Corporate America's earnings recession may have finally ended

Corporate America’s long earnings recession may have finally come to an end.

Earnings for the S&P 500 (^GSPC) has seen year-over-year declines for five straight quarters. Q3 of 2016 was supposed to have marked the sixth straight quarter of decline, but recent earnings announcements and comments from companies have analysts revising up their estimates in a big way.

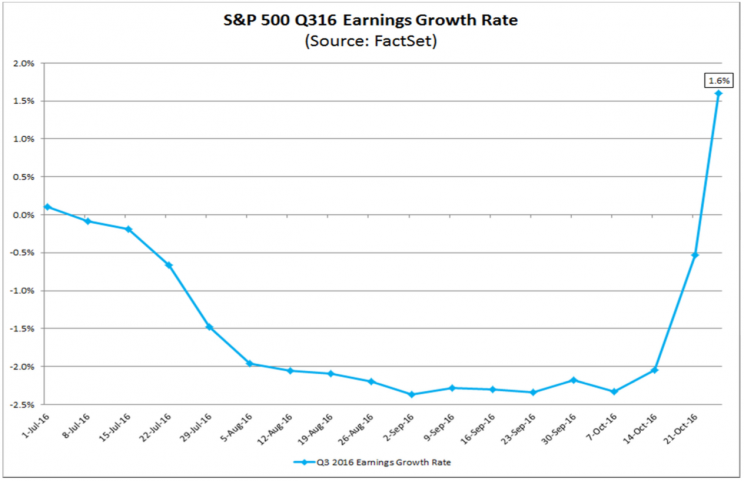

“The blended (combines actual results for companies that have reported and estimated results for companies yet to report) earnings growth rate for the S&P 500 is 1.6%, which is above the year-over-year blended decline of -0.5% at the end of last week and the year-over-year estimated decline of -2.2% at the end of the third quarter (September 30),” FactSet’s John Butters observed.

“If the index reports growth in earnings for the quarter, it will mark the first time the index has seen year-over-year growth in earnings since Q1 2015 (0.5%),” he added.

Importantly, the good news seems to be broad based.

“At the sector level, all eleven sectors have contributed to this increase in earnings,” Butters observed. “However, the Financials sector has been the largest contributor of all eleven sectors to the rise in earnings growth for the index since the end of the third quarter. This sector accounts for $3.6 billion (or 36%) of the $10.1 billion increase in earnings for the S&P 500 since September 30.”

It’s not a total surprise that this is happening. There’s a long history of earnings expectations being too low, making it easy for companies to surprise to the upside.

Regarding earnings, the bigger and more important question may be about 2017. Will earnings grow at the 13% pace currently estimated by the average market forecaster? Or fall short?

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Goldman Sachs cuts its outlook for 2017 earnings

The most controversial use of corporate cash could hit $1 trillion this year

A growing chorus of strategists are sounding the same warning about 2017

The next selloff could be triggered by something we’re not discussing right now