4 reasons why forgiving U.S. student debt makes sense

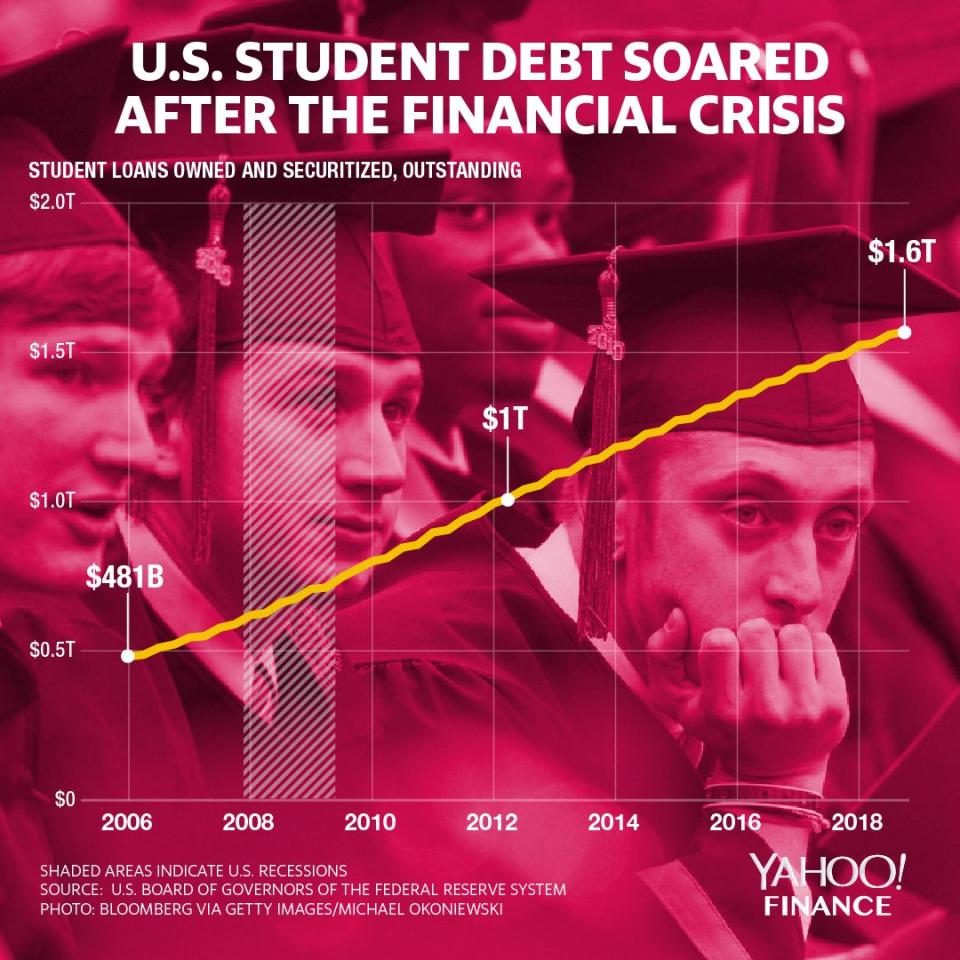

The student loan system is $1.5 trillion mess that has attracted a ton of attention from policymakers to presidential candidates, with Sen. Elizabeth Warren (D-MA) proposing to cancel large amounts of outstanding debt.

That kind of debt relief would have clear benefits, according to a new report from the National Bureau of Economic Research (NBER).

Researchers looked at debt relief data from the credit bureau as well as from a lawsuit filings from 2017 related to National Collegiate — which held 800,000 private student loans totaling over $12 billion or about 11% of all outstanding student debt at the time — and concluded that there are “benefits of intervening in the student loan market to reduce the consequences of debt overhang problems by forgiving student debts.”

The report asserted that four things happened to borrowers in default who experienced debt relief: They saw their overall indebtedness reduced by 26%, were 12% less likely to default on other accounts, gained increased mobility when it came to job opportunities, and were more likely to increase consumption overall.

Since those examined in the report were already in default, they weren’t making student loan repayments. But even though their monthly expenses hadn’t changed, the experience of debt relief led them to manage other debt differently.

“The thing that was interesting about this study is that the people that got the forgiveness weren't paying anyway, so it actually did not change their monthly loan payments at all,” Ben Miller, the senior director for post-secondary education at the Center for American Progress, told Yahoo Finance. So “it suggests there might be some sort of psychological benefit to this relief that goes beyond the household balance sheet.”

“That to me is really interesting,” Miller added, “because it suggests that there may be external benefits to debt relief that you don't otherwise see.”

Borrowers could see overall debt reduce by 26%

The first effect of student debt relief is that borrowers reduce their total liabilities by about $4,000 beyond the cancelled loan liabilities, according to the study. This means that with an average level of debt at $15,317, borrowers could see a 26% reduction.

“We find that consistently across all debt categories, and both with and without county-month fixed effects, the treated borrowers are significantly more likely to reduce the number of accounts,” the researchers wrote.

The study estimated that debt relief on average would reduce credit card debt specifically by $350, auto loans by $300, and mortgages by about $1,000.

“Overall, these findings suggest that treated individuals are significantly more likely to reduce their leverage after the debt is discharged,” said the report.

Borrowers less likely to default or go delinquent on other debt

The second effect of debt relief is that borrowers saw the likelihood of default on all types of accounts reduced by 12%. Borrowers would also be less likely to miss payments on credit cards and mortgages, both massive and ballooning components of household debt that Deutsche Bank Economist Torsten Slok warned was a cause for concern in the U.S. economy.

“These findings speak to the potential spillover effects across liabilities and to a potential indirect benefit of intervening in this market by helping borrowers unable to afford their student loan debts,” the researchers noted.

Borrowers likely to move and get better-paying jobs

The third effect was that borrowers who experience debt relief were more likely to consider moving for a job opportunity and thereby see their incomes rise.

“Consistent with a debt overhang problem affecting these borrowers, we find that the treated individuals are significantly more likely to move when their student loans get discharged,” said the researchers.

And once debt is discharged, borrowers also saw income rise by $4,000 over three years, estimated the researchers, which is roughly equivalent to two months’ salary, “likely due to the borrowers’ ability to accept better jobs.”

Overall consumption could rise

The final effect the researchers found was that with student loan debt relief, borrowers were more likely to increase consumption overall.

“We show that borrowers that were delinquent exclusively on their student debts are significantly more likely to increase their consumption after the court decision,” the report stated.

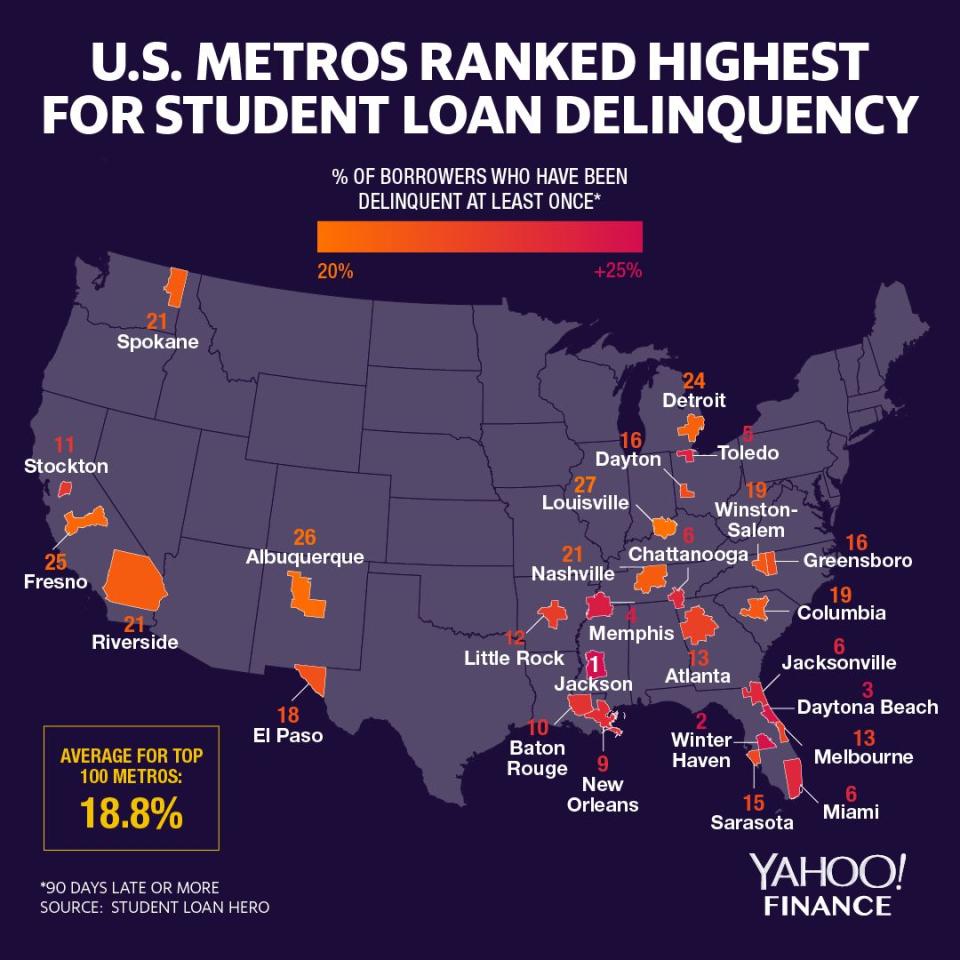

With 11.5% of outstanding student loans in serious delinquency, the average student borrower — who is putting off major milestones like starting a family and owning a home — would see considerable relief in their overall indebtedness and thus be more likely to spend.

That relief could prevent the potential drag on growth that Fed Chair Jerome Powell acknowledged in March when he said that as the student debt crisis “goes on and as student loans continue to grow and become larger and larger, then it absolutely could hold back growth." (Powell added that student debt should be discharged in bankruptcy.)

“Our findings suggest that the costs of the rising student debt burden on the new generations can indeed have important effect: student debt limits the borrowers’ access to better opportunities and also has significant spillover effects to other debt classes,” the NBER researchers wrote.

Miller stressed that while “student loans aren't as large as the housing market was and they're not going to likely bankrupt the entire economy, they do matter for kind of generational wealth building for young people.”

‘Student loan debt is holding back a generation’

“Since 11 percent of borrowers are 90 days or more delinquent on their student debts, rising student debt is considered one of the creeping threats of our time,” the researchers wrote.

And while debt cancellation was initially perceived as radical — particularly when Senator Warren pitched her $640 billion plan — the NBER study provides an argument for the clear benefits of that kind of approach.

“If student loan debt is holding back a generation from improving their financial situation, it seems safe to assume that discharging this debt would help graduates more fully participate in the economy,” Student Loan Hero Student Loan Debt Expert Rebecca Safier told Yahoo Finance.

Safier added that this kind of mass loan forgiveness “could improve borrowers’ financial lives on an individual level and, in turn, have a positive impact on the economy as a whole.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Amid student debt surge, a debate over whether $1.5T is a crisis or 'peanuts'

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.