Struggling US tech giant soars as it explores breakup

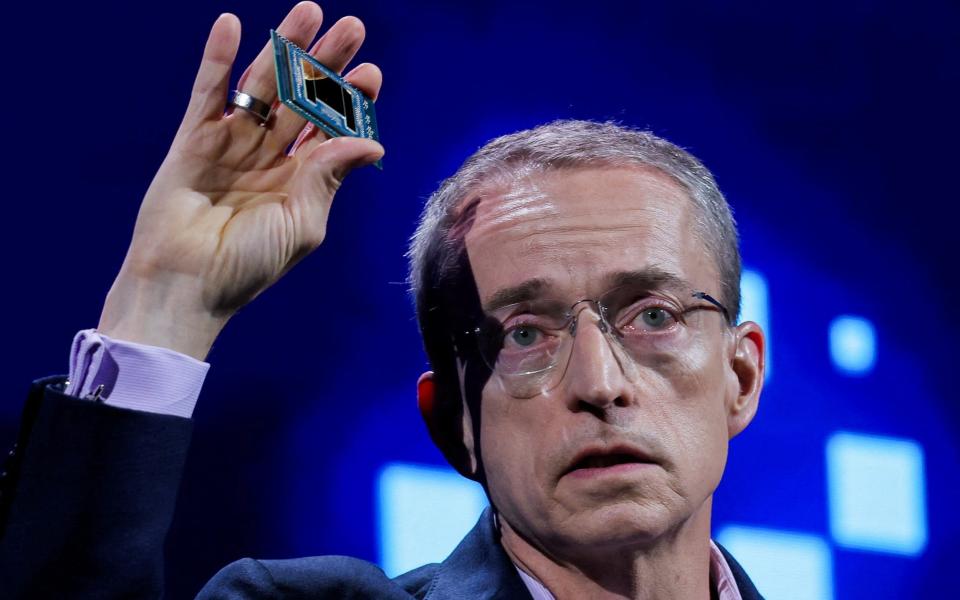

Intel’s shares jumped by as much as 10pc this afternoon, after a report that the struggling chipmaker is exploring options that could involve splitting the company in two.

The company is working with investment bankers and considering various options such as separating its flagship product business from its money-losing manufacturing unit, Bloomberg reported.

Intel is also discussing potentially scrapping some factory projects, the report said.

Building and expanding chip production sites is at the core of Intel’s turnaround efforts focused on becoming a contract manufacturer for other chip firms - a capital intensive undertaking that has strained the company’s finances.

A change in strategy would be a dramatic about-turn for chief executive Pat Gelsinger, who has viewed manufacturing as a key competitive advantage for Intel.

The chip giant has been the biggest winner of subsidies from the Biden administration under the Creating Helpful Incentives to Produce Semiconductors (Chips) Act, intended to help boost chipmaking in the US.

In March, the US government announced up to $8.5bn in funding to Intel to support manufacturing in Arizona, New Mexico, Ohio and Oregon.

US Secretary of Commerce Gina Raimondo at the time said: “With this agreement, we are helping to incentivise over $100bn in investments from Intel - marking one of the largest investments ever in US semiconductor manufacturing, which will create over 30,000 good-paying jobs and ignite the next generation of innovation.”

But Scott Lincicome, a trade economist at the Cato Institute in Washington DC, warned this month that it is still not clear whether Intel is capable of manufacturing leading-edge chips “at commercially viable quantities and prices”.

While Intel is still the biggest player in processors for traditional PCs, the company failed to establish itself in the market for mobile phone processors.

Chips based on designs by Britain’s Arm Holdings dominate the smartphone market, where low cost and energy use are vital. Arm was set up in 1990 with just £1.5m in investment from Apple, and intellectual property and staff from BBC Micro designer Acorn. Since it started on a shoestring, it never opened factories, relying instead on licensing its technology.

Intel declined to comment.

06:07 PM BST

Ed Miliband proposes £5.5bn subsidy for Sizewell C nuclear plant

Ed Miliband wants a subsidy scheme worth up to £5.5bn to help support the Sizewell C nuclear plant being built by France’s EDF in southeast England.

As part of efforts to meet climate targets and boost energy security, the Department for Energy Security and Net Zero is seeking to build new nuclear plants to replace its ageing fleet.

Yet Sizewell C has struggled to attract additional investment and the government has already committed around £2.5bn pounds of taxpayers’ money to the project.

The Development Expenditure Scheme proposed on Friday would help to fund the project’s development up to and including the point when a financial investment decision can be taken on whether to fund it through to completion - or when there are enough other investors on board to continue.

“We are committed to Sizewell C, which will play an important role in helping the UK achieve energy security and net zero, while securing thousands of good, skilled jobs and supporting our energy independence beyond 2030,” a spokesperson for Britain’s Department for Energy Security and Net Zero (DESNZ) said.

Julia Pyke and Nigel Cann, joint managing directors at Sizewell C, said:

This latest commitment enhances our ability to deliver key works over the next year, from developing local infrastructure to progressing significant earthworks onsite, new offices, and training facilities.

If built, Sizewell C would be expected to generate enough electricity to power around 6m homes.

It would be only the second new nuclear plant built in Britain in more than two decades, after EDF’s Hinkley Point C which has had several delays and cost overruns and is currently expected to start operations in 2029, with an estimated cost of between 31 and 34 billion pounds at 2015 prices.

When initially proposing the project, EDF said Sizewell C would be around 20pc cheaper than Hinkley C.

05:59 PM BST

Libya’s oil production plunges 63pc due to oilfield closures

Libya’s National Oil Corporation said today that recent oilfield closures have caused the loss of 63pc of the country’s total oil production, as a conflict between rival eastern and western factions continues.

The North African country’s oil blockade has widened, with eastern leaders demanding western authorities back down over the replacement of the central bank governor, a key position in a state where control over oil revenue is the biggest prize for all factions.

The crisis over control of the Central Bank of Libya threatens a new bout of instability in a major oil producer split between eastern and western factions that have drawn backing from Turkey and Russia.

The repeated shutdowns have resulted in the loss of a large portion of the country’s oil production, caused a deterioration of the sector’s infrastructure, and dissipated efforts to increase production, the NOC added in its statement.

Eastern factions have vowed to keep Libya’s oil output shuttered until the internationally recognised Presidency Council and Government of National Unity in Tripoli in the west return veteran central bank governor Sadiq al-Kabir to his post.

Presidency Council chief Mohammed al-Menfi said he was dismissing Kabir earlier this month, a move rejected by the eastern-based House of Representatives parliament and eastern commander Khalifa Haftar’s Libyan National Army.

05:27 PM BST

Stocks waver as investors weigh inflation data

US and European stock markets wobbled on Friday as investors digested inflation figures that raised the prospect of interest rate cuts in the two major economies next month.

Paris closed 0.1 percent lower while Frankfurt was marginally in the red after the indexes were in the green for most of the day.

The UK’s main stock index hit over a three-month high, clocking gains for the topsy-turvy month, with real estate shares in the lead as interest rate-cut hopes held firm, while energy shares tumbled on demand concerns, capping intra-day gains.

The blue-chip FTSE 100 index ended flat, but registered its second straight monthly gain and third consecutive weekly advance.

In New York, the Dow opened higher but is down 0.2pc currently, a day after closing at a record high following the release of data showing the US economy performed better than thought in the second quarter.

The broad-based S&P 500 index and the tech-heavy Nasdaq rose.

Official data out this afternoon showed the US Federal Reserve’s favoured measure of inflation - the personal consumption expenditures (PCE) price index - held steady on an annual basis in July at 2.5pc.

Bret Kenwell, US investment analyst at eToro trading platform, said:

It’s another reassuring inflation report for a Fed that’s looking to lower interest rates at its mid-September meeting.

It would have taken a scorching hot inflation report for the Fed to reverse course on a rate cut now.

04:53 PM BST

FTSE 100 closes flat

The FTSE 100 closed virtually flat this afternoon after shares declined after about 3:30pm.

The biggest riser was LondonMetric Property, up 2.6pc, followed by gambling business Entain, up 2.2pc.

The biggest faller was miner Fresnillo, down 2.3pc, followed by Premier Inn owner Whitbread, down 1.8pc.

Meanwhile, the mid-cap FTSE 250 rose 0.3pc.

Leading the risers was Hunting, a manufacturer for the oil and gas industry, which rose 3.6pc, followed by City firm Close Brothers, up 3.2pc.

The biggest faller was Upper Crust owner SSP, down 2.9pc, followe by Diversified Energy, down almost as much.

04:46 PM BST

French central bank chief urges ECB rate cut

France’s central bank chief has called for the European Central Bank to cut interest rates at its next meeting in September as eurozone inflation gradually eases.

Reducing borrowing costs at the meeting would be “fair and wise”, Bank of France governor Francois Villeroy de Galhau said in an interview with Le Point magazine published today.

“We are not yet at our two percent inflation target on a permanent basis, but we will very probably be there in the first half of next year for France and in the second half for the eurozone,” he said.

Data this week showed that inflation in France and Germany, the eurozone’s biggest economies, had fallen below 2pc this month.

And official data released Friday showed consumer price rises in the 20 countries that use the euro eased to 2.2pc in August, their lowest level in more than three years and not far off the ECB’s 2pc target.

“If we waited until we were actually at two percent to lower rates, we would be acting too late,” said the French central bank chief, noting that it takes some time for monetary policy changes to feed through to the economy.

The Frankfurt-based ECB launched a historic campaign of interest rate hikes in 2022 after Russia’s invasion of Ukraine sent energy and food costs soaring. Inflation peaked at 10.6pc in October that year.

With inflation easing, the ECB cut rates for the first time after the hiking cycle in June. It kept borrowing costs on hold in July but expectations have been growing for a further cut at its meeting on September 12.

04:20 PM BST

Virgin Media o2 seeks outside investor for its network arm

Virgin Media O2 is looking for outside investors to help raise at least £1bn fund its broadband fibre arm, according to a report.

Bloomberg said that the BT Openreach rival was working with rivals to sell a minority stake in the network business, which could be worth over £5bn.

In February, Virgin Media O2 announced the formation of NetCo, which it described as “a distinct, focused fixed wholesale challenger at scale offering clear choice” to other internet service providers.

At the time, it said that NetCo would “provide new financing optionality” and suggested that it would take buy so-called “alt-nets” - independent rivals to Openreach.

Bloomberg said that the potential sale could involve a 20pc to 40pc stake and could “kick off” as soon as October. It is reportedly targeting infrastructure, private equity, pension and sovereign wealth funds.

Virgin Media o2 declined to comment.

04:10 PM BST

Global stocks rise as traders bet on Goldilocks scenario

Global stocks rose today, on track for the fourth consecutive month of gains despite a bout of heavy selling in early August.

The recovery from an early August sell-off reminiscent of October 1987’s “Black Monday” came as traders priced a so-called Goldilocks scenario, in which the US economy keeps growing but not so much to prevent interest rate cuts.

Today, Europe’s Stoxx 600 index, which includes some of Britain’s largest companies, is up 0.2pc and the FTSE 100 us virtually flat. MSCI’s world share index ticked 0.3pc higher.

03:55 PM BST

The ‘summer squall of early August has been forgotten’, says analyst

The final trading day of August is seeing more gains for stocks, which have staged an major rebound, according to Chris Beauchamp, chief market analyst at online trading platform IG. He said:

August is finishing in a very different form to how it began. While the Nikkei 225 is still down for the month by 1.2pc, itself a significant achievement, the FTSE 100, Dax, Dow and others are all in positive territory for the month.

The summer squall of early August has been forgotten, and with US economic data still looking strong, and rate cuts on the way, investors remain confident about the near-term outlook.

03:44 PM BST

Market prefers Shell to BP as investors turn increasingly sceptical of net zero focus

Shares in Shell are outperforming those in BP, amid concerns that the latter is too focused on low-carbon businesses such as offshore wind.

BP shares have fallen 7pc over the past six months, while Shell has risen 10.4pc. Bloomberg reported that BP has been hit by analyst downgrades, unexciting earnings reports and an impairment linked to a refinery in Germany.

Despite relying on oil and gas for its profits, BP has been shifting towards the likes of offshore wind despite the sector not currently delivering strong returns.

Shell, under its new chief executive Wael Sawan, has dialled back on renewables and put a bigger emphasis on oil and gas.

Allen Good, an analyst at Morningstar Investment Services, said:

The differences in these strategies is driving a preference for Shell over BP.

He cut his rating on BP to “hold” from “buy” this month.

03:27 PM BST

Intel surges as it explores breakup

Intel’s shares jumped 9pc this afternoon, after a report that the struggling chipmaker is exploring options that could splitting the company in two.

The company is working with investment bankers and considering various options such as separating its flagship product business from its money-losing manufacturing unit, Bloomberg reported.

Intel is also discussing potentially scrapping some factory projects, the report said.

Building and expanding chip production sites is at the core of Intel’s turnaround efforts focused on becoming a contract manufacturer for other chip firms - a capital intensive undertaking that has strained the company’s finances.

Intel declined to comment.

03:11 PM BST

India growth slows to 6.7pc on lower consumer spending

India’s economic growth slowed to 6.7pc year-on-year in the April-June quarter, official data showed today, as lower government outlays and lacklustre consumer spending weighed on the world’s fifth-largest economy.

Friday’s reading still places the world’s most populous country among the fastest-growing major economies globally.

But the figure is unwelcome news for Prime Minister Narendra Modi, whose party suffered the surprise loss of its parliamentary majority after elections in June.

It may also put pressure on the Reserve Bank of India to cut interest rates after holding them steady at 6.5pc for more than 18 months.

Year-on-year gross domestic product grew at its slowest pace in five quarters and came in below the Indian central bank’s estimate of 7.1pc.

Experts say the pace of growth slowed in part due to sluggish government capital expenditure.

Businesses have also blamed protracted summer heatwaves in parts of the country for hampering store footfalls and urban consumption.

02:59 PM BST

‘Market is responding positively’ after inflation figures point to cut in interest rates

Wall Street stocks remain up this afternoon after markets took in a report indicating that inflation held steady while spending remained resilient last month.

Peter Cardillo, of Spartan Capital, said:

We had good macro news today. PCE [the personal consumption expenditures price index] shows that inflation is moving in the right direction.

If you have inflation going down and spending staying at a solid pace, that’s good news for the economy.

So that’s good news for the Fed. They will cut in September, and the market is responding positively.

The US central bank is widely expected to begin lowering interest rates from a decades-high level in September, with inflation cooling.

But apart from price increases, traders will also be eyeing the performance of the labour market next week as they anticipate the size of the Fed’s first post-pandemic rate reduction.

02:50 PM BST

City minister backed tax raid on landlords’ ‘unearned income’

The City minister called for a national insurance raid on landlords in a speech before taking power, it can be disclosed, as ministers were urged to impose the tax on rental income for the first time. Eir Nols?e reports:

Before taking office Tulip Siddiq said that she would be in favour of taxing “unearned income” such as rent on buy to let properties in a fashion more in line with wages.

Her comments, from a speech in 2022, are likely to fuel further speculation of a crackdown on buy-to-let.

Economists at the Resolution Foundation think tank are urging Rachel Reeves, the Chancellor, to hit landlords with National Insurance, which is currently charged at 8pc on wages.

The City minister called for a national insurance raid on landlords in a speech before taking power, it can be disclosed, as ministers were urged to impose the tax on rental income for the first time.

Before taking office Tulip Siddiq said that she would be in favour of taxing “unearned income” such as rent on buy to let properties in a fashion more in line with wages.

Her comments, from a speech in 2022, are likely to fuel further speculation of a crackdown on buy-to-let.

Economists at the Resolution Foundation think tank are urging Rachel Reeves, the Chancellor, to hit landlords with National Insurance, which is currently charged at 8pc on wages.

02:28 PM BST

US government bonds rise after inflation data released

The yield on benchmark 10-year US Treasury notes rose after the latest inflation figures were released.

Traders cut bets on a half a percentage point rate cut but had still fully priced in a quarter point cut.

The yieled spiked before pairing back some of the gain. Currently the yield is 3.873pc compared with 3.865pc last night.

02:24 PM BST

Wall Street poised for higher open after July inflation data

Wall Street’s main indexes were set for a higher start on Friday after a key inflation report reiterated that price pressures were moderating, cementing bets for an interest-rate cut at the Federal Reserve’s upcoming meeting in September.

The Personal Consumption Expenditure index, the central bank’s preferred inflation measure, rose 2.5pc in July on an annual basis compared to an estimate of 2.6pc, according to economists polled by Reuters. On a monthly basis, it rose 0.2pc as expected.

Among rate-sensitive megacaps, Alphabet and Meta gained 0.8pc and 0.6pc, respectively, while Tesla added 1.2pc in premarket trading.

Today’s PCE report is the last before the Federal Reserve’s September meeting and follows Fed Chair Jerome Powell’s comments last week expressing support for an imminent policy adjustment.

Andre Bakhos, managing member at Ingenium Analytics, said:

Powell’s speech at Jackson Hole reiterated several times that we’re approaching our desired target. Nothing here is going to cause me to change anything.

I would vote 25 bps [a quarter percentage point] because it’s been going in the direction the Fed has been targeting and the market has factored all of this in.

Trading volumes are expected to thin ahead of an extended weekend due to a public holiday in the US on Monday.

02:18 PM BST

Markets betting on a quarter point US rate cut in September

Markets are betting on a quarter point cut in US interest rates next month, although a bigger, half point cut is being priced in with 30pc probability

Christophe Boucher, chief investment officer ofABN AMRO Investment Solutions, said:

Core PCE [personal consumption expenditures inflation] in July is slightly below expectations, rising [annually] by 2.6pc vs 2.7pc [that was] estimated ... Meanwhile, personal income came in a bit stronger than expected and personal spending rose in line with expectations.

This combination of resilient consumption and ongoing disinflation would be welcomed by the Fed, and suggests a soft landing is well in play.

This small downside surprise on inflation only confirms the Fed’s dovish tone in Jackson hole and would not make a difference in the Fed’s narrative until the jobs report release next week.

Until now, no data point urges the Fed to cut by [half a percentage point] nor does any report cast doubt on a quarter percentage point cut in September.

The jobs report next week will be decisive in this sense. Absent a major downside surprise, the Fed’s first cut would mark the beginning of a policy adjustment rather than a response to a downturn.

Markets’ reaction remained muted: they fully price-in a [quarter percentage point] cut in September and expect a half percentage point cut with over 30pc probability.

02:14 PM BST

Opec+ likely to proceed with planned output hike from October, despite sluggish demand

Oil cartel Opec+ is set to proceed with a planned oil output hike from October, despite a slowdown in demand growth, notably in China, which has weighed on oil prices.

That has prompted some analysts to doubt whether the Organisation of the Petroleum Exporting Countries and allies, known as Opec+, will go ahead with the October increase.

But eight Opec+ members are scheduled to boost output by 180,000 barrels per day in October, as part of a plan to begin unwinding their most recent layer of output cuts of 2.2 million barrels per day while keeping other cuts in place until end-2025.

It follows Libyan oil production outages and pledged cuts by some members to compensate for overproduction counter the impact of sluggish demand, six sources from the producer group told Reuters.

But six Opec+ sources told Reuters the plan to increase production remains in place as the loss of Libyan output tightens the market and hopes build that the US Federal Reserve will cut interest rates in mid-September.

“There are many uncertainties on demand but there is also the hope that the Fed’s interest rate cut will boost economic growth,” one of the sources said.

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman has previously said Opec+ could pause or reverse the production hikes if it decides the market is not strong enough.

02:08 PM BST

Oasis record sales soar after Oasis reunite

Sales of Oasis music have soared after Liam and Noel Gallagher confirmed that Oasis would reunite for a series of live shows next year, their first in over 16 years.

According to HMV, sales rose by 526pc in the past week.

The LP of Definitely Maybe jumped 443pc, What’s The Story was up 684pc and Knebworth increased by 209pc.

Phil Halliday, managing director, of HMV and Fopp, said:

Oasis are a truly iconic band who have made such a positive impact on British music. Sales figures from the past week, both in-store and online, pay testament to their popularity across the nation.

It’s great to see so many people revisiting their vinyl catalogue, from classic releases like Definitely Maybe all the way through the Knebworth LP. I’m sure I won’t be the only one trying to get my hands on tickets on Saturday!

02:02 PM BST

EY expects majority of Fed decision-makers to favour a interest rate cut

A rate cut is coming in September, the chief economist of accounting giant EY has said, barring any surprises with the labour market.

Gregory Daco, of EY, said in a note ahead of release of this afternoon’s inflation figures: “Economic fundamentals continue to point to sustainable disinflation [a decrease in the rate of inflation]”.

This means increased pricing sensitivity, reduced markups and easing housing cost inflation, he said, alongside moderating wage growth and strong productivity growth.

“Unless labour conditions deteriorate materially in the coming weeks, we continue to expect a majority of policymakers will favour a [quarter percentage point] cut in September,” Mr Daco added.

Last Friday, Fed chairman Jerome Powell said the “time has come” for America to begin lowering interest rates, saying his confidence has risen that the battle against inflation is on track.

01:58 PM BST

‘Persistent rate cuts’ could be coming to US, says City firm

Today’s US inflation figures give further support for a cut in US interest rates next month.

Isabel Albarran, of City merchant bank Close Brothers Asset Management, said:

Today’s widely anticipated 0.2pc rise in the core US personal consumption expenditure from July is yet another confirmation that we will see a [quarter percentage point] cut from the Fed at next month’s meeting, and underlines the progress made on inflation.

As we look towards the November election, this will no doubt be welcome news to [Kamala] Harris, with a combination of falling inflation and still-strong employment historically favouring the incumbent party.

With inflation cooling, the Fed’s attention is now firmly on the US labour market side of their dual mandate [of both price stability and maximum sustainable employment].

After the recent market turmoil initiated by weaker than expected non-farm payroll data, [Fed chairman Jerome] Powell and [Fed committee] members will no doubt be keeping a close eye on unemployment data to ensure it is not rising too aggressively.

While they certainly won’t want to see inflation accelerating, as noted by Powell last week, they also won’t “seek or welcome further cooling of labour market conditions” that could suggest a collapsing economy.

If we do see further cooling, its highly likely that the Fed will deliver persistent rate cuts through 2025.

01:51 PM BST

Another hurdle for US rate cuts is cleared

An inflation measure closely tracked by the US Federal Reserve remained low last month, extending a trend of cooling price increases that clears the way for the Fed to start cutting its key interest rate next month for the first time in over four years.

Prices rose just 0.2pc from June to July, the Commerce Department said Friday, up a tick from the previous month’s 0.1pc increase. Compared with a year earlier, inflation was unchanged at 2.5pc.

The slowdown in inflation could upend former President Donald Trump’s efforts to saddle Vice President Kamala Harris with blame for rising prices. Still, despite the near-end of high inflation, many Americans remain unhappy with today’s sharply higher average prices for such necessities as gas, food and housing compared with their pre-pandemic levels.

Excluding volatile food and energy costs, so-called core inflation rose 0.2pc from June to July, the same as in the previous month. Measured from a year earlier, core prices increased 2.6pc, also unchanged from the previous year. Economists closely watch core prices, which typically provide a better read of future inflation trends.

Today’s figures underscore that inflation is steadily fading in the United States after three painful years of surging prices hammered many families’ finances. According to the measure reported today, inflation peaked at 7.1pc in June 2022, the highest in four decades.

The Fed tends to favour the inflation gauge that the government issued today - the personal consumption expenditures (PCE) price index - over the better-known consumer price index. The PCE index tries to account for changes in how people shop when inflation jumps. It can capture, for example, when consumers switch from pricier national brands to cheaper store brands.

In general, the PCE index tends to show a lower inflation rate than CPI. In part, that’s because rents, which have been high, carry double the weight in the CPI that they do in the index released Friday.

In a high-profile speech last week, Fed chair Jerome Powell attributed the inflation surge that erupted in 2021 to a “collision” of reduced supply stemming from the pandemic’s disruptions with a jump in demand as consumers ramped up spending, drawing on savings juiced by federal stimulus checks.

With price increases now cooling, Mr Powell also said last week that “the time has come” to begin lowering the Fed’s key interest rate. Economists expect a cut of at least a quarter-point cut in the rate at the Fed’s next meeting September 17-18.

With inflation coming under control, Mr Powell indicated that the central bank is now increasingly focused on preventing any worsening of the job market. The unemployment rate has risen for four months in a row.

12:35 PM BST

Landlord numbers drop

The number of individual landlords dropped in 2022/23 for the first time in at least four years, official data shows.

In the year to 2022/23, the number of individual buy-to-let investors reporting their rental income to HMRC fell by 20,000 to 2.84m, the first such drop since at least 2018/19.

The official figures back up widespread reports of buy-to-let landlords quitting the sector in the wake of the government’s buy-to-let tax crackdown, which included phasing out mortgage interest relief between 2017 and 2020.

The drop could also reflect landlords incorporating their portfolios into limited companies, which are able to deduct business costs from their tax bill. However, this is unlikely to have been a viable option for many landlords as the process is costly and involves paying capital gains tax on the sale to the company as well as stamp duty on the company’s purchase.

11:56 AM BST

House prices surge at fastest pace since December 2022

House prices have jumped at the fastest pace since December 2022 as lower mortgage rates boost demand.

House prices rose by 2.4pc year-on-year in August, according to Nationwide. This means the average home cost £6,222 more than a year earlier, with an average sale price of £265,375.

This was up from 2.1pc growth recorded in July and the fastest pace of house price growth since December 2022, when prices rose by 2.8pc.

However, values were still down around 3pc compared to the record highs recorded in the summer of 2022, at the end of the pandemic property boom.

Robert Gardner, Nationwide’s Chief Economist, said: “Providing the economy continues to recover steadily, as we expect, housing market activity is likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

10:53 AM BST

Core inflation still “stubbornly high”

A rise in services inflation means that Euro area core inflation is still “stubbornly high” despite a fall in the headline rate, analysts have warned.

Core inflation fell only slight from 2.9pc to 2.8pc, while services price inflation increased from 4pc to 4.2pc in August, according to Eurostat.

Bert Colijn, Senior Economist at ING, said this rise was partly due to an increase in French services inflation during the Olympics.

Mr Colijn said:

“The drop in inflation in August was mainly due to energy inflation coming down, with core inflation still stubbornly high.

“For the ECB, the modest progress in core inflation and wages now and expectations for next year seem enough to cut by 25bps in September.

“But this remains a slow and gradual process of releasing the brakes on the economy as the ECB continues to be concerned about upside risks to the inflation outlook.”

10:46 AM BST

Mortgage approvals jump to highest level since mini-Budget

Mortgage approvals have jumped to the highest level since the September 2022 mini-Budget sent the housing market into turmoil.

Nearly 62,000 mortgages were approved for home purchase in July, up 29pc to nearly a two-year high, Bank of England data shows.

This was an increase of 1,374 on June and surpassed economists’ expectations of 60,500.

Mortgage approvals are a key leading indicator for housing market activity as they flow into transaction figures a few months later.

10:42 AM BST

Inflation data “clears the way” for a rate cut

The drop in Euro area inflation will pave the way for a second ECB rate cut, according to Natasha May, global market analyst at J.P. Morgan Asset Management.

Ms May said:

“Today’s inflation release clears the way for a second eurozone rate cut. To justify taking its foot further off the brake, the Governing Council can point to the lowest headline inflation reading in three years.

“Lagarde has emphasised the ECB’s independence from the Fed, and with good reason: eurozone inflation is closer to target, eurozone financial conditions are much tighter, and activity data has been weaker. And while this month’s inflation decline was mostly driven by the energy component of the inflation basket, forward-looking wage indicators suggest even sticky services inflation should ease over the coming quarters.

“Broadly, the ECB’s hawkishness has had the intended effect. While upcoming inflation numbers could prove bumpy, the Governing Council should feel comfortable opting for another rate cut before the Fed takes its first step.”

10:39 AM BST

Euro area inflation falls

Euro area inflation cooled to 2.2pc in August, down from 2.6pc in July, according to a flash estimate from the EU’s statistics office.

Falling energy prices meant consumer price growth is now in close reach of the European Central Bank’s 2pc target rate, bolstering calls for a second interest rate cut.

Markets are betting on a 0.25 percentage point cut in the ECB rate from 3.75pc to 3.5pc at Bank’s next meeting on September 12.

10:00 AM BST

New STV boss

Scottish broadcaster STV has announced its incoming chief executive. James Warrington has the latest:

Scottish broadcaster STV has named the executive behind the launch of ITV’s streaming service as its new boss.

Rufus Radcliffe, who was ITV’s head of streaming until March and oversaw the launch of ITVX at the end of 2022, will join STV in November.

It comes after the broadcaster, which holds the channel 3 licence in Scotland, said chief executive Simon Pitts will step down to take up the top job at media giant Global.

Mr Radcliffe has held a number of senior roles at ITV over a 13-year career. Prior to this, he was head of marketing at Channel 4, overseeing the launch of E4 and streaming service 4OD.

Paul Reynolds, STV chairman, said: “The board is delighted to welcome Rufus to lead STV following a competitive selection process involving some of the best leadership talent in the UK media industry.

“We now embark on the next phase of STV’s exciting growth journey as a digital first, content-led business and Rufus brings with him a rare breadth of strategic and operational expertise from his previous significant industry roles. We very much look forward to working with him.”

09:33 AM BST

German unemployment rises by less than expected

Unemployment in Germany rose by much less than expected in August, official data shows.

The number of people out of work rose by just 2,000 in seasonally adjusted terms, far less than the 16,000 increase that economists had expected.

Overall in August there were 2.8m people unemployed in Germany, keeping the rate steady at 6pc, according to the Federal Labour Office.

But a drop in the number of job openings showed that demand for labour is slowing down.

There were 699,000 job openings in August, a drop of 72,000 compared to August 2023.

09:16 AM BST

Libyan oil supply chaos

Libya’s crude oil production was slashed in half this week as a political crisis threatens to wreak havoc on the Opec member’s oil exports.

Authorities shut down the North African state’s export terminals on Thursday and the production of more than 500,000 barrels a day in the east of the country was halted in the worst outage since an eight-month blockade in 2020.

Consultants Rapidan Energy Group warned that up to one million barrels of oil per day could become disrupted, equivalent to around 1pc of the world’s supply.

The disruption is due to a standoff between eastern and western political factions, which have backing from Russia and Turkey, over the control over the Central Bank of Libya.

09:00 AM BST

French inflation cools to 3-year low

French inflation has cooled to its slowest pace since July 2021, boosting the case for more interest rate cuts from the European Central Bank.

Consumer prices in the EU’s second largest economy rose by 2.2pc year-on-year in August, down from a 2.7pc rise in July, official figures show.

This was much closer to the ECB’s target rate of 2pc and follows similar slowdowns in Germany and Spain.

The ECB will meet in less than two weeks to make its next interest rate decision, after making its first cut in June and then voting to hold rates steady at 3.75pc in July.

However, ratesetters may take caution from the French services inflation figures, which rose from 2.6pc to 3.1pc in August, suggesting the underlying causes of inflation are not completely under control.

08:49 AM BST

Oil prices rise

Oil prices have climbed above $80 per barrel after stronger than expected data on the US economy and fears over supply disruptions in Libya.

The price of Brent crude has risen by more than $2 in two days to $80.52.

However, this was still down from the April peak of $91.17 and Goldman Sachs has cut its oil price forecast for this year because of sluggish demand in China.

08:31 AM BST

“I will not ban fracking”

US presidential candidate Kamala Harris has said she will not ban fracking if elected, reversing her previous opposition to the technique which is used to produce the bulk of US oil and gas today.

In an interview with CNN, Ms Harris said:

“As vice president, I did not ban fracking.

“As president, I will not ban fracking.”

08:20 AM BST

Chinese EV setback

European tariffs have hit Chinese carmakers, triggering a drop in EV sales.

The share of electric cars registered by Chinese companies in Europe fell from 10.2pc in July 2023 to 9.9pc last month, according to Dataforce, a research company.

This follows new EU tariffs that came into effect on July 5 and mean that charges added to Chinese-made EVs are as much as 48pc.

The tariffs are due to be made permanent in November, depending on the conclusion of trade talks between the EU and Beijing.

08:13 AM BST

Coffee traders race to beat new EU rules

European coffee traders are racing to stock up on coffee beans before new EU environmental rules kick in at the end of December.

Coffee exports from Brazil to the EU have surged by 65pc year-on-year while coffee trade from Uganda hit an all-time record high in July, according to Bloomberg.

The cargoes are flooding Europe before new regulations from the EU’s Deforestation Regulation body that from December 30 will start requiring importers to prove that their produce does not contribute to deforestation.

The new rules will also affect commodities including beef, cocoa and timber, but coffee is particularly vulnerable because the sector is reliant on millions of small farmers across the world.

07:45 AM BST

President Xi’s $5.4 trillion mortgage gamble

China is considering allowing homeowners to refinance as much as $5.4 trillion in mortgage debt at cheaper rates as President Xi Jinping scrambles to boost consumer demand.

The plans would also homeowners to renegotiate cheaper rates with their existing lenders before banks reprice their mortgages in January, according to Bloomberg.

They would also be allowed to switche lenders and refinance with different banks for the first time since the global financial crisis.

It would be the latest move in a series of state attempts to stimulate consumption as the world’s second largest economy grapples with a massive property downturn that has become a major brake on growth.

07:33 AM BST

2025 bounce

High mortgage rates are keeping a cap on homebuyer demand but Bank of England rate cuts could mean bigger house price jumps next year.

Ashley Webb, UK economist at Capital Economics, said:

“The further drop in interest swap rates over the past month suggests there is scope for mortgage rates to fall further and house price growth to accelerate early next year.

“Our view that Bank Rate will decline from 5.00pc now to 3.00pc by the end of next year suggests that mortgage rates will fall from 4.8pc now to below 4.0pc in 2025.

“That could result in house prices growing by an above-consensus 5.0pc year-on-year in Q4 2025.”

07:28 AM BST

Monthly house prices fall

On a monthly basis, average house prices in August fell for the first time since April.

Home values dipped by 0.2pc month-on-month, worth £950 off a typical property, but the sector is bullish.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said:

“With agents reporting activity levels up as much as 20pc on the same period last year, the housing market is on a firmer footing and buyer and seller confidence is noticeably stronger.

“If that isn’t filtering through into higher prices month-on-month that is likely to be down to affordability constraints caused by higher mortgage pricing.”

07:24 AM BST

Budget could spook housing market, agents warn

Buyer demand in the property market could take a hit if Chancellor Rachel Reeves launches an anticipated tax raid in the October Budget, agents warn.

Jeremy Leaf, north London estate agent and a former RICS residential chairman said:

“On the ground, activity remains stronger than it was a few months ago, particularly due to increased political certainty.

“Despite falls in base rate and inflation, confidence is a little fragile and won’t be helped by the Prime Minister’s recent announcement for us to expect a painful Budget at the end of October.”

07:17 AM BST

Good morning

House prices have climbed at the fastest pace since December 2022.

Read the latest updates below.

5 things to start your day

1) Bring in skilled migrants to fuel housebuilding boom, Rayner urged | Think tank suggests seasonal visas could plug labour shortages in construction sector

2) More than £200m wiped off Britain’s struggling Concorde successor | Schroders cuts value of stake in Reaction Engines by 87pc amid slow revenue growth

3) Ed Miliband betrayed families with energy-saving pledge, says Claire Coutinho | Shadow energy secretary says her successor’s policy is rooted in ideology rather than fact

4) Matthew Lynn: Reeves’s tax raid on the rich has already flopped | A near-certain increase in the capital gains levy will raise far less than the Chancellor is hoping for

5) Ambrose Evans-Pritchard: Europe’s Anglo-German axis is an astonishing turn of events | Brussels must watch its step as it tries to assert its authority over Berlin

What happened overnight

Asian stocks rose in trading on Friday and were poised for a solid end to August while the dollar was staring at its worst monthly performance in nine months, on the view that the Federal Reserve is all but certain to cut interest rates next month.

The release of the US core personal consumption expenditures (PCE) price index, the Fed’s preferred measure of inflation, as well as a reading on euro zone inflation later on Friday take centre stage, and would likely offer further clues on the rate outlook across major economies.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.77pc and was set for a gain of 2.3pc for the month.. Japan’s Nikkei has since recovered from its early month collapse, though the index was still set to lose 1.6pc for the month. It was up 0.3pc on Friday afternoon.

Elsewhere, Chinese shares jumped on Friday from near seven-month lows, with property stocks in particular making solid gains. The CSI 300 Real Estate index of shares surged more than 8pc, while Hong Kong’s Hang Seng Mainland Properties Index was up 7pc.

A late-afternoon slide by some Big Tech companies cut into Wall Street’s gains Thursday, leading to a mixed finish for US stock indexes.

The S&P 500 ended flat last night after giving up an earlier gain of nearly 1pc. The benchmark index is about 1.3pc away from its record set in July.

The Dow Jones Industrial Average managed a 0.6pc gain, enough for its third all-time high since Monday. The Nasdaq Composite, which is heavily weighted with technology stocks, slipped 0.2pc. It had been up 1.3pc earlier during the day.

In the bond market, the yield on benchmark 10-year US Treasury notes rose to 3.87pc from 3.84pc late on Wednesday.