The worst two-day selloff since 2015: Morning Brief

Wednesday, February 26, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Why the stock market’s silver lining playbook flopped on Tuesday

Stocks got drubbed on Tuesday.

After the market endured its worst day in two years to start the week, a Turnaround Tuesday failed to materialize for the market.

When the dust settled, the Dow was off 879 points, or 3.1%, the S&P 500 dropped 97 points, or 3%, while the Nasdaq fell 255 points, or 2.8%. Tuesday marked the first back-to-back 3% declines for the S&P 500 since August 2015.

Meanwhile, the 10-year Treasury hit a record low on Tuesday, cementing the view held by many in the market that bonds had been signaling trouble ahead for some time.

Trouble that appears to have now arrived.

The Centers for Disease Control on Tuesday said the coronavirus is “a serious public health threat” in the U.S. The agency added in a briefing that the coronavirus will likely begin spreading in the U.S., saying “It’s not so much of a question of if this will happen anymore but rather more of a question of exactly when this will happen.”

In a note published Tuesday, Greg Daco at Oxford Economics said the firm now expects coronavirus will take 0.25% off 2020 GDP. But this assumes a global pandemic doesn’t break out. An assumption that financial markets now view more skeptically.

“If the coronavirus outbreak becomes a global pandemic, the consequences would be much more severe,” Daco writes. “Along with the human costs that would entail, the US economy would fall into a recession, with GDP tumbling 1.7% relative to a no-virus scenario.”

As for the market outlook, Tuesday’s decline now puts investors into territory we haven’t explored since 2015.

On Monday, analysts at Bespoke Investment Group noted that when the market begins a week with a decline of more than 2%, the market tends to bounce back quickly. A bit of optimism — a silver lining —for investors left stunned after Monday’s decline.

According to Bespoke, excluding this week’s action there have been 18 Mondays since 2009 during which the S&P 500 dropped 2% or more. The market traded higher the next day 15 times with these gains on these days averaging 1%.

Over the next week, the market was higher 94% of the time following a Monday decline of 2% or more. Only three times since the crisis had the market declined the next day after a Monday sell-off greater than 2% before Tuesday.

But now this has happened four times. And while stocks were eventually higher over the next month in two of these three prior instances in which stocks dropped 2% on Monday and kept falling on Tuesday, the timing isn’t inspiring — June 2009, October 2011, and August 2015 aren’t periods investors would care to remember.

And this week’s market moves also send a clear message to investors that when it comes to how coronavirus impacts financial markets, this time is very different. And the story is far from settled.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

7 a.m. ET: MBA mortgage applications, week ended Feb. 21 (-6.4% prior)

10 a.m. ET: New home sales, January (710,000 expected, 694,000 prior)

Earnings

Pre-market

6 a.m. ET: Lowe’s (LOW) is expected to report adjusted earnings of 91 cents per share on $16.15 billion in revenue

7:35 a.m. ET: Papa John’s (PZZA) is expected to report earnings of 32 cents per share on $403.82 million in revenue

Post-market

4:05 p.m. ET: Square (SQ) is expected to report adjusted earnings of 21 cents per share on $593.37 million in revenue

Other notable reports: Etsy (ETSY), Booking Holdings (BKNG), Marriott International (MAR), Nutanix (NTNX)

Top News

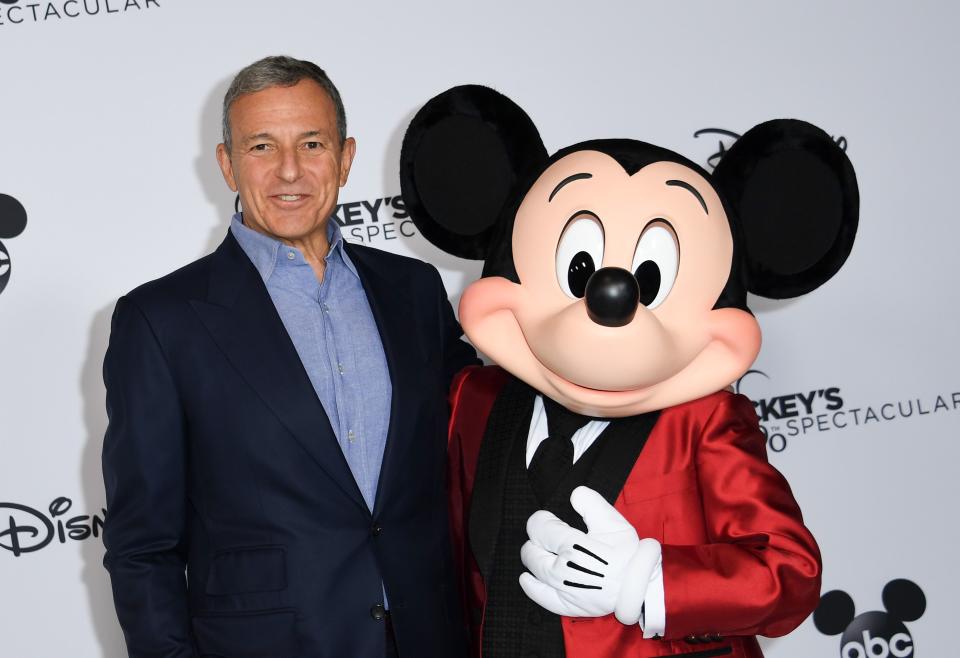

Disney CEO Bob Iger steps down, Bob Chapek named new head [AP]

Salesforce co-CEO Keith Block steps down, ceding control to Marc Benioff [Yahoo Finance]

Branson's Virgin Galactic posts quarterly loss of $73 million [Reuters]

Starbucks adds Beyond Meat to its menu across 1,400 Canadian stores [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Bitcoin tumbles along with stocks amid coronavirus, questioning 'safe haven' theory

Scaramucci sounds off on why markets are so volatile, hitting Fed, Volcker Rule

The 25 best-performing large cities in the US: Milken Institute

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.