Stock market news live updates: Stocks pare losses as Netflix, Amazon hit records

Stocks ended Thursday’s mixed session modestly higher, after another surge in U.S. weekly unemployment claims and a slump in new-home construction underscored the depth and breadth of the coronavirus’ impact on the domestic economy, while officials debate a strategy to restart public life.

[Click here to read what’s moving markets heading into Friday, April 17]

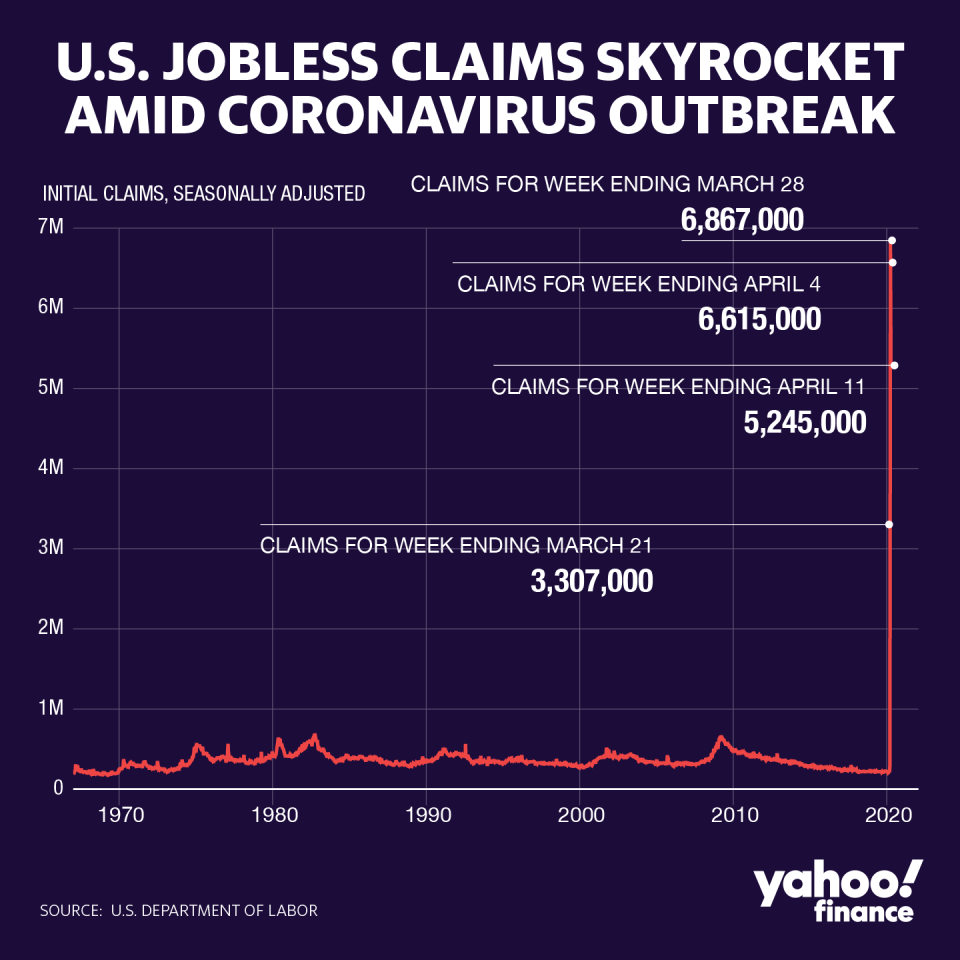

Initially, investors reacted badly to the news that new jobless claims topped five million for the week ended April 11, which brought the four-week total to more than 22 million. Still, equity traders mostly looked past the data toward President Donald Trump and state governors moving toward a consensus on slowly reopening the economy.

Meanwhile, Wall Street — which has been aggressively discounting stocks in anticipation of the coming economic calamity — is gradually looking ahead to better days.

“The stock market seems to count job layoffs the same way they read the curve of new positive coronavirus cases and think that 5.245 million jobless claims this week is better and lower than the 6.615 million applications last week,” Chris Rupkey, chief financial economist at MUFG, said in an email.

“The labor market curve is flattening and that's a good thing for the economic outlook as it signifies a recession this time around not a new Great Depression from the 1930s that lasted three and a half years,” he added. “We hope stock market investors are right that the peak in layoffs each week means the worst is over, but somehow it seems irrelevant how fast the layoffs are coming as long as they are coming. And more job layoffs are coming.”

Recent quarterly results from some of the country’s biggest financial institutions including Goldman Sachs (GS), Morgan Stanley (MS), Bank of America (BA) and Citigroup (C) reflected steep drops in first-quarter earnings over last year, providing some the first comprehensive glimpses at the coronavirus’s impact on corporate profitability.

Yet large banks are mostly setting aside billions to cover what they expect to be heavy loan losses, as the outbreak ravages Main Street and key economic sectors.

While pivotal to containing the spread of the coronavirus, social distancing measures have taken a catastrophic toll on the domestic economy, leaving the question of when businesses across the country will reopen hanging in balance.

Though federal and state officials from New York to California are weighing reopening plans as new coronavirus cases level off, definite timelines for easing distancing standards have yet to be established.

President Donald Trump is expected to announce guidelines on Thursday to ease stay-at-home measures in some parts of the country, after speaking with more than 200 leaders in a series of calls earlier this week. However, testing is a linchpin of any reopening strategy, as many observers fear a premature restart of the economy could trigger a fresh wave of COVID-19 illnesses.

—

4:02 p.m. ET: Stocks pare losses as Netflix, Amazon hit records, Dow closes higher

Here were the main moves in markets as of 4:02 p.m. ET:

S&P 500 (^GSPC): +16.19 (+0.58%) to 2,799.55

Dow (^DJI): +33.33 (+0.14%) to 23,537.68

Nasdaq (^IXIC): +139.19 (+1.66%) to 8,532.36

Crude (CL=F): -$0.11 (-0.55%) to $19.76 a barrel

Gold (GC=F): -$4.30 (-0.25%) to $1,735.90 per ounce

10-year Treasury (^TNX): -2.9 bps to yield 0.6090%

—

3:34 p.m. ET: Amazon, Netflix hit record intraday highs

Tech heavyweights including Amazon and Netflix outperformed on Thursday, leading the Nasdaq’s more than 1.3% gain in the last half-hour of trading. Each hit record intraday highs during Thursday’s session, as investors bet the companies would see sustained upticks in business even after social distancing measures ease.

Walmart, Dollar General, Eli Lilly, Abbott Laboratories, Citrix Systems and Market Access Holdings also hit record intraday highs during Thursday’s session.

—

2:38 p.m. ET: Crude oil holds at 18-year low

U.S. West Texas intermediate crude oil futures settled unchanged from the prior day at $19.87, the lowest price since 2002. Brent crude, the international benchmark, edged up slightly, rising 0.61% to trade at $27.86 per barrel as of 2:30 p.m. ET.

The oil market is unlikely to see much relief as the coronavirus crisis obliterates global demand — creating what one energy CEO told Yahoo Finance on Thursday was a “train wreck in full speed” for crude producers.

—

12:32 p.m. ET: S&P 500, Dow negative while Nasdaq holds slightly higher

Stocks were mixed Thursday afternoon as investors digested the latest batch of earnings and economic data.

Here were the main moves in markets, as of 12:34 p.m. ET:

S&P 500 (^GSPC): -13.2 points (-0.47%) to 2,770.16

Dow (^DJI): -270.11 points (-1.13%) to 23,239.57

Nasdaq (^IXIC): +19.4 points (+0.23%) to 8,413.93

Crude (CL=F): +$0.05 (+0.25%) to $19.92 a barrel

Gold (GC=F): -$5.10 (-0.29%) to $1,735.10 per ounce

10-year Treasury (^TNX): -4.1 bps to yield 0.6%

—

10:35 a.m. ET: Coronavirus relief small business loan program exhausts $349 billion in funds 13 days after launch

The small business funding program authorized in the Trump administration’s Paycheck Protection Program hit its $349 billion threshold Thursday morning after a flood of applicants sought funds amid the coronavirus pandemic. The program hit its allotment less than two weeks after its launch on April 3.

More than 1.62 million applications were approved, totaling $349 billion in loans from more than 4,900 lenders, according to the Small Business Association.

—

10:20 a.m. ET: Jobless data becomes a ‘weekly torture’ session

As Thursday’s jobless claims show, the coronavirus has affected the U.S. economy with devastating speed and impact that’s nothing short of brutal. Each week, Wall Street analysts find no shortage of (grim) ways to describe the carnage.

Amid a debate over how and when to restart the economy picks up speed, the award for most colorful euphemism belongs to veteran market watcher Peter Boockvar:

“The weekly torture is having to look at these weekly jobless claims figure and to think about the people behind these numbers. Fortunately they are being given help via expanded benefits but we want this situation turned around of course and a reopening would begin to do that. When this reopening begins, hopefully in a few weeks when testing capabilities are more fully ramped up, we all understand how difficult the process will be, the set backs we'll see and the danger of another wave of spread it brings. But I don't see any other way and wearing a mask will be key to this.”

