The stock market is facing one of three scenarios

The stock market’s decline in October has sparked many questions from market participants. The most common questions people are asking me include: Is this just a brief correction? Is this the start of a bear market? And what are the reasons for the decline?

The best traders I’ve studied always seem to have a strong understanding of where we are in the stock market’s big picture. I try to mimic that concept by taking a step back, assessing the overall trend, and keeping an open mind to the following possibilities with today’s market:

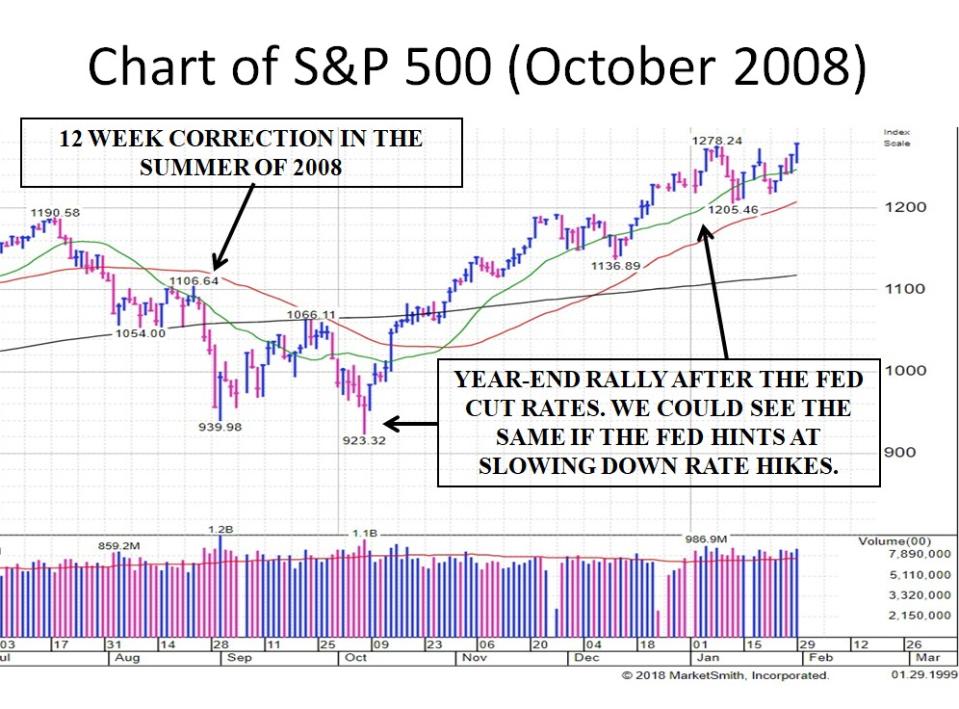

1) This is just a normal 8%-12% correction that lasts about 6-12 weeks. The reason I’m using the term “normal” is that historically the stock market averages a -14% intra-year decline (see above table). The problem is that 2017 was an anomaly. It was the first time since 1995 that the stock market did not see a correction of greater than -3% all year. This slow-grind, low volatility environment made many people forget that we actually have corrections and the price action we saw in October should be expected from time to time.

2) Another possibility is that we are heading into a bear market. I’m not leaning towards this possibility because the economy is still strong and there are few signs of a recession on the horizon. Since the recovery in 2009, the economy slowly experienced a 1%-2% growth rate. The past two years, GDP has accelerated to over 3% and many economists are saying this is unsustainable. Even if they are correct, I could see us going back to the slow and steady 1%-2% growth, but it would be tough to see a negative slowdown at this point.

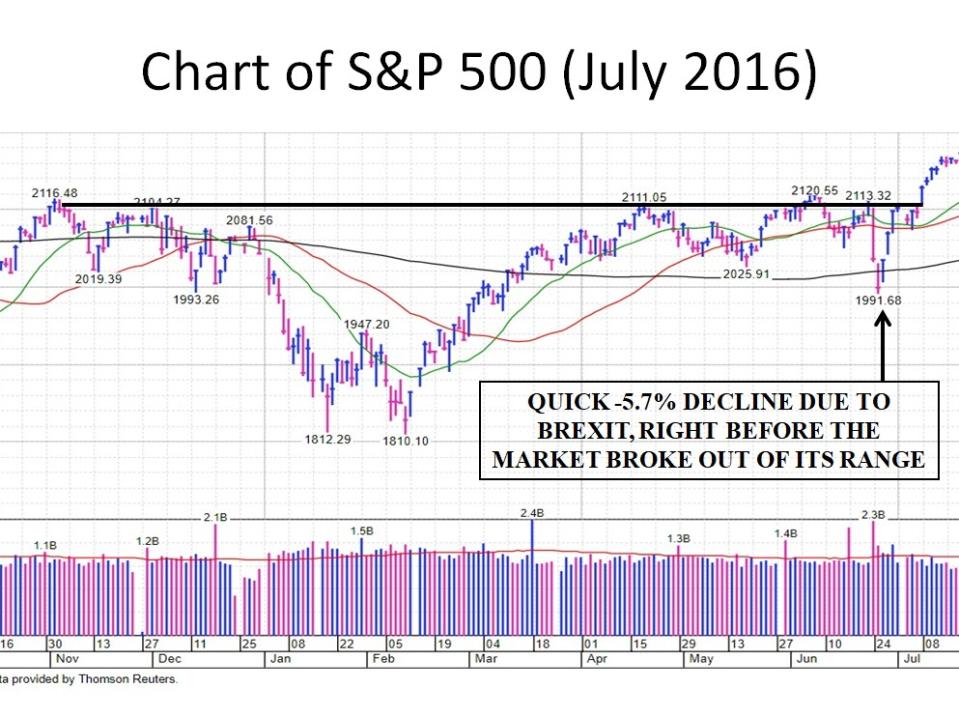

3) A third scenario is the October pullback is just one big shake-out before a year-end rally, similar to October 1998 (see above chart). Many times, the market experiences a quick drop to create doubt and shake out the weak hands before a rally. A perfect example was the Brexit event in July 2016 where the market dropped a quick -5.7% right before reversing course and breaking out to the upside (see chart below). This third scenario could be possible but it would require some resolution on the China trade war or some dovish comments from the Federal Reserve that they will slow down future interest rate hikes.

Of these three possibilities, I am leaning towards scenario one that this is just a normal correction. Obviously, nobody knows so the main point to stress is that investors should keep an open mind. It doesn’t make sense to get too negative because the market has been so resilient over the years. It also would be wise to be patient and let the market prove itself before turning bullish.

Many people are asking “Why is the market correcting?” It could be one of four reasons: China trade wars, higher interest rates, fear heading into the midterm elections, or possibly something that we don’t know about yet such as trouble with the European banks.

The main point to stress is that people need to be less concerned with the “why” and more focused on defining their investment objectives. For example, investors should accept that we will have these types of corrections and stick to their longer-term discipline. Traders should remain defensive, especially with all the major market indexes below their 200-day moving averages. There’s nothing wrong with being cautious until all this selling calms down and we see healthier signs such as the major institutions consistently buying back into the market.

See also: We’ve got 3 years left in this bull market — but there’s a catch

I can be reached at: [email protected].

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.