Why student loan forgiveness should target the graduates who need it most

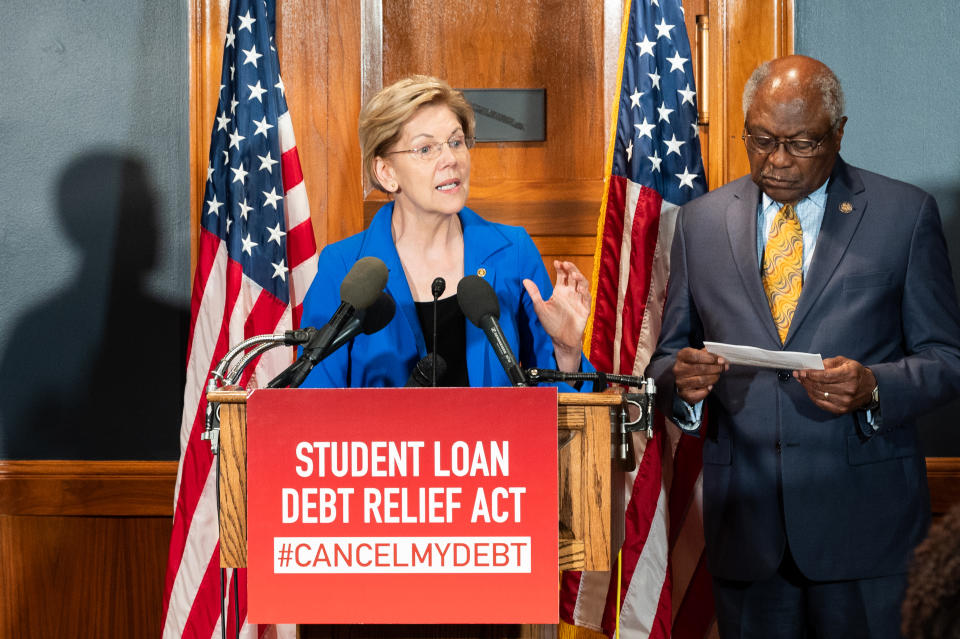

Massive student debt forgiveness — a centerpiece of the campaigns of both Elizabeth Warren and Bernie Sanders — has gone bipartisan. And no wonder. With 43 million people holding student debt and pretty much everyone in the country knowing someone who is struggling with it, the issue has powerful political appeal.

The bidding opened with Warren’s proposal last spring to forgive up to $50,000 of federal debt for borrowers making less than $100,000 annually, gradually phasing out for borrowers making more than $250,000 per year. She was one-upped very quickly by Bernie Sanders’s proposal to forgive all federal student debt — about $1.4 trillion.

Now comes Republican A. Wayne Johnson, a former senior Trump education official harboring designs on the open Senate seat in Georgia, one-upping the Democrats. He proposes to forgive up to $50,000 of debt and provide tax credits up to that amount for borrowers who have already repaid their student loans. Going forward, he would scrap student loans completely in favor of $50,000 grants per student to cover higher education costs.

A bipartisan idea that still remains controversial

Polling data underscores why student debt forgiveness has suddenly become more popular, even among Republicans. A recent Harris poll shows 58% of Americans who are registered voters supporting massive student debt forgiveness, and that includes 40% of Republicans. Yet the idea remains controversial, particularly around cost. Notably, all three candidates have proposed ways to pay for their ambitious proposals but many (including me) are skeptical that revenue raisers will be passed as easily as student debt giveaways. If we have learned anything over the past decade, it is that Washington is good at spending money but terrible at raising it.

More fundamentally, there are many who are old fashioned enough to believe that people should live up to their financial obligations and that there is no reason why taxpayers — many of whom never went to college — should pay for the excesses of student borrowers.

I am sympathetic to these concerns. They are reminiscent of the arguments I heard during the financial crisis against forgiving mortgage debt. In that case, we were talking about banks and investors — not the government — taking the losses. Still, there was the same argument about “moral hazard” in rewarding irresponsible mortgage borrowing with debt forgiveness. But then — as now — I found the counter-arguments more persuasive. Mortgage debt was a tremendous drag on our economy. Our failure to deal with it was one of the reasons why the recovery took so long and was so uneven, as middle- and lower-income families struggled with unaffordable mortgage obligations. Also arguing in favor of debt forgiveness was the fact that millions of borrowers had been duped by misleading marketing practices, including labeling mortgages with steep payment shocks as “fixed hybrid” loans.

Those arguments also apply to our student debt debacle. This time, of course, it has been the government, not the private sector, doing the unaffordable lending, but too many colleges arranging those loans for the government have been far from transparent about the nature of students’ obligations. For instance, loans are typically marketed as “aid” and lumped in with other types of funding, such as grants and scholarships, which do not have to be repaid.

And make no mistake, that $1.4+ trillion in debt is a drag on our economic growth and the consumer spending that underpins it. Student borrowers have only so much income capacity. Every dollar they make in loan payments is a dollar they cannot spend or invest elsewhere. Every dollar they owe reduces their capacity to take on other forms of “good” wealth-building debt, such as a mortgage to buy a home or a loan to start a small business.

A more modest proposal

There are sound policy reasons to forgive student debt, but the question remains how and how much? Interestingly, as the politicians engage in bidding wars, a more modest proposal comes from a progressive group led by the Center for Responsible Lending that proposes debt forgiveness of up to $10,000, which would wipe out debt for about 40% of borrowers.

This less costly proposal targets its largesse on the borrowers in greatest distress. Borrowers with smaller loan balances are typically from lower income households. Many have failed to graduate, or they went to poor quality schools with degrees that did not boost their earning capacity. The high dollar borrowers — who usually went to graduate or professional school and tend to have greater financial resources — would receive marginal benefit.

Such a proposal might be combined with a program of “earned forgiveness” for larger balances of up to $50,000. For instance, debt forgiveness could be conditioned on borrowers making some minimum level of regular payments over a period of time, perhaps earning a tax-free reduction of $1 in principal for every dollar of loan payment. Knowing that they were earning debt forgiveness with each payment dollar could serve as a powerful incentive for more borrowers to repay their loans — and stick with it!

About 15% of student borrowers are past due or in default on their loans, and another 20% are not making payments under the many deferral or forbearance plans offered by the government. Even of those currently making payments, only 36% paid enough last year to cover interest costs and reduce their principal balances. The ability to earn forgiveness, tax-free, within a reasonable time period would give them a foreseeable path to a student-debt free future. This would be far superior to current income-driven repayment plans, which extend to 20 to 25 years and allow principal balances to grow if payments are insufficient to cover interest costs. Not surprisingly, nearly half of student borrowers say they fear they will never be able to pay off their loans.

Of course, massive student debt forgiveness would be ill-advised if we keep the current, broken student loan program in place. Future borrowers will just get in over their heads again. This is why I have long argued that we should transition from a debt model to an income-share model along with: 1) common sense caps on the total amount the federal government will finance for a student’s higher education and 2) a requirement that schools dip into their own pockets to finance part of the income share agreement so that they also assume part of the financial risk of future nonpayment.

Debt forgiveness may be a necessary and justified part of student debt reform, but it does not attack the root causes that got us into this mess. Without common sense caps and college accountability, student debt will once again grow to unsustainable levels, burdening our economy and the financial futures of our young people.

Sheila Bair is the former Chair of the FDIC and has held senior appointments in both Republican and Democrat Administrations. She currently serves as a board member or advisor to a several companies and is a founding board member of the Volcker Alliance, a nonprofit established to rebuild trust in government.

Read more:

Why the Fed should oversee Facebook’s Libra

How regulators can stop leveraged lending from becoming the new subprime

The $1.4 trillion student loan market faces a huge issue — transparency

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.