Wall Street warns: Don't be fooled by the calm in the markets

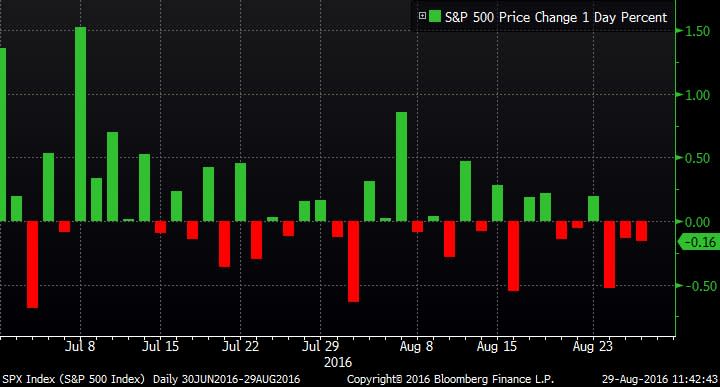

On Monday, the S&P 500 (^GSPC) climbed a modest 0.5%, marking the 35th straight day during which the index made a move of less than 1%.

“The current streak of market stability represents the longest period without a 1%+/- daily move since the summer of 2014,” Goldman Sachs’ David Kostin said of the trend on Friday.

While this may be a welcome calm for investors, some Wall Street experts argue that the low volatility is unexpected and unwarranted in light of the global uncertainty we read about in the news everyday. In addition to the volatile global political environment, the impending tightening of monetary policy by the Federal Open Market Committee (FOMC) poses a very direct risk to the financial markets.

“We caution people to not be fooled by the summer lull, for markets will likely face an abundance of policy-related risks in the coming months,” Wells Fargo’s Gina Martin Adams said on Monday.

“This autumn, investors face a FOMC moving toward a rate hike (futures currently price a 42% chance of a hike in September and a 65% chance of a hike by December), heated election campaigns in the United States, Europe transitioning into ‘‘Brexit’‘ amid a key referendum vote in Italy, and the Bank of Japan flirting with more easing and possibly, further negative interest rates.”

‘Periods of volatility are to be expected’

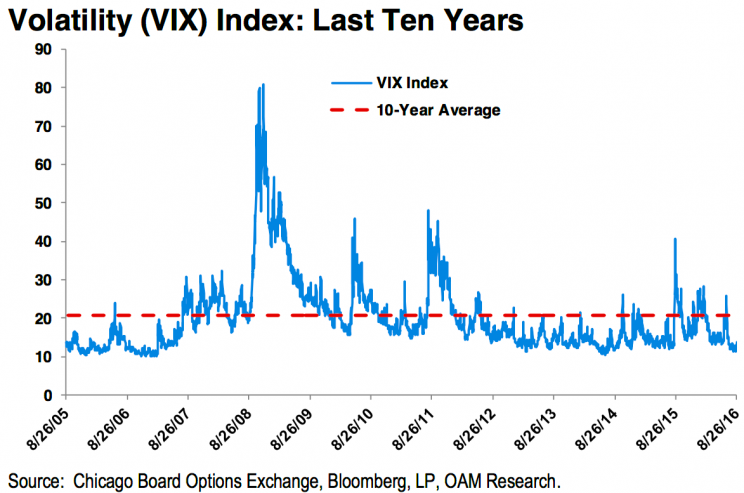

The CBOE Volatility Index (^VIX) is one of the more popular measures of how much fear and complacency is being priced into the stock market. At just under 13, the VIX is low by historical standards.

“We expect volatility to remain a recurrent factor as the market weighs from week to week the Fed’s progress in its efforts to normalize interest rates against economic growth, currency, and commodity prices,” Oppenheimer’s John Stoltzfus said.

“International developments (economic and geopolitical) will likely also continue to serve as potential catalysts for jumps in volatility,” Stoltzfus added. “Further adjustments to currency and the effects of domestic stimulus policy in China, along with developments tied to Brexit, are also likely to continue to feed into levels of volatility for the balance of the year. An additional source of volatility for the market could come as the process of the presidential election moves ahead and as the candidates further define their respective platforms on issues relevant to the markets.”

When volatility hits, it tends to be swift and sharp.

“It goes without saying that a VIX of 14 is not exactly discounting much in the way of any possible turbulence ahead,” Gluskin Sheff’s David Rosenberg said early on Monday. “[Y]et the past three episodes of such in just the past year saw the index pop above 25, even if for a short time. So if there is anything ‘cheap’ out there, it is volatility.”

Wells Fargo Investment Institute’s Peter Donisanu offers his four best practices for investors to prepare for future volatility. Here they are verbatim:

Commit to an investment plan—indecision and market volatility do not make good bedfellows.

Employ prudent portfolio management strategies that include aligning a strategic asset allocation with your long-term investment goals.

Rebalance frequently, particularly ahead of uncertain market events, by bringing portfolio allocations in line with strategic objectives.

Exploit price drops in markets as entry points for favored investments—while also trimming allocations as favorable market conditions present themselves.

The S&P 500 is currently trading near 2,180, just 13 points below its all-time high. The index is up 6.7% year-to-date.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

The stage is set for the next 10% plunge in stocks

The peculiar pattern of S&P 500 earnings surprises

David Rosenberg nails the stock market in a perfect sentence