Siemens And 2 Other German Dividend Stocks To Enhance Your Portfolio

As the pan-European STOXX Europe 600 Index recently ended lower on renewed fears about global economic growth, Germany's DAX also saw a decline of 3.20%. In this uncertain market environment, dividend stocks can offer a measure of stability and income to your portfolio. When considering good dividend stocks, it's crucial to focus on companies with strong fundamentals and consistent payout histories. Siemens and two other German firms are prime examples of such investments that can enhance your portfolio in these volatile times.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 4.93% | ★★★★★★ |

MLP (XTRA:MLP) | 5.46% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.74% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 5.23% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.07% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 7.40% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.38% | ★★★★★☆ |

MVV Energie (XTRA:MVV1) | 3.83% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.31% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

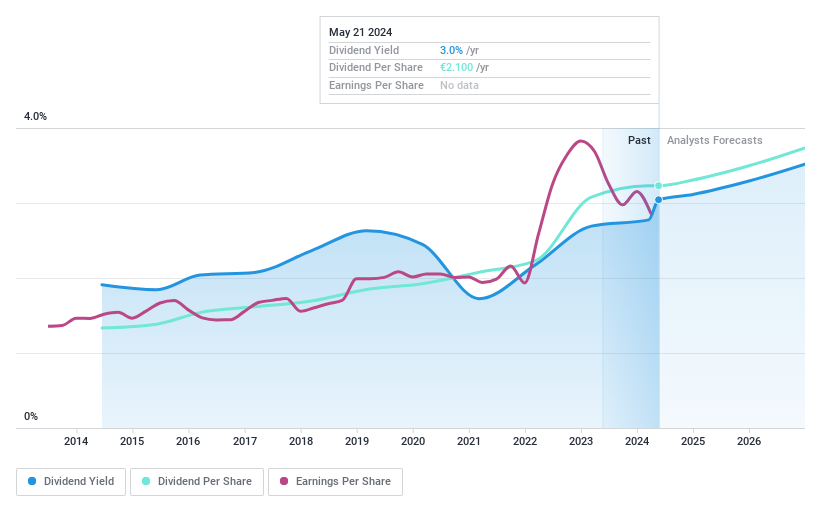

Brenntag

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE, with a market cap of €9.28 billion, purchases and supplies various industrial and specialty chemicals and ingredients across Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Operations: Brenntag SE's revenue segments include Brenntag Essentials - Latin America (€674 million), North America (€4.27 billion), Asia Pacific (€751.10 million), and Europe, Middle East & Africa (€3.30 billion).

Dividend Yield: 3.3%

Brenntag offers a reliable dividend yield of 3.27%, though it is lower than the top quartile of German dividend payers. The company's payout ratio stands at 51.1%, indicating dividends are well-covered by earnings and cash flows, with a cash payout ratio of 36.9%. Despite high debt levels, Brenntag's dividends have been stable and growing over the past decade. Recent earnings showed a decline, but strategic partnerships like the one with Aquaporin could bolster future growth.

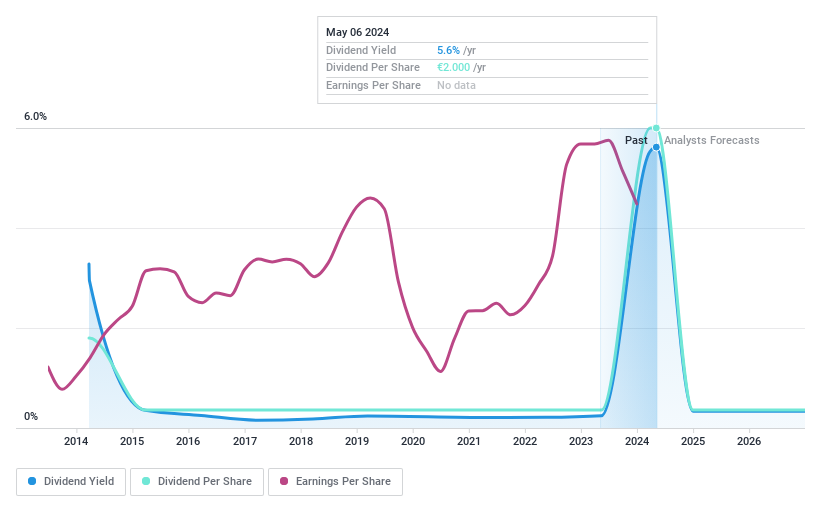

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally with a market cap of €93.80 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) generates revenue primarily from its Systems segment (€96.65 million) and Displays segment (€161.99 million).

Dividend Yield: 7.5%

DATA MODUL's dividend yield of 7.52% places it in the top 25% of German dividend payers, and its payout ratio of 64% indicates dividends are covered by earnings. However, the company's dividend history is marked by volatility over the past decade. Recent earnings showed a significant decline, with Q2 sales dropping to €50.99 million from €66.7 million last year and net income falling to €0.897 million from €3.8 million, raising concerns about future stability.

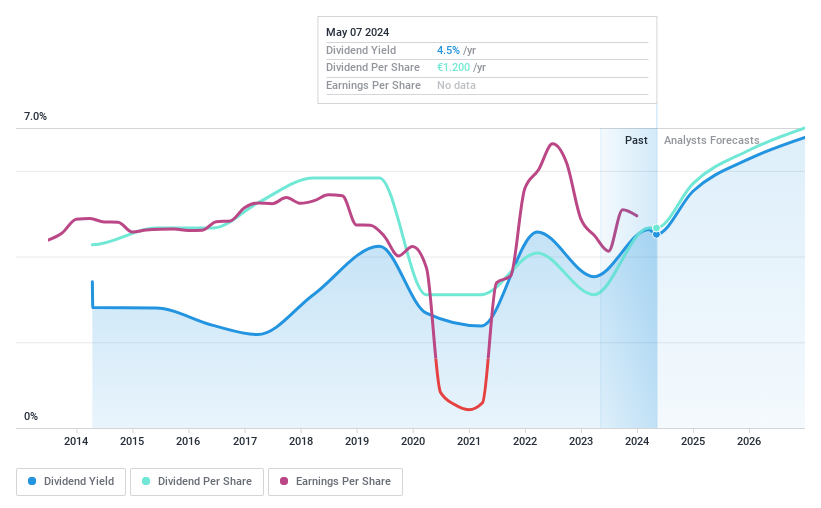

INDUS Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm specializing in mergers and acquisitions and corporate spin-offs, with a market cap of €567.50 million.

Operations: INDUS Holding AG generates revenue from three main segments: Materials (€584.27 million), Engineering (€586.92 million), and Infrastructure (€567.79 million).

Dividend Yield: 5.5%

INDUS Holding's dividend yield of 5.45% ranks it among the top 25% of German dividend payers, supported by a low payout ratio of 47.1%, ensuring coverage by earnings and cash flows (19%). Despite a decade-long increase in dividends, the payments have been volatile and unreliable. Recent Q2 results showed sales decreased to €429.65 million from €454.23 million, but net income rose significantly to €21.48 million from €5.42 million, highlighting mixed financial stability amidst lowered annual guidance due to macroeconomic conditions.

Key Takeaways

Click this link to deep-dive into the 32 companies within our Top German Dividend Stocks screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BNR XTRA:DAM and XTRA:INH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]