Brian Coulton, Fitch Ratings’ chief economist thinks April jobs’ report could see 25 million on the dole, representing 15% of the workforce — a new post-war high.

Meanwhile, Nick Bunker, Indeed Hiring Lab’s economic research director there’s an open question about what happens to these workers once businesses open again:

“Whether these workers will be recalled to their former jobs or get hired at new ones is a matter of when the public feels safe returning to a semblance of normalcy. Only then can businesses start to ramp up hiring and the number of jobless workers can start to fall."

—

10:09 a.m. ET: Stocks turn mixed, Dow tumbles after grim data

Wall Street has mostly given up on an early rally, as investors digest latest batch of coronavirus-hit data that spells near-term doom for the economy. The Dow is now off by over 200 points, but the Nasdaq is up nearly 2% — underscoring how some high-flying tech stocks are outperforming in the current pandemonium. Both Amazon (AMZN) [groceries, online shopping and streaming] and Netflix (NFLX) [the market leader in streaming] hit new record highs in early trading.

—

9:30 a.m. ET: Stocks open slightly higher

Stocks opened slightly higher even after economic data showed another surge in unemployment claims last week.

Here were the main moves in markets, as of 9:32 a.m. ET:

S&P 500 (^GSPC): +17.55 points (+0.63%) to 2,800.91

Dow (^DJI): +44.44 points (+0.19%) to 23,548.79

Nasdaq (^IXIC): +97.99 points (+1.17%) to 8,490.77

Crude (CL=F): +$0.22 (+1.11%) to $20.09 a barrel

Gold (GC=F): +$8.10 (+0.47%) to $1,748.30 per ounce

10-year Treasury (^TNX): -3.3 bps to yield 0.608%

—

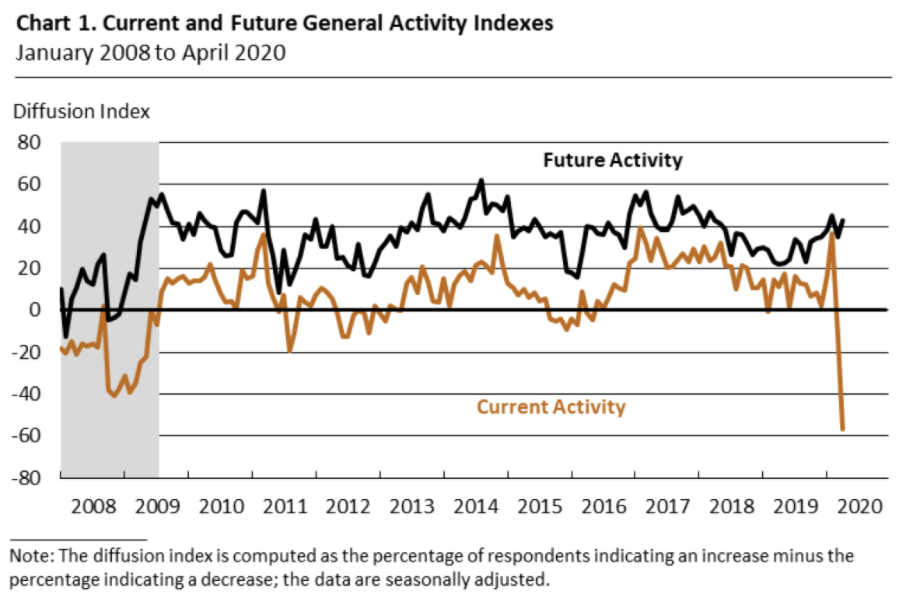

8:35 a.m. ET: Philadelphia Fed Index plummets to -56.6 in April, the lowest in 40 years

The Philadelphia Fed index for business conditions plummeted in April to -56.6, down from -12.7 in March. This was much worse than the -32 expected by economists, and represented the lowest level since July 1980.

From the Philly Fed: “This is the current activity index’s lowest reading since July 1980. The percentage of firms reporting decreases (60 percent) this month far exceeded the percentage reporting increases (4 percent). The index for new orders fell further into negative territory, from -15.5 to -70.9, its lowest reading ever. Also reaching an all-time low, the current shipments index fell 74 points after remaining slightly positive in March. Unfilled orders fell 6 points further into negative territory, while delivery times rose 13 points to 4.1, suggesting longer delivery times.“

—

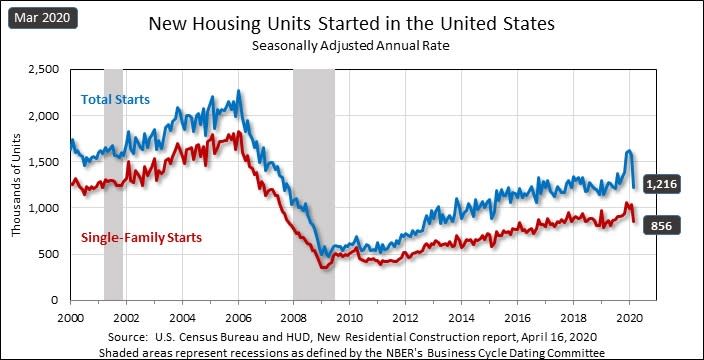

8:31 a.m. ET: New home construction drops by the most since 1984 in March

U.S. housing starts slid in March over February by the widest margin since 1984, highlighting the coronavirus’s early devastation on the domestic housing market.

Housing starts dropped 22.3% in March to a seasonally adjusted annual rate of 1.216 million, from a revised 1.564 million in February. Consensus economists had expected housing starts to drop 18.7%, according to Bloomberg-compiled data.

Building permits, which serve as a proxy for future home-building, also dropped in March, albeit less than expected. Permits dropped 6.8% to a seasonally adjusted 1.353 million in March, extending February’s 6.3% decline from the prior month.

—

8:30 a.m. ET: New jobless claims totaled 5.245 million last week, bringing four-week total to more than 22 million

New unemployment claims totaled 5.245 million for the week ended April 11, the Labor Department reported Thursday. This followed a rise of 6.615 million claims for the prior week, which were upwardly revised from the previously reported 6.606 million.

The headline new unemployment claims figure was trivially below consensus estimates for 5.5 million, according to Bloomberg compiled data. Over the past four weeks, new unemployment claims topped 22 million as the coronavirus pandemic sparked businesses across the country to temporarily shut down and furlough or lay off workers.

Continuing jobless claims rose to 11.976 million, topping the prior week’s 7.446 million for a new record high.

—

7:20 a.m. ET: Morgan Stanley 1Q earnings fall over last year, sales and trading revenue tops expectations

Morgan Stanley (MS) delivered first-quarter earnings per share of $1.01, down from the $1.39 reported in the same quarter last year. The bank said its expenses rose due in part to higher allowances for credit losses for unfunded lending commitments.

Morgan Stanley joined peers including Goldman Sachs and Bank of America in reporting strong sales and trading figures, as the bank benefited from increased client activity amid the March market volatility. Morgan Stanley’s bond-trading revenue was $2.2 billion, versus the $1.77 billion Bloomberg-compiled consensus expectation. Equity sales and trading revenue of $2.42 billion topped estimates for $2.3 billion.

Overall, however, company-wide net revenue of $9.5 billion was below expectations for $9.6 billion, and was down from $10.3 billion last year.

“Over the past two months, we have witnessed more market volatility, uncertainty and anxiety as a result of the devastating COVID-19 than at any time since the financial crisis,” CEO James Gorman said in a statement. “While it’s too early to predict how this will unfold, Morgan Stanley navigated the quarter well given the conditions, and our results bear testament to the strength of our balanced business model.”

—

7:14 a.m. ET Thursday: Stock futures edge up ahead of jobless claims report

Stock futures were slightly higher Thursday morning leading up to the Labor Department’s latest report on weekly jobless claims.

Here were the main moves in markets, as of 7:14 ET:

S&P 500 futures (ES=F): up 13.25 points, or +0.48% to 2,788.25

Dow futures (YM=F): up 86 points, or +0.37% to 23,477.00

Nasdaq futures (NQ=F): up 68.75 points, or +0.79% to 8,662.25

Crude (CL=F): +$0.22 (+1.11%) to $20.09 a barrel

Gold (GC=F): +$21.40 (+1.23%) to $1,761.60 per ounce

10-year Treasury (^TNX): -1.3 bps to yield 0.628%

—

6:01 p.m. ET Wednesday: Stock futures open lower

Here were the main moves at the start of the overnight session for U.S. equity futures, as of 6:01 p.m. ET Wednesday

S&P 500 futures (ES=F): down 3.5 points, or -0.13% to 2,771.5

Dow futures (YM=F): down 37 points, or -0.16% to 23,354.00

Nasdaq futures (NQ=F): down 9.5 points, or -0.11% to 8,584.50

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay