How the stock market schooled everyone in 2020: Morning Brief

Monday, November 16, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Even if you knew what was coming, you probably would’ve been wrong

As Wall Street rolls out its 2021 forecasts for the stock market, we think it’s worth reflecting on what it said a year ago about 2020.

Of the 23 strategists followed by Yahoo Finance at the time, only one expected the S&P 500 (^GSPC) to climb above 3,500 for the year. The S&P closed at 3,585 on Friday, up 11% year-to-date.

Keep in mind that those 2020 forecasts were published before most folks knew about the disease that would later become known as COVID-19.

But had we known exactly how the coronavirus pandemic would affect the economy and corporate earnings, we’d wager that those S&P targets would’ve actually been much lower.

For one thing, earnings — which Wall Street always expects to go up — are now estimated to fall by 14.5% in 2020, according to FactSet data. And earnings and the prospects for earnings growth are the most important drivers of stock prices in the long run.

Though in the short run, history has shown there is “ZERO correlation for annual returns and EPS growth,” as 2020 has taught us yet again.

We’d add that 2019’s massive rally, which came with above-average valuations, did not prove to be reasons to be bearish in 2020 either. All of this reminds us that forecasting one-year stock market returns is basically impossible.

Assuming the S&P doesn’t erase its year-to-date gain — which it certainly could — 2020 is on track to become another powerful data point in the market history books, which are riddled with examples of price moves in conflict with earnings and valuations.

And so today’s Morning Brief isn’t very helpful if you want to know precisely where the S&P 500 will end in 2021.

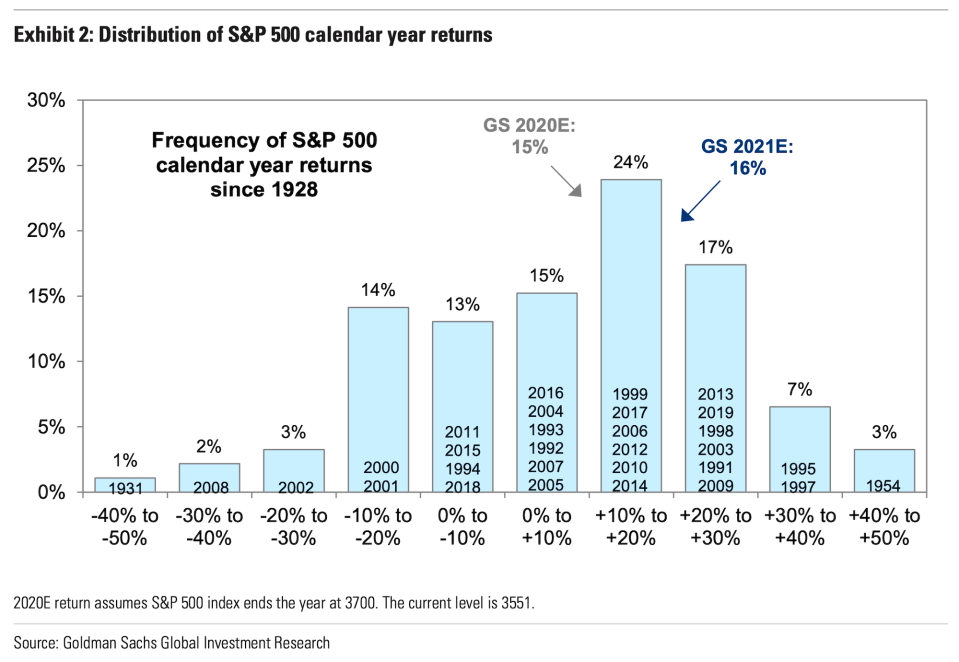

We will, however, flag this chart from Goldman Sachs’ 2021 market outlook report. It’s yet another reminder that stocks usually go up.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: Empire Manufacturing, November (13.9 expected, 10.5 in October)

Earnings

Pre-market

Before market open: Palo Alto Networks (PANW) is expected to report adjusted earnings of $1.33 per share on revenue of $926.61 million

6:55 a.m. ET: AECOM (ACM) is expected to report adjusted earnings of 57 cents per share on revenue of $3.23 billion

7:25 a.m. ET: JD.com (JD) is expected to report adjusted earnings of 2.72 yuan per share on revenue of 170.49 billion yuan

7:30 a.m. ET: Tyson Foods (TSN) is expected to report adjusted earnings of $1.19 per share on revenue of $11.02 billion

Post-market

4:05 p.m. ET: SmileDirectClub (SDC) is expected to report an adjusted loss of 15 cents per share on revenue of $146.58 million

Top News

Stocks rise as Chinese factory output beats expectations [Yahoo Finance UK]

One of world's largest oil company hires banks to raise cash amid COVID-19 hitting oil prices [Yahoo Finance UK]

PNC to buy BBVA's U.S. banking arm for $11.6B in cash [Bloomberg]

SpaceX launches astronauts into space [Reuters]

YAHOO FINANCE HIGHLIGHTS

Coronavirus vaccine: Cold storage remains hurdle for Pfizer vaccine distribution

'The Trump administration has done nothing' to help schools amid pandemic: AFT president

The psychedelic drug industry is 'the new cannabis' for investors

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay