The stock market may have already bottomed: Morning Brief

Monday, April 6, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Stocks bottom long before the economy does

The economy is getting slammed by the lockdowns triggered by the coronavirus pandemic, and most agree it’ll get much worse before it gets better.

However, we cannot rule out the possibility that the stock market, which touched a low on March 23, may have already priced in most if not all of the bad news to come.

“While the world seems to be heading for such a sharp slowdown, equity prices might not fall much further in our view, for two reasons,” Capital Economics’ Simona Gambarini wrote on Thursday.

“First, the recession could potentially be very short-lived, so output and earnings could recover more quickly than they have done in the past,” she said.

Many economists are on board with this expectation for a “V-shaped” recovery as the U.S. households and businesses entered the crisis in pretty good financial shape; in other words the recession was not caused by excesses or imbalances. And while some have tried to compare this pandemic to a natural disaster, it’s critically important to note that any recovery won’t be delayed by a need to rebuild damaged or destroyed capital goods and property.

“Second, prices appear to reflect a much less benign economic outlook than analysts’ current expectations for earnings,” Gambarini said.

Indeed, the S&P 500 (^GSPC) has tumbled 35% from peak to trough, even though most strategists are expecting a much more modest decline in earnings. According to FactSet, the average strategist expects earnings per share (EPS) to decline just 4.5% in 2020. Goldman Sachs, by far the biggest bear among the bulge bracket firms, sees EPS falling 33% to $110.

In other words, the stock market is either already prepared for worse news or it has overcorrected. Both are conditions that would make for an attractive entry point for stock market investors.

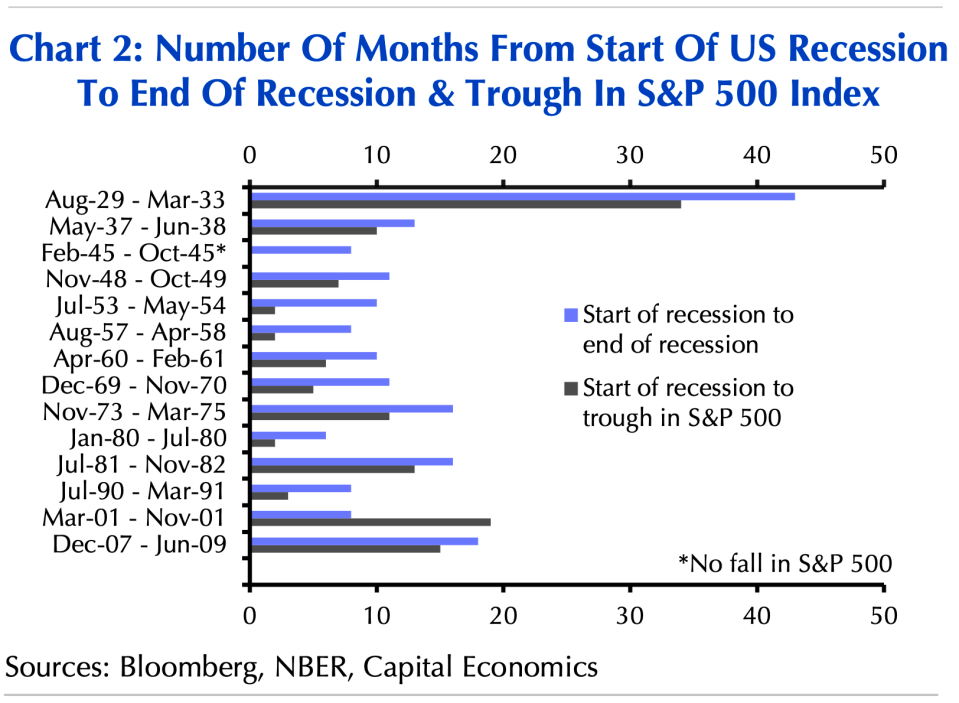

Keep in mind that historically, the stock market has bottomed long before the economy did. In a note published on Wednesday, Capital Economics’ Hubert de Barochez observed that this was the case every time except after the dot com bubble burst.

“That is because valuations were very high when the crisis started, and the [dot com] bubble was still in the process of deflating a year later,” he said. “At the same time, the recession was quite short by past standards.”

Of course, all of these assumptions and expectations depend on the world’s ability to contain the coronavirus.

"The negative wildcard remains the COVID-19 daily infection rate, which is slowing,” JPMorgan’s John Normand wrote on Friday, adding “but remains too high to have much confidence on the duration of lockdowns/social distancing and therefore the duration and depth of the recession.”

In other words, uncertainty is still high, which would explain why stock prices remain depressed.

But that essentially defines the stock market, which gives greater rewards to investors willing to take on higher risk.

As is often the case, Warren Buffett said it best.

“I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now,” Buffett wrote during the financial crisis in 2008. “What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

There are no major economic reports or corporate earnings announcements scheduled for today, but coronavirus developments will continue to take centerstage for investors.

Top News

Stocks, US futures jump as global coronavirus case growth slows [Yahoo Finance UK]

Pound rises with UK prime minister 'still in charge' in hospital [Yahoo Finance UK]

Oil pares losses as investors weigh chance of price-war truce [Bloomberg]

Berkshire Hathaway sells part of Delta, Southwest airline stakes [Reuters]

Tesla engineers show ventilator prototype on YouTube [Reuters]

YAHOO FINANCE HIGHLIGHTS

'The sun will shine again': Jefferies CEO Rich Handler encourages next generation amid coronavirus

Americans buying ‘historic’ amount of computers during coronavirus lockdown

Coronavirus pandemic leading to 'unprecedented' financial pain for U.S. households, survey shows

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay