Stock market news live updates: Wall Street ends mixed, weighing grim data against states reopening

Stocks ended Wednesday’s session on a mixed note, with the Dow dropping by over 200 points as investors continued to price in the possibility of more states relaxing restrictive stay-at-home orders, while evaluating the ongoing damage to the world’s largest economy — which is unlikely to recover anytime soon.

Earlier, a new report Wednesday morning showed U.S. private sector companies cut a record 20.2 million jobs in April, the latest in an ever-longer list of data revealing the pandemic’s growing toll on the economy. Just Tuesday, Disney (DIS) reported second-quarter earnings that were badly undermined by COVID-19 related closures of its profitable parks, but that impact was offset by a surge in its digital properties — including its nascent streaming service, Disney+, which has seen subscribers soar to over 54 million.

A similar effect has been seen in crude markets, where benchmark oil contracts succumbed to new selling pressures on Wednesday, falling for the first time in six sessions. Crude had been under intense selling pressure as the coronavirus demand shock converged with an oversupplied market, and a price war between Saudi Arabia and Russia.

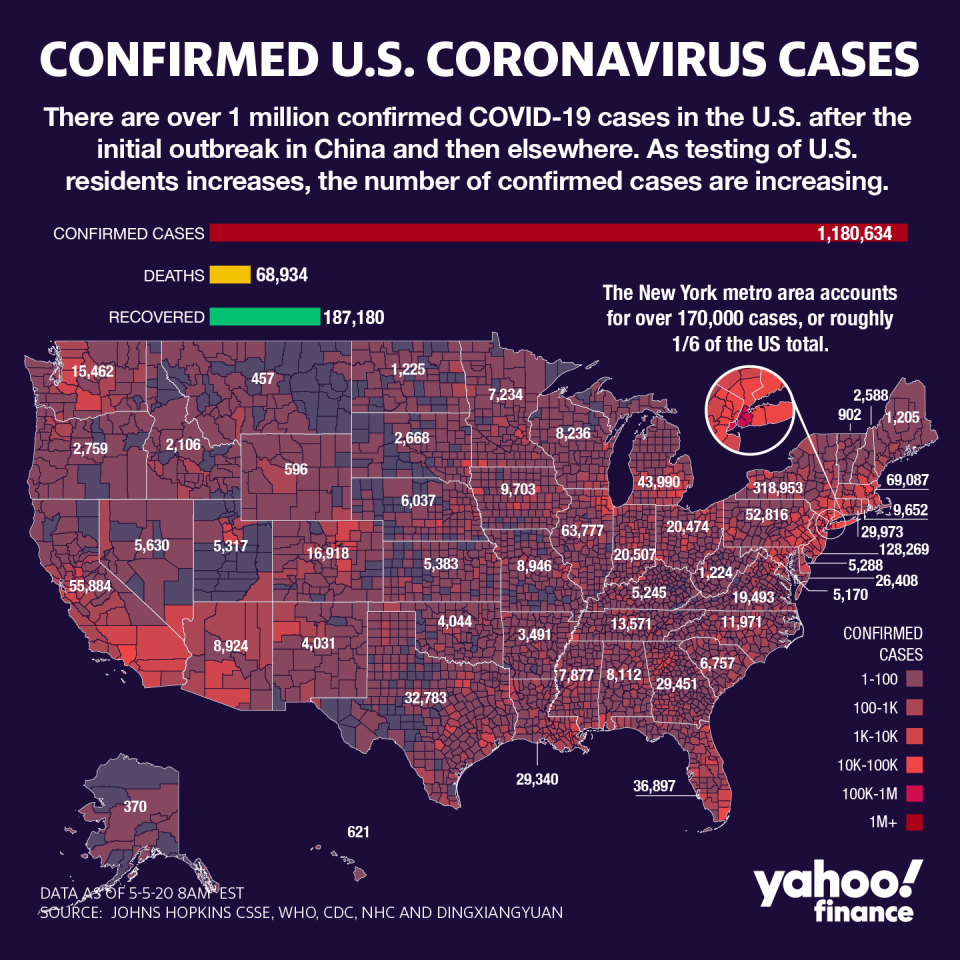

Across the U.S., cases as a whole rose to more than 1.2 million, with deaths topping 70,000. In New York state, the latest reported daily death toll was 232 as of Wednesday’s count, roughly flat from the day prior, and the total hospitalization rate fell again. In California, Governor Gavin Newsom said the state’s lockdown restrictions will begin loosening on Friday, joining a number of other states in slowly kick-starting the business reopening process.

Other states have already begun to reopen businesses — including Georgia, Florida and Texas. Those regions are being watched for signs that loosening the economically crippling stay-in-place orders can provide a boost to economic activity, but without sparking a new wave of infections that could lead to a devastating second round of lockdowns.

Meanwhile, more signs of distress emerged from key industries undermined by social distancing measures at containing the virus’ march.

Norwegian Cruise Line Holdings (NCLH) said Tuesday it had “substantial doubt” about its “ability to continue” as a “going concern” in the current environment, though the company said in an update Wednesday that new financing would allow it to withstand “well over 12 months of voyage suspensions in a potential downside scenario.”

Separately, Hertz (HTZ) temporarily avoided filing bankruptcy after its lenders granted it more time to “develop a financing strategy and structure that better reflects the economic impact of the Covid-19 global pandemic.”

—

4:03 p.m. ET: Stocks end mixed as investors weigh some states’ reopenings against dismal economic data

Here were the main moves in markets as of 4:03 p.m. ET:

S&P 500 (^GSPC): -20.02 (-0.70%) to 2,848.42

Dow (^DJI): -218.45 (-0.91%) to 23,664.64

Nasdaq (^IXIC): +45.27 (+0.51%) to 8,854.39

Crude (CL=F): -$0.49 (-2.00%) to $24.07 a barrel

Gold (GC=F): -$18.90 (-1.10%) to $1,691.70 per ounce

10-year Treasury (^TNX): +5.4 bps to yield 0.7110%

—

2:50 p.m. ET: Crude oil settles lower, breaking five-session winning streak

U.S. June West Texas intermediate crude oil futures settled 2.3% lower to $23.99 per barrel, snapping a five-session winning streak that had helped the commodity pare some of its steep year-to-date declines.

—

12:53 p.m. ET: Stocks hold onto modest gains, Nasdaq outperforms

The Nasdaq advanced more than 1% Wednesday afternoon while the S&P 500 and Dow were each just slightly higher.

In the S&P 500, the Information Tech sector led advances, rising more than 1.5%. A 2% advance in shares of Intel, as well as a 1.75% gain in Apple’s stock, led gains in the 30-stock Dow.

—

10:46 a.m. ET: S&P 500, Dow erase most earlier gains, trade roughly flat

Here were the main moves in markets, as of 10:46 a.m. ET:

S&P 500 (^GSPC): +8.83 points (+0.31%) to 2,877.27

Dow (^DJI): +84.93 points (+0.36%) to 23,968.02

Nasdaq (^IXIC): +107.22 (+1.22%) to 8,916.17

Crude (CL=F): -$0.46 (-1.87%) to $24.10 a barrel

Gold (GC=F): -$17.40 (-1.02%) to $1,693.20 per ounce

10-year Treasury (^TNX): +7 bps to yield 0.727%

—

9:33 a.m. ET: Stocks open higher as Wall Street shakes off stream of tough data

Here were the main moves in markets, as of 9:33 a.m. ET:

S&P 500 (^GSPC): +20.34 points (+0.71%) to 2,888.78

Dow (^DJI): +168.48 points (+0.71%) to 24,051.57

Nasdaq (^IXIC): +92.09 (+1.05%) to 8,902.27

Crude (CL=F): -$1.19 (-4.85%) to $23.37 a barrel

Gold (GC=F): -$21.70 (-1.27%) to $1,688.90 per ounce

10-year Treasury (^TNX): +6.4 bps to yield 0.721%

—

9:11 a.m. ET: Uber slashes 3,700 jobs, CEO foregoes base salary for the rest of the year, to cut costs amid pandemic

Ride-hailing company Uber (UBER) said in a securities filing Wednesday it will cut 3,700 full-time employee roles mostly in its customer service and recruiting teams in a bid to cut costs as the coronavirus pandemic dents business. This will amount to about 14% of its 26,900 employees as of Uber’s most recently disclosed headcount.

The company plans to incur $20 million in severance and other termination benefit-related costs following the move, it said in the filing.

The company also said its CEO Dara Khosrowshahi will forego his base salary for the remainder of the year ended December 31.

—

8:30 a.m. ET: Post-COVID recovery ‘is going to take years’

The ADP data was just as grim as markets anticipated, which may be why stocks are in Honey Badger mode and holding pre-market gains.

Count Peter Boockvar at Bleakley among those who don’t see a V or U-shaped recovery, but something that’s shaping up to be a multi-year rebound:

Bottom line, this is what you get when government forces business to close and consumers are fearful to go outside. We know however that as things reopen, many of these jobs will get restored but certainly to not anywhere near where they stood in February. Let's be honest, this is a healing process that is going to take years.

—

8:15 a.m. ET: Private payrolls drop by 20.236 million in April, the worst on record: ADP

U.S. private sector payrolls plunged by 20.236 million in April, according to ADP’s monthly report released Wednesday. This was the worst one-month decline on record. The result was trivially better than the 20.55 million private job losses expected for April, according to the median economist estimate as compiled by Bloomberg.

Private payrolls for March were sharply downwardly revised to see a drop of 149,000, from the decline of 27,000 previously reported.

Large businesses, or those with between 500 or more employees, saw most of the declines, with this category shedding 8.963 million jobs in April. Small businesses, or those with between 1-49 employees, saw payrolls shrink by 6 million, and medium-sized businesses shed 5.269 million payrolls.

By sector, service-providing industries were worse off than their goods-producing counterparts, as the coronavirus pandemic and social distancing measures drove a steep drop-off in payrolls in leisure and hospitality and trade services.

—

7:45 a.m. ET: General Motors ekes out profit despite big coronavirus hit

The biggest of Detroit’s Big Three (GM) saw first quarter profit dive as it burned through cash, after North American vehicle production shut down as the pandemic took root in the U.S. GM, however, posted a profit of $274 million, and is hoping to restart most North American production on May 18. Shares rallied by nearly 5% in pre-market action.

—

7:36 a.m. ET: Wendy’s slashes dividend and posts more than 50% drop in first-quarter net income

Wendy’s lowered its first-quarter dividend to 5 cents a share from 12 cents previously and reported first-quarter profit that more than halved over last year as its investments in building out its breakfast offerings were unable to be offset with higher revenue as the coronavirus pandemic hit restaurant chains across the country.

First-quarter revenue declined about 1% over last year to $405 million, missing estimates for $412.8 million, according to Bloomberg-compiled data. Net income dropped to $14.4 million, down 54.9% from the $31.9 million reported in the same quarter last year.

—

7:22 a.m. ET: CVS first-quarter profit, sales rise over last year on as consumers stocked up on drugstore goods

Health giant CVS (CVS) posted first-quarter results that rose over last year on both the top and bottom lines, driven by strong results in its pharmacy benefit manager and drugstore businesses.

First-quarter adjusted earnings per share of $1.91 on net revenue of $66.76 billion were each higher than the $1.62 per share on net sales of $64.39 billion expected. The impacts of Covid-19 added about 10 cents to first-quarter adjusted EPS, CVS said, “as we met elevated consumer and member needs.”

CVS highlighted an “increase in prescription volume due to pull-forward in scripts driven by early maintenance medication refills and greater use of 90-day prescriptions,” amid the coronavirus outbreak. Front-store revenue in CVS’s retail segment grew 8.5%, a “significant portion” of which was due to Covid-19, the company said.

Unlike a number of other companies which have withdrawn guidance in recent weeks, CVS maintained its full-year earnings outlook, and still sees adjusted EPS in a range of $7.04 and $7.17 for 2020.

—

7:15 a.m. ET: Weekly mortgage applications for home purchases rose for a third straight week

An index tracking mortgage applications for home purchases rose on a week-over-week basis for a third consecutive week for the period ended May 1, indicating some recovery in home-buying amid the coronavirus pandemic.

The Mortgage Bankers Association’s (MBA) unadjusted Purchase Index rose 7% over the prior week, according to a statement, but was still 19% lower from the same week a year ago. An index tracking refinances fell 2% from the previous week, but was 210% higher than the same week a year ago.

The 30-year fixed rate mortgage declined to a fresh record low of 3.4% last week, according to the MBA.

“Despite lower rates, refinance applications dropped, as many lenders are offering higher rates for refinances than for purchase loans, and others are suspending the availability of cash-out refinance loans because of their inability to sell them to Fannie Mae and Freddie Mac,” Mike Fratantoni, MBA’s senior vice president and chief economist, said in a statement.

“Purchase volume increased for the third week in a row, led by strong growth in Arizona, Texas and California. Although purchase activity remains almost 19 percent below year-ago levels, this annualized deficit has decreased as more states reopen amidst the apparent, pent-up demand for home-buying,” he added.

—

7:08 a.m. ET Wednesday: Stock futures extend gains

Here were the main moves in markets, as of 7:07 a.m. ET Wednesday:

S&P 500 futures (ES=F): up 25 points, or 0.87%, to 2,883.25

Dow futures (YM=F): up 210 points, or 0.88%, to 23,971.00

Nasdaq futures (NQ=F): up 72 points, or 0.81%, to 8,996.25

Crude (CL=F): +$0.90 (+3.66%) to $25.46 a barrel

Gold (GC=F): -$2.20 (-0.13%) to $1,708.40 per ounce

10-year Treasury (^TNX): +2.7 bps to yield 0.684%

—

6:04 p.m. ET Tuesday: Stock futures open slightly higher

Here were the main moves at the start of the overnight session for U.S. equity futures, as of 6:20 p.m. ET:

S&P 500 futures (ES=F): up 5.75 points, to 2,864

Dow futures (YM=F): up 36 points to 23,797

Nasdaq futures (NQ=F): up 24.75 to 8,949.00

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay