Dow plunges more than 1,000 points, enters a correction

Markets Insider

The stock market has plunged into a correction, defined as a 10% drop from its most recent high.

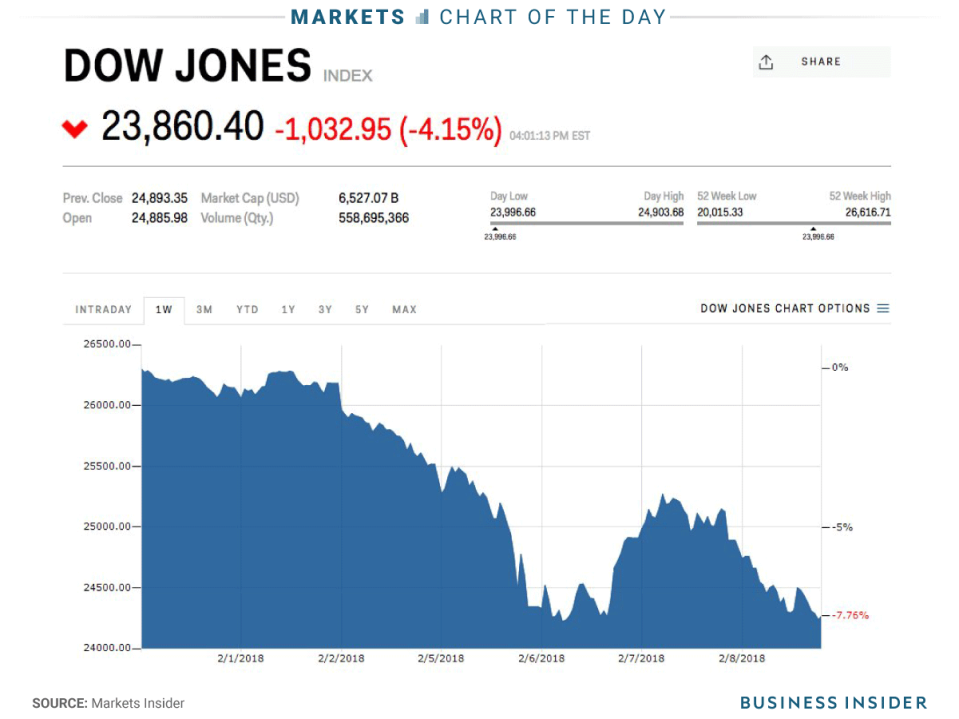

On Thursday, the Dow Jones industrial average fell more than 1,000 points in a sell-off that accelerated near the end of the trading session.

Stocks have failed to hold on to a strong rebound since Friday, when a better-than-expected report on wages added to worries about higher US inflation.

Track the Dow at Markets Insider.

The stock market is officially in a correction, defined as a 10% decline from its most recent high.

Here's the scoreboard of the three major indexes on Thursday:

Dow: 23,860.46, -1,032.89, (-4.15%)

S&P 500: 2,581.08, -100.58, (-3.75%)

Nasdaq: 6,777.16, -274.82, (-3.90%)

The benchmark S&P 500 closed 10.4% below its record high on January 26. It's the fourth correction for the index since the bull market began in March 2009, according to Bespoke Investment Group.

Stocks have failed to hold a strong rebound since Friday, when a better-than-expected report on wages added to worries about higher US inflation. The selling has continued this week, worsened by technical factors including the implosion of trading strategies that had bet on low volatility.

Stocks rallied on Wednesday, with the Dow closing up 567 points, or 2.3%. By Thursday, the index of large companies including Boeing and Apple returned to the red for 2018.

The sharp moves this week have raised questions about how quickly investors would be willing to buy stocks at lower prices or stay cautious amid the threat of higher inflation. After a period of low borrowing costs that benefitted companies, the Federal Reserve may be moved to raise interest rates faster than investors expect.

"There's no rush to come in here and buy this market, because it's not just a technical sell-off," Larry Hatheway, the chief economist at GAM Investments, told Business Insider. "There are several fundamental stories that lie behind it, and that's preventing people who might see value from jumping in at better prices to exploit it."

Several other strategists, however, have said this is an opportunity to "buy the dip."

The Cboe Volatility Index rose again on Thursday to as high as 34.54, which is more than twice as high as its recent, unprecedented lows, having suffered its biggest-ever one-day spike on Monday. The so-called fear gauge tracks traders' expectations for future instability and moves opposite the S&P 500 most of the time.

"Expect more volatility from here," Jeremy Hale, the head of asset allocation and global macro at Citi, said in a note on Thursday. "Rather than try to catch a falling knife, we would rather wait for signs of stabilization."

Read more coverage of the market meltdown:

CITI: There's a 'clear winner' for investors who want to cash in on the market's biggest fear

One of the biggest narratives behind why the stock market just went haywire is wrong

NOW WATCH: Why you shouldn't panic when markets tumble

See Also:

There are 2 reasons why the volatility explosion that rocked markets won't happen again anytime soon

TUESDAY TURNAROUND: Dow jumps 567 points the day after its biggest point drop on record

Wall Street lays out the case for a comeback that would quickly erase the stock market's plunge

SEE ALSO: One of the biggest narratives behind why the stock market just went haywire is wrong