Stock market news live: Stocks close at 3-year low in worst week since 2008; Trump era gains obliterated

Stocks on Friday plunged to a three-year low, closing out their worst week since the 2008 financial crisis and obliterating all of the gains made since President Donald Trump was inaugurated, as investors weighed the escalating coronavirus outbreak against vast stimulus measures designed to mitigate the crisis.

[Click here for what’s moving markets on Monday, March 23.]

The losses, which came to more than 4% for the S&P 500 and Dow during Friday’s session alone, brought the S&P 500’s total weekly losses to 15% for its worst weekly performance since October 2008. The Dow swan-dived 17.3% on the week, with all the benchmarks settling at their lowest levels since early 2017.

Risk assets dropped even as the Trump administration unveiled a laundry list of new relief measures — including a three-month delay to the April 15 tax deadline and temporary pause on federal student loan payments — meant to backstop consumers. The Federal Reserve also stepped in with more relief, broadening out the types of assets included in its purchase program and expanding its dollar liquidity operations with other major central banks.

However, the virus’ rapid spread had led to social distancing policies that have all but brought America’s public life to a grinding halt. Amid mass closures of private businesses, soaring layoffs and school shutdowns, economists all but expect the global economy — and the world’s largest — to plunge into a deep recession in the coming quarters.

“We expect declines in services consumption, manufacturing activity, and building investment to lower the level of [growth] in April by nearly 10%, a drag that we expect to fade only gradually in later months,” Goldman Sachs said on Friday. The bank predicted the U.S. economy will contract by a staggering 24% in the second quarter before rebounding in the second half.

As companies cut costs and reduce workers’ hours amid store closures, economists are bracing for a surge in joblessness and slump in consumer spending to undercut the U.S. economy’s previously booming labor market and services sector.

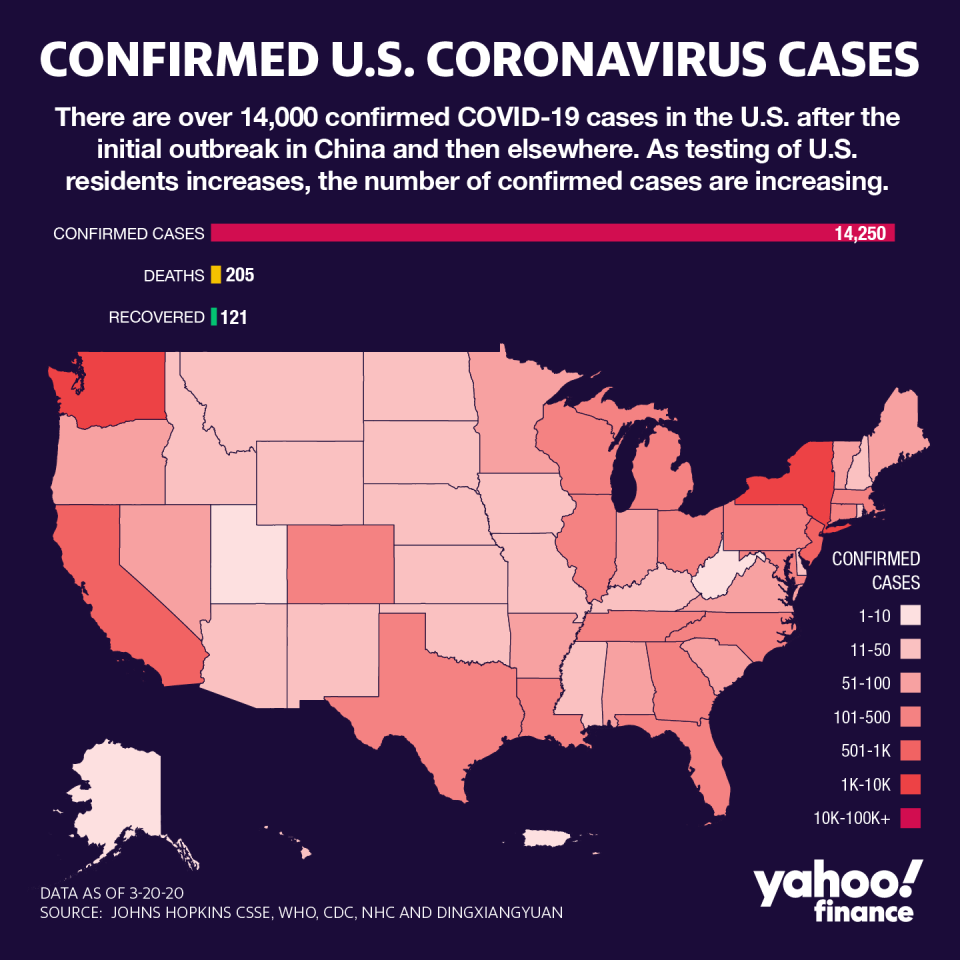

The number of coronavirus cases climbed above 258,000 globally on Friday, including more than 16,600 in the U.S. A day earlier, the number of deaths in Italy overtook those in China, the original epicenter of the outbreak, further escalating concerns that the pandemic remains far from being contained globally. The U.S. State Department Thursday afternoon issued an advisory urging U.S. citizens not to travel internationally at all amid the coronavirus outbreak.

Most market participants have come to anticipate further volatility, as impending corporate earnings results and economic data begin to reflect the fuller effects of the coronavirus outbreak.

Already a growing number of companies have tossed their full-year outlooks out the window, needing more time to assess the impact of the ever-evolving health crisis.

—

4:00 p.m. ET: Stocks close at three-year lows, S&P 500 posts biggest weekly drop since October 2008

The three major indices dropped into market close Friday, with the Dow shedding more than 900 points as heavy selling resumed across Wall Street.

Here’s where the three major indices ended Friday’s session:

S&P 500 (^GSPC): 2,304.92, -104.47 (-4.34%)

Dow (^DJI): 19,173.98, -913.21 (-4.55%)

Nasdaq (^IXIC): 6,879.52, -271.06 (-3.79%)

Gold (GC=F): $1,489.30 per ounce, +10 (+0.68%)

10-year Treasury (^TNX): -24.7 bps to yield 0.882%

—

3:50 p.m. ET: McDonald’s gives up on buybacks

The Golden Arches has suspended share buybacks to help it navigate thorough the coronavirus crisis, but has not changed its dividend policy, Chief Executive Officer Chris Kempczinski told CNBC in an interview on Friday.

—

3:24 p.m. ET: Selloff accelerates, Dow drops 700+ points

Stock declines steepened with less than an hour left of trading Friday. The S&P 500’s losses were led by drops in the Consumer Staples and Utilities sectors.

Here were the main moves in markets, as of 3:24 p.m. ET:

S&P 500 (^GSPC): 2,317.72, -91.67 (-3.8%)

Dow (^DJI): 19,338.00, -749.19 (-3.73%)

Nasdaq (^IXIC): 6,949.09, -201.49 (-2.81%)

Gold (GC=F): $1,483.90 per ounce, +4.60 (+0.31%)

10-year Treasury (^TNX): -18.9 bps to yield 0.94%

—

2:30 p.m. ET: Oil gives back prior day’s gains, set for grim weekly record

Crude’s (CL=F) short-lived rally on Thursday proved unable to sustain itself: The commodity is ending Friday’s trading off by nearly 15%, with U.S. (WTI) oil cracking $20 per barrel. According to Bloomberg data, this is crude’s worst week ever.

—

12:27 p.m. ET: Stocks sell off as more localities urge residents to stay inside amid coronavirus

Stocks turned negative Friday afternoon and erased early gains as cities and states in the U.S. and abroad expanded efforts to keep residents indoors amid the rapidly expanding coronavirus outbreak.

London on Friday is set to become one of the latest cities to order restaurants, pubs, cinemas and other nonessential public spaces to shut down temporarily, according to a report from Bloomberg. And New York Governor Andrew Cuomo on Friday ordered 100% of the nonessential workforce to remain at home.

Meanwhile, the Trump administration provided another update on the White House response to the outbreak, saying Friday that the U.S. would waive interest on federally held student loans for at least 60 days without penalty. He also said he was suspending all non-essential travel from Mexico amid the outbreak.

Here were the main moves in markets, as of 12:36 p.m. ET:

S&P 500 (^GSPC): 2,377.36, -32.03 (-1.33%)

Dow (^DJI): 19,894,93, -192.36 (-0.96%)

Nasdaq (^IXIC): 7,114.82, -35.76 (-0.5%)

Crude (CL=F): $23.63 per barrel, -$1.59 (-6.3%)

Gold (GC=F): $1,482.80 per ounce, +3.50 (+0.24%)

10-year Treasury (^TNX): -18.3 bps to yield 0.946%

—

—

11:22 a.m. ET: NY Governor Cuomo says 100% of workforce must stay home, expanding push for social distancing

New York Governor Andrew Cuomo said Friday that 100% of New York’s workforce must remain at home, aside from those at essential businesses, in an effort to slow the spread of the coronavirus in the state.

Speaking in a regular briefing Friday morning, Cuomo added that public transportation should not be taken unless necessary.

New York state now has 7,000 confirmed coronavirus cases, Cuomo said Friday.

—

11:15 a.m. ET: Fed adds municipal bonds to asset purchases

The Federal Reserve on Friday announced it is adding short-term municipal bonds to its list of asset purchases, in an effort to provide further liquidity across financial markets. The new program will work through the Fed’s Money Market Mutual Fund Liquidity Facility launched earlier this week.

The Fed previously had announced plans to purchase $500 billion in Treasuries across the full range of durations, as well as $200 billion in mortgage-backed securities.

—

10:04 a.m. ET: Trump administration is pushing tax deadline back by three months amid pandemic

U.S. Treasury Secretary Steven Mnuchin said Friday that the U.S. tax deadline will now by July 15, three months later than the usual deadline of April 15.

At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15. All taxpayers and businesses will have this additional time to file and make payments without interest or penalties.

— Steven Mnuchin (@stevenmnuchin1) March 20, 2020

—

10:01 a.m. ET: Federal Reserve announces coordinated action with global central banks to improve liquidity via swap lines

The Federal Reserve on Friday announced it was expanding its dollar liquidity operations with major central banks, including the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank. The move involves increasing the frequency of its seven-day maturity operations to daily, from weekly, starting Monday.

Here’s what the Federal Reserve said in its statement:

To improve the swap lines' effectiveness in providing U.S. dollar funding, these central banks have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 23, 2020, and will continue at least through the end of April. The central banks also will continue to hold weekly 84-day maturity operations.

The swap lines among these central banks are available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses, both domestically and abroad.

—

10:00 a.m. ET: Existing home sales surged to a 13-year high in February ahead of coronavirus outbreak escalation

Sales of previously owned homes surged to a seasonally adjusted annual rate of 5.77 million in February, representing the highest level since February 2007 and a jump of 6.5% over last month, the National Association of Realtors (NAR) said Friday. Consensus economists had expected existing home sales to rise by just 0.9% to 5.51 million, according to Bloomberg data.

January’s existing home sales were slightly downwardly revised to a seasonally adjusted annual rate of 5.42 million, from the 5.46 million previously reported.

Sales in February surged across three of the four major regions, with the Northeast the only one to report a drop in sales. Sales in the South, the largest region, jumped 7.2%.

February’s home sales depicted a strong housing market heading into the coronavirus outbreak, but that strength could deteriorate in forthcoming data as the outbreak starts being taken into account.

“These figures show that housing was on a positive trajectory, but the coronavirus has undoubtedly slowed buyer traffic and it is difficult to predict what short-term effects the pandemic will have on future sales,” Lawrence Yun, NAR’s chief economist, said in a statement.

—

—

9:55 a.m. ET: That didn’t last long...

Less than half an hour into the trading day, benchmarks have given up on the rally, with the S&P now negative but the Dow and Nasdaq clinging to meager gains. Tech shares are leading the way for a second consecutive session. Investors are fighting against the relentless wave of coronavirus bad news, but pinning hopes on a big bang fiscal package that can hopefully contain the fallout.

—

9:30 a.m. ET: Stocks pop at the opening bell

Wall Street aimed for a second consecutive day of gains, even as the coronavirus pandemic grew worse. Investors are looking for Washington to finalize a massive stimulus package that will help support consumers and bolster businesses across America that have been ravaged by widespread lockdowns.

Here’s where the market began trading:

S&P 500 (^GSPC): 2,432.04, +22.65 (+0.94%)

Dow (^DJI): 20,207.71, +120.52 (+0.60%)

Nasdaq (^IXIC): 7,150.58+160.74(+2.30%)

Crude (CL=F): $24.57 per barrel, -0.65 (-2.58%)

Gold (GC=F): $1,496.40 per ounce, +17.10 (+1.16%)

10-year Treasury (^TNX): -10.8 bps to yield 1.0110%

—

9:00 a.m. ET: JPMorgan to give ‘front line’ workers $1000 bonus

JPMorgan Chase (JPM) is joining Facebook (FB) in paying out a special bonus to help offset the turmoil of the coronavirus. A memo seen by Reuters said the largest U.S. bank will give "front line employees" a one-time bonus of $1,000, paid out in two installments in April and May.

—

7:24 a.m. ET Friday: Stocks rise, Nasdaq futures touch upper trading limit

Contracts on the three major indices turned positive with just over two hours to go until regular trading opens.

Here were the main moves in markets, as of 7:24 a.m. ET:

S&P 500 futures (ES=F): 2,457.00, +68 points or +2.85%

Dow futures (YM=F): 20,528.00, +653 points or +3.29%

Nasdaq futures (NQ=F): 7,559.25, +285.75 or +3.93%

Crude oil prices (CL=F): $26.56 per barrel, +$1.34 or +5.31%

10-year Treasury note: yielding 0.997%, down 13.2 basis points

—

6:02 p.m. ET Thursday: Stock futures fall amid renewed selling

Futures for each of the three major indices dropped during late trading Thursday, reversing gains from the regular session.

Here were the main moves in markets, as of 6:02 p.m. ET:

S&P 500 futures (ES=F): 2,348.5, -40.5 or -1.7%

Dow futures (YM=F): 19,500.00, -375 or -1.89%

Nasdaq futures (NQ=F): 7,163.50, -110.5 or -1.51%

10-year Treasury note: yielding 1.158%, unchanged

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay