Stock market news live: Markets rebound as coronavirus rocks China; Google jumps on Q4 earnings beat

U.S. stocks recovered some losses after a sell-off Friday that sent the Dow lower by 600 points. Equities in China, however, tumbled after an extended Lunar New Year holiday.

4:05 p.m. ET: Google slides after mixed Q4 earnings report

Google parent company Alphabet (GOOG, GOOGL) reported its fourth quarter earnings — the first since Sundar Pichai took over from Larry Page and Sergey Brin — after the closing bell on Monday. In another first for the company, it out revenue for its YouTube and Cloud businesses — but still missed Wall Street’s expectations on revenue even as it beat on earnings per share.

The stock shed 3% in after-hours trading, to trade around $1440.

—

4:00 p.m. ET: Stocks claw back losses, oil hits the skids on virus scare

Major U.S. benchmarks managed to temporarily shake off coronavirus fears, recouping a chunk of Friday’s steep losses. Nerves remain frayed as the casualties in China mount, and officials scramble to head off a global pandemic. Those jitters have pushed crude into a bear market, and prompted Saudi Arabia to mull production cuts amid expectations of waning global demand.

Here’s where markets closed, as of 4:00 p.m. ET:

S&P 500 (^GSPC): +0.73% or +23.40 points to 3,248.92

Dow (^DJI): +0.51%, or +135.49 points to 28,399.54

Nasdaq (^IXIC): +1.34%, or +122.47, to 9,273.40

Crude oil (CL=F): -2.99%, or -1.54 to 50.02

Gold (GC=F) -$6.60, or -0.42% to 1,581.30 per ounce

—

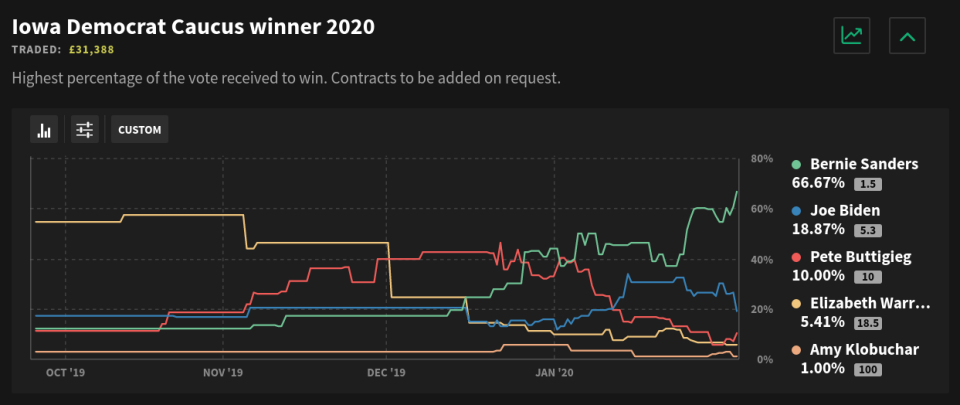

2:35 p.m. ET: Political market investors feel the Bern, but...

According to political betting website Smarkets, Vermont Senator Bernie Sanders is a “clear favorite” to win tonight’s closely-watched Iowa Democratic caucus vote.

The site’s predictive market sees a 2-in-3 chance (67%) that he beats contenders like former VP Joe Biden, Mass. Senator Elizabeth Warren and South Bend Mayor Pete Buttigieg — all of whom have lost steam in recent weeks. At 19%, Biden is considered the 2nd favorite to prevail, but Smarkets says he hasn’t been favored at all in Iowa.

The most eye-popping statistic is that President Donald Trump’s chances for reelection are currently the highest they’ve ever been, with Smarkets currently estimating a 57% chance he prevails in November. A vote to remove the president, who was impeached by Congress in December, is expected this week.

—

1:27 p.m.: Stocks hold onto gains but come off highs of the session

The three major domestic indices held in positive territory during Monday’s intraday session. However, they pulled back slightly from the highs of the day, when the Dow was up by as many as 374 points.

Here were the main moves in markets, as of 1:28 a.m. ET:

S&P 500 (^GSPC): +0.78% or +25.26 points to 3,250.78

Dow (^DJI): +0.54% or +153.7 points to 28,409.73

Nasdaq (^IXIC): +1.19% or +109.04 points to 9,259.23

Crude oil (CL=F): -$1.09 or -2.11% to $50.47 a barrel

Gold (GC=F): -$5.20 or -0.33% to $1,582.70 per ounce

—

1:03 p.m.: U.S. crude oil prices briefly dip below $50 per barrel for the first time in more than one year

West Texas intermediate crude oil (CL=F) prices briefly fell below $50 per barrel for the first time since January 2019 during Monday’s session.

At the lows of the day, domestic crude oil prices were down to as low as $49.92 per barrel. They last traded lower by 1.76% to $50.65 per barrel as of 1:05 p.m. ET.

—

11:20 a.m. ET: UBS sees China’s economic growth decelerating in 2020 as coronavirus impact spreads

China’s economic growth could come in below 5% in 2020 if the impacts of the coronavirus extend into the second quarter this year, according to UBS economists.

The UBS economists, led by Tao Wang, said consumption in China will likely be hit significantly, “especially in travel and tourism, hotel and catering, and transport” amid the coronavirus. “We think overall retail sales growth could weaken by 5 (percentage points) in Q1.”

Meanwhile, restrictions on transportation and factory closures could disrupt industrial production and exports, Wang added.

Quantifying the economic impact of the outbreak is extremely challenging at this stage. Assuming that the outbreak will be controlled in Q1 with few new cases thereafter, we estimate that Q1 GDP growth will drop to 3.8% y/y, while subsequent normalization of activities, release of pent-up demand and policy support should see growth rebounding in Q2-Q4. With this assumption, we downgrade China's 2020 GDP growth forecast to 5.4%. Risk to our forecast is biased on the downside. In the case the outbreak lasts well into Q2, GDP growth will likely fall <5% in 2020.

Prior to the outbreak, the Chinese government targeted 2020 GDP growth of around 6%, down from last year’s target of 6-6.5%. China’s 2019 GDP growth of 6.1% had been the slowest pace of expansion since 1990.

—

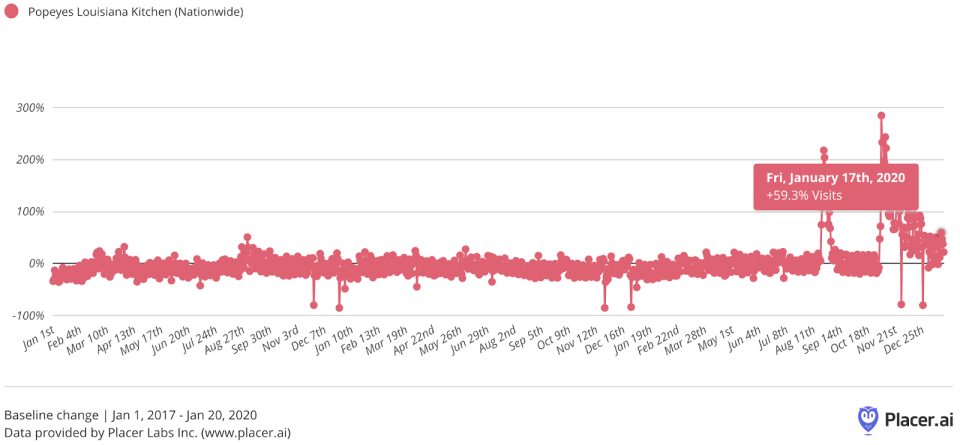

11:00 a.m. ET: Here’s who has the edge in the Chicken Sandwich Wars

A jam-packed January news cycle distracted consumers from what really matters: Restaurant chains and the ongoing war for chicken sandwich supremacy. On a battlefield dominated by Chick-Fil-A and Restaurant Brands’ (QSR) Popeye’s, McDonald’s (MCD) has now entered the fray.

Two new data points published on Monday show who’s got the edge. Data analytics firm Placer.ai said that since firing the first salvo last summer, Popeye’s shows no immediate signs of slowing down:

On Friday, January 17th, visits rose 59.3% above the baseline for the period between January 1st, 2017 and January 20th, 2020. Analyzing that same period, every week in January has come in at least 20% or more above the baseline for weekly traffic.

Early reviews of McDonald’s new chicken sandwich have been lackluster, at best. But Bank of America expects the Golden Arches to mount a challenge to both CFA and Popeye’s eventually, even though the path to victory won’t be easy:

MCD must rebuff a now formidable national competitor in Chick-Fil-A following years of 6% unit and double digit comp growth...The challenge for McDonald's is matching its chicken focused competitors on taste and quality despite a broader menu that makes it impossible to divert as much attention to the platform.

MCD could try to match them on quality with store changes and equipment investments but we expect a national rollout that moves MCD closer on taste and then leverages supply chain and marketing advantages to undercut its peers on price.

BofA says that gradual improvements in product quality will boost the stock, which the firm rates a “Buy” with a $240 price target. MCD traded up nearly 1% on Monday around $216.

—

10:00 a.m. ET: U.S. manufacturing sector expands for the first time since July

Activity in the U.S. manufacturing sector expanded for the first time in six months in January, in a sign of life after domestic goods-producing industries had contracted for much of last year.

The Institute for Supply Management’s purchasing mangers’ index registered at 50.9 in January, popping just above the level of 50 to indicate expansion. In December, the ISM’s PMI had been 47.8, and consensus economists had expected the PMI to rise to just 48.5 in January.

“Global trade remains a cross-industry issue, but many respondents were positive for the first time in several months. Among the six big industry sectors, Food, Beverage & Tobacco Products remains the strongest, followed closely by Computer & Electronic Products. Petroleum & Coal Products is the weakest,” Timothy Fiore, chair of the ISM Business Survey Committee, said in a statement. “Overall, sentiment this month is moderately positive regarding near-term growth.”

—

10:00 a.m. ET: U.S. markets bounce to session highs, shake off China’s rout

Major benchmarks are picking up steam, effectively shaking off the rout in Chinese stocks. While coronavirus fears remain in the driver’s seat — and are undermining global growth prospects — investors appear to be driven by U.S. fundamentals (which still remain strong) and bargain hunting.

Barely half an hour into Monday’s trading session, and the S&P 500 (^GSPC), Dow (^DJI) and Nasdaq (^IXIC) are all perched at session highs over 1%.

—

9:50 a.m. ET: Tesla keeps burning rubber

Wall Street has fallen back in love with Tesla (TSLA), which has been setting new records for the better part of two weeks. In early trading, the shares hit a new high above $709, up a whopping 9% on the session.

The rally picked up speed after the car marker posted Q4 earnings that broadly topped expectations, and has seen a steady increase in analyst upgrades — such as Oppenheimer, which last week rated Tesla as an “Outperform” (keep in mind the stock has already blown past its price target of $650.57). The dramatic move higher has also burned short-sellers, who S3 Partners estimated last week had lost over $4 billion.

—

9:34 a.m. ET: Stocks open higher after Friday’s coronavirus selloff

The three major U.S. stock indices opened higher Monday morning, pushing the S&P 500 back into positive territory for the year-to-date.

Shares of Nike (NKE) led advances in the Dow, after a pair of bullish recommendations from UBS and JPMorgan pushed the athletic-wear maker’s stock higher. The consumer discretionary, communication and health-care sectors led the S&P 500 higher.

Here were the main moves in markets, as of 9:34 a.m. ET:

S&P 500 (^GSPC): +0.55% or +17.71 points to 3,243.23

Dow (^DJI): +0.48% or +135.49 points to 28,391.52

Nasdaq (^IXIC): +0.67% or +61.75 points to 9,215.52

Crude oil (CL=F): -$0.37 or -0.72% to $51.19 a barrel

Gold (GC=F): -$4.60 or -0.29% to $1,583.30 per ounce

—

9:21 a.m. ET: Oil prices stabilize after WSJ reports Saudi Arabia is mulling a production cut

West Texas intermediate and Brent crude oil prices hovered little changed Monday morning in New York after the Wall Street Journal reported that Saudi Arabia was considering a major, temporary oil production cut to put a floor on prices amid the coronavirus.

According to the report, Saudi Arabia is considering production cuts beyond the 1.7 million barrel-per-day reduction OPEC and its allies had agreed in December to enforce.

The coronavirus has sent prices for both commodities tumbling, as investors fear the outbreak’s impact on demand in China, the world’s largest oil importer. Prices of both West Texas intermediate and Brent are down about 15% for the year to date.

—

7:36 a.m. ET: Stock futures rise as coronavirus spreads further

U.S. stock futures rebounded slightly after posting sharp declines Friday, which had wiped away the S&P 500’s year to date gains.

In China, the Shanghai Composite tumbled more than 7% as investors furiously tried to price in fears over the coronavirus after an extended market shutdown for the Lunar New Year holiday. Prior to Monday, Chinese markets had been closed since January 23.

China’s National Health Commission said Monday that the coronavirus had claimed the lives of 361 individuals among more than 17,000 confirmed cases. There have been 151 coronavirus cases in 23 countries outside of China, according to the World Health Organization’s Director-General Tedros Adhanom Ghebreyesus.

Here were the main moves during the pre-market session, as of 7:36 a.m. ET:

S&P futures (ES=F): 3,237.00, up 13 points or 0.4%

Dow futures (YM=F): 28,293.00, up 97 points or 0.34%

Nasdaq futures (NQ=F): 9,037.5, up 39.75 points or 0.44%

Crude oil (CL=F): $51.69 per barrel, up $0.31 or 0.25%

Gold (GC=F): $1,584.00 per ounce, down $3.90 or 0.25%

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news