Most presidents are great for the market: Morning Brief

Tuesday, November 5, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

...because stocks usually go up.

Tuesday is Election Day in America. And in one year’s time, Americans will take to the polls to cast their vote in the 2020 presidential election.

So as the Democratic field continues to take shape, investors are beginning to speculate which candidates could impact financial markets most. And some have weighed in with force on who they think poses the biggest risk to the market.

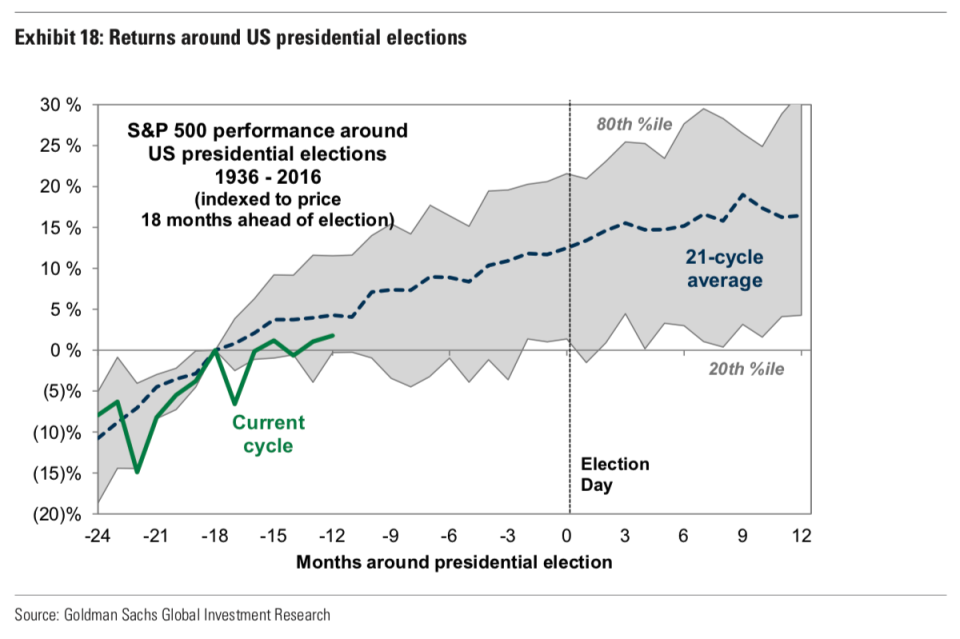

But in a note published late last week, Goldman Sachs strategist David Kostin reminded clients that while all candidates have big plans, betting on all these plans being realized may be a fool's errand.

“A candidate would need to win the presidency, have the support of both chambers of Congress, and actually pass legislation,” Kostin writes.

“Prediction markets currently assign a 74% probability that Democrats control the House, a 54% likelihood that they win the presidency, but only a 35% probability that they control the Senate. Combining these probabilities, prediction markets imply a base case of divided government.”

While implementation is a hurdle for candidates with policy ambitions deemed market positive or market negative, this year’s market has also served as a reminder to investors that Fed policy and the economic cycle matter more than the president’s policy agenda.

President Trump's signature economic policy reduced the corporate tax rate from 35% to 21% and has certainly been a tailwind to the stock market, what has backed the market's huge rally in 2019 is not Trump's trade war but that after fears about a recession have abated. Fears related, in part, to the consequences of Trump’s trade fight. A president’s economic agenda matters, but a president’s economic agenda doesn’t necessarily set the course for the business cycle.

Strategists, for instance, warned in 2016 that a Donald Trump victory would lead to a global recession and erase trillions of dollars in value from the stock market. Election night 2016 saw a sharp sell-off in the futures market, but the S&P 500 has gone up over 40% since Trump’s election win and closed at a record high on Monday.

No candidate has drawn the ire of investors more than Sen. Elizabeth Warren (D-MA), currently polling second among Democratic candidates in national polls while holding leads in both Iowa and New Hampshire, the first two states to cast votes in the Democratic primary. Betting markets, however, peg Warren as the favorite to win the Democratic nomination.

In recent weeks, Paul Tudor Jones, Steven Cohen, and Leon Cooperman have been among the billionaire hedge funders arguing that a Warren win could send the market down 10% or more because of the wealth tax she has proposed as part of raising funds for “Medicare For All.”

Certain elements of Warren's or Sen. Bernie Sanders' (D-VT) proposed economic policy agenda obviously concern some investors, particularly billionaires who could face new taxes on their fortunes. But Trump's trade war, his rhetoric regarding the Federal Reserve, and the prospect of impeachment also concern some investors. In the end, concerns about markets don't necessarily move markets.

And while citing the stock market's rise or fall is, ultimately, a pithy retort to the very serious civic choices and debates involved in electing a president, if an investor comments on likely market reactions to policy it is important to put in context how markets react to policy.

Which is to say — stocks usually go up. And especially if there is no recession.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Trade Balance, September (-$52.5 billion expected, -$54.9 billion in August)

9:45 a.m. ET: Markit US Services PMI, October final (51.0 prior); Markit US Composite PMI, October final (51.2 prior)

10 a.m. ET: JOLTS Job Openings, September (7051 in August);

10 a.m. ET: ISM Non-Manufacturing Index, October (53.6 expected, 52.6 in September)

Earnings

Pre-market

7 a.m. ET: Peloton (PTON) is expected to report an adjusted earnings loss of 41 cents per share on $199.35 million of revenue

Post-market

4:10 p.m. ET: Match Group (MTCH) is expected to report adjusted earnings of 45 cents per share on $540.71 million of revenue

Other notable reports: Chesapeake Energy (CHK), Mylan (MYL), Regeneron (REGN)

From Yahoo Finance

Correspondent Julia La Roche will be reporting from and moderating a panel at the Greenwich Economic Forum, featuring Steve Case, founder of Revolution and AOL, and Alan Patricof, founder and managing director, of Greycroft. Tune into Yahoo Finance from 9 a.m. ET and 5 p.m. ET.

Top News

China wants US to drop tariffs on $360 billion of imports for trade deal [Bloomberg]

Uber reports narrower-than-expected 3Q loss [Yahoo Finance]

Key UK industries face worst spell since the crash as Brexit bites [Yahoo Finance UK]

Shake Shack misses Q3 sales expectations, stock falls [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

SF Fed's Daly: No more rate cuts unless there's a 'material change'

Goldman Sachs to give all new parents 20 weeks paid leave

President Trump will be out of office by March 2020, says Anthony Scaramucci

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.