacing the Hong Kong market's growth rate.

WuXi XDC Cayman

Overview: WuXi XDC Cayman Inc. is an investment holding company that provides contract research, development, and manufacturing services globally, with a market cap of HK$22.80 billion.

Operations: Revenue from pharmaceuticals amounted to CN¥2.12 billion.

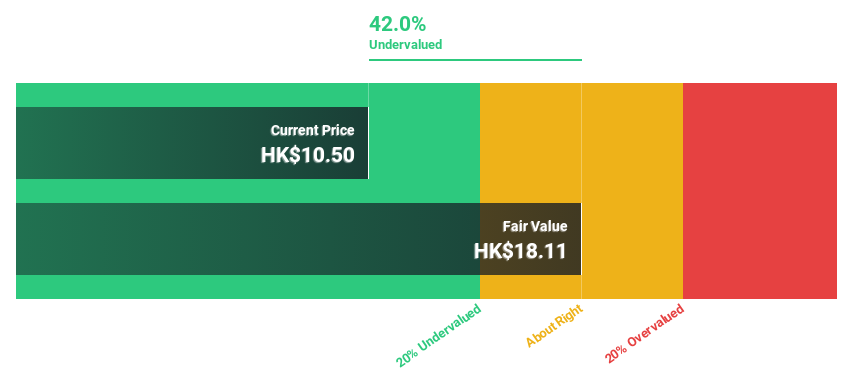

Estimated Discount To Fair Value: 49.1%

WuXi XDC Cayman, trading at HK$19.04, is significantly undervalued with an estimated fair value of HK$37.44 based on discounted cash flow analysis. Earnings are forecast to grow 44.6% annually over the next three years, well above the Hong Kong market's 11%. Recent inclusion in the S&P Global BMI Index and strong revenue growth projections (25.3% per year) further highlight its potential despite a lower return on equity forecast of 17.3%.

China Medical System Holdings

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China, with a market cap of HK$17.64 billion.

Operations: The company generates revenue through the manufacturing, sales, marketing, and promotion of pharmaceutical products in the People’s Republic of China.

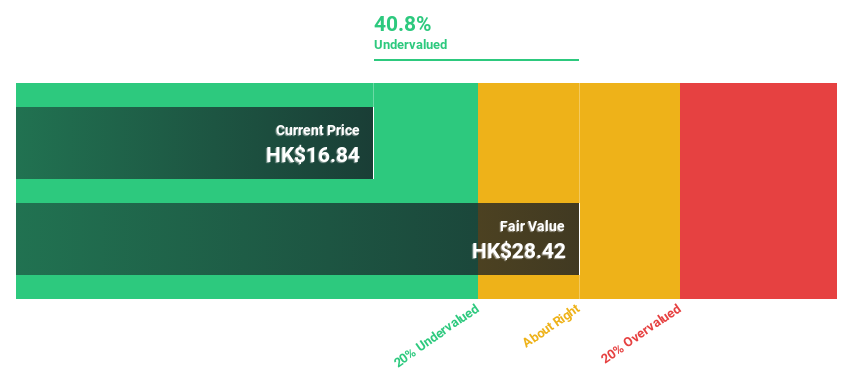

Estimated Discount To Fair Value: 27.8%

China Medical System Holdings, trading at HK$7.23, is undervalued with an estimated fair value of HK$10.01 based on discounted cash flow analysis. Earnings are expected to grow 22.7% annually over the next three years, surpassing the Hong Kong market's 11%. Despite a lower return on equity forecast of 15.8%, recent product approvals and executive changes aim to bolster its strategic direction and long-term growth potential amidst declining profit margins and revenue challenges.

Next Steps

Get an in-depth perspective on all 33 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1821 SEHK:2268 and SEHK:867.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]