Student Loan Bankruptcy Gap: New paper aims to bust 'the myth that student loans are not dischargeable'

Recent court rulings prove that student debt can be erased in personal bankruptcy.

But most borrowers aren’t aware of that fact, and lenders routinely exploit that ignorance.

“About half of all bankrupt student loan debtors would obtain relief if they took the appropriate legal steps,” Jason Iuliano, an expert on student loan debt and bankruptcy, asserted in an upcoming article in the Duke Law Journal. “Unfortunately, because nearly everyone has bought into the myth that student loans are not dischargeable, most debtors do not take those steps.”

The general acceptance of that myth created the Student Loan Bankruptcy Gap, which is “an unprecedented situation in the law,” according to the paper. “Nowhere else have so many people sought legal relief while so few have obtained it.”

The Student Loan Bankruptcy Gap has persisted for decades, according to Iuliano, due to creditor manipulation: Lenders preemptively settle cases that would form the basis for broader student debt cancellation through bankruptcy.

Based on an analysis of student loan bankruptcy proceedings, Iuliano found that lenders actively “stack the set of cases that go to trial in their favor” to make the process more difficult for student loan borrowers seeking relief during the personal bankruptcy process.

“Specifically,” the paper stated, “the data show that creditors have adopted a case selection strategy” that “distorts” legal decisions and “masks the true likelihood of obtaining a student loan discharge.”

This amounts to “strategic settlement — a process that involves settling unfavorable cases to avoid adverse precedent and aggressively litigating favorable cases to tilt the law in their favor.” And through this strategy, “creditors have successfully cultivated a myth of non-dischargeability — a myth that scholars, bankruptcy attorneys, and media commentators all subscribe to.”

‘Throw 50 grand at a case and make it go away’

The personal bankruptcy process related to student debt initially appears relatively straightforward.

A debtor looking for financial relief generally files for either chapter 7 or 13 bankruptcy and then takes the step of filing an adversary proceeding for their student debt.

The commonly-believed notion is that the debtor’s student loans are excluded from any relief, and statistics seem to support that belief. But the opposite is true.

Under bankruptcy law, student loan debt is dischargeable in two ways.

Either a student debtor successfully argues that their student loan wasn’t an “educational benefit” as defined by section 523(a)(8) of the bankruptcy code, and can hence be canceled or “discharged” by a court, or they successfully argue that the debt creates an “undue hardship.”

When a debtor makes that first argument — that the loan isn’t an educational benefit — the lender has frequently pushed to settle that case, Iuliano noted, so that a judge’s ruling wouldn’t create an adverse precedent for creditors.

In other words, because settling the case shields winning arguments from public view because they are mostly confidential, they won’t have any effect on the way future cases play out in court.

“Let's just say there’s an average consumer bankruptcy attorney, and their client comes to them,” Iuliano explained to Yahoo Finance. The plaintiff’s attorney, looking at the case, would look at the available resources and pull old cases. “But what they’re not going to do … is look for the settlements, because those aren’t precedential, they're not binding, and many of them are confidential.”

The attorney, looking at the odds, would often advise the client against trying to file bankruptcy for their student loans.

So not only is it “nearly impossible” to go through the bankruptcy process to erase your student debt, NYC Bankruptcy Assistance Project Director Bill Kransdorf told Yahoo Finance, it also becomes “nearly impossible to get a lawyer” in the first place.

This, in turn, further perpetuates the myth that student debt is untouchable by bankruptcy courts.

Furthermore, Iuliano added, “creditors have these long term incentives” to keep this system going because “they’re happy to throw 50 grand at a case and make it go away.”

Most student loan creditors in the U.S. handle federally-backed loans, meaning that the government is often also a party to this process.

“The banks and the Department of Education are manipulating the courts to keep legitimately dischargeable debt from being discharged,” Kransdorf alleged. “They should be looking objectively at the law and choosing not to preserve incorrect interpretations of the law.”

One big way to help address this issue, Kransdorf stressed, is if Congress makes student loan discharge in bankruptcy more accessible with legislation, such as the Student Borrower Bankruptcy Relief Act of 2019.

Student Loan Bankruptcy Gap will persist ‘unless something changes’

Over the past decade, Iuliano found, more than two million Americans with student debt filed for bankruptcy.

However, the vast majority of those debtors — more than 99% — did not file an adversary proceeding to seek a student loan discharge.

