The path of the stock market since 1928: Morning Brief

Thursday, October 8, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Stocks usually go up

What does the path of the stock market look like in an average year?

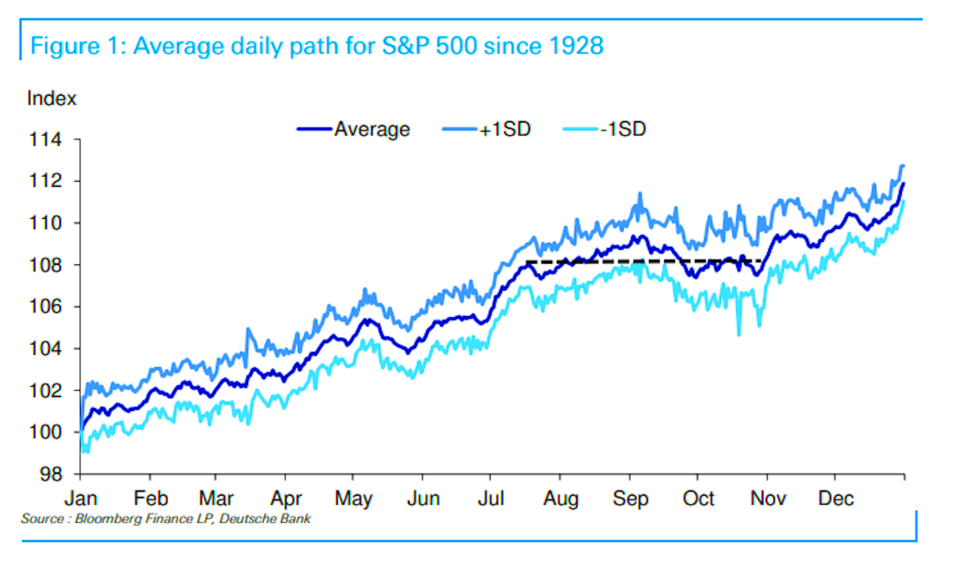

In an email blast this week, Deutsche Bank strategist Jim Reid shared this chart mapping the average path of the S&P 500 (^GSPC) since 1928.

Reid, citing the work of his colleague Binky Chadha, noted that volatility tends to be highest in October, only to settle down as prices rally during the final two months of the year. It’s an outcome Deutsche Bank expects to unfold this year as the presidential election comes and goes.

“Markets have traditionally not tended to care who wins the election, they just want certainty,” Reid said.

There’s also another way to look at this chart: on average, stocks start the year at a level and embark on a bumpy path only to end the year much higher.

Sure, this year is certainly unprecedented when you consider all the bad stuff that’s happened. And in no way are we suggesting any of that stuff isn’t bad.

But since 1928, there’s been a lot of bad stuff that’s happened. There’ve been wars, civil unrest, asset bubbles, natural disasters, financial crises, viral outbreaks, and so on. And many of these events have come with economic contraction, falling corporate profits, and of course falling stock prices. (Investors shouldn’t ignore this stuff. Volatility and uncertainty is a part of investing.)

However, amid both bad times and good times, for whatever reason people want a better life. And that includes having better stuff and using better services. This resilience is an incredibly bullish force that drives growth and innovation and everything else that powers the earnings that send stock prices higher.

And keep in mind: the stock market is not a static set of companies. Once iconic companies shrink and go bankrupt and get replaced as new companies offering new goods and services emerge. This is why the market as a whole will go up as individual names go to zero.

Yes, there’ll be bouts of volatility and sometimes extended periods of falling prices. Indeed, the stock market has priced in a high bar for earnings growth amid persistent problems in the economy.

But barring some collective long-term change in consumer psychology or a massive change in the rules of business, the long run outlook for stocks continues to seem bright.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: Initial jobless claims, week ended October 3 (820,000 expected, 837,000 during prior week)

8:30 a.m. ET: Continuing claims, week ended September 26 (11.4 million expected, 11.767 million during prior week)

Earnings

7:30 a.m. ET: Domino’s Pizza (DPZ) is expected to report adjusted earnings of $2.79 per share on revenue of $952.96 million

Top News

Market pressure eases as US fiscal policy and a Democratic win appear in focus [Yahoo Finance UK]

Regeneron antibodies in demand after Trump treatment, doctors seek more data [Reuters]

Pence, Harris spar over COVID-19 in vice presidential debate [AP]

YAHOO FINANCE HIGHLIGHTS

Activist investor Loeb to Disney: Nix dividend and 'more than double' your Disney+ budget

If Howard Stern bolts from Sirius, here's how much the stock could tank

Most Americans support higher taxes if it's spent on these 2 things: Poll

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay