A quirky post-crisis stock market trend has flipped: Morning Brief

Wednesday, April 8, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Buying the open and selling the close is making money

In the coronavirus market, it seems like up is down and down is up.

As we noted yesterday, earnings forecasts from Wall Street analysts have moved from just about the most uniform on record to the most disparate.

The economy went from historically stable to facing the deepest recession on record.

And even an oft-overlooked quirk in the market’s daily action has completely reversed the pattern that has endured for most of the last 30 years.

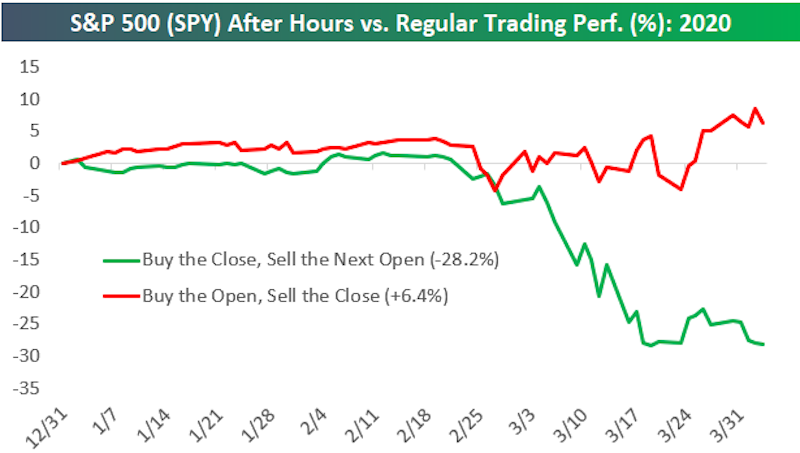

In a note to clients over the weekend, analysts at Bespoke Investment Group observed that buying the market open in the SPY ETF (SPY) that tracks the S&P 500 and selling the close would’ve actually seen investors gain about 6% year-to-date (through Friday’s close). Buying the close and selling the open, in contrast, would see an investor down over 28%.

On the surface, this might seem somewhat unremarkable. Many folks who follow markets closely will remember the “overnight futures gap down” headlines that seemed to come almost daily in mid-March.

And so perhaps it is not a huge surprise that the data confirms most of the pain in this market is being inflicted by overnight futures trading and the resulting gaps at the next day’s open. That is what this period has felt like.

But the bigger challenge this trend poses for investors is that it is the exact opposite of what has prevailed over the last few decades.

“If we go all the way back to 1993 when SPY began trading, we see that all of SPY's gains over this time frame have come outside of regular trading hours,” Bespoke writes.

“That is, if you bought SPY at the close every trading day and sold it at the next day's open, you'd currently be up 500%. If you did the opposite and instead bought SPY at the open every trading day and sold at the close, you'd actually be down 6.8%.”

The overnight gaps in markets have long been an investor’s friend. This quirk in the S&P 500’s returns has been known for years. It is part of what informs the old market adage that dumb money sells the open and smart money buys the close.

And that this trade is not only not working but in fact underperforming both the opposite strategy and the broader market shows just how much pressure consensus views of all sorts are coming under pressure in this environment.

After a big rally in the final days of March, it seemed like a uniform view that stocks would eventually re-test their March 23 lows. And maybe they will. But from its recent low the S&P 500 is up over 20%.

Bringing to mind another old market cliché that seems relevant right now — the goal of the market is to inflict as much pain on as many people as possible.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

7 a.m. ET: MBA Mortgage Applications, week ended April 3 (15.3% prior)

2 p.m. ET: FOMC minutes

Take our survey

How's the coronavirus recession affecting you? And what questions can we answer?

Top News

Oil climbs amid hopes of production deal between Russia and Saudi Arabia [Yahoo Finance UK]

Tesla to furlough workers, cut employee salaries due to coronavirus [Reuters]

Zoom sued for fraud over privacy, security flaws [Bloomberg]

Jack Dorsey pledges $1 billion of his Square stake for COVID-19 relief efforts [Reuters]

Levi's reports solid quarterly earnings, CEO says jeans maker will come out of coronavirus stronger [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Howard Schultz is sending coronavirus stimulus to Seattle workers ahead of federal response

'Nightmare': 3 small-business owners describe process of applying for PPP coronavirus loans

Coronavirus will reshape how people, companies, governments behave

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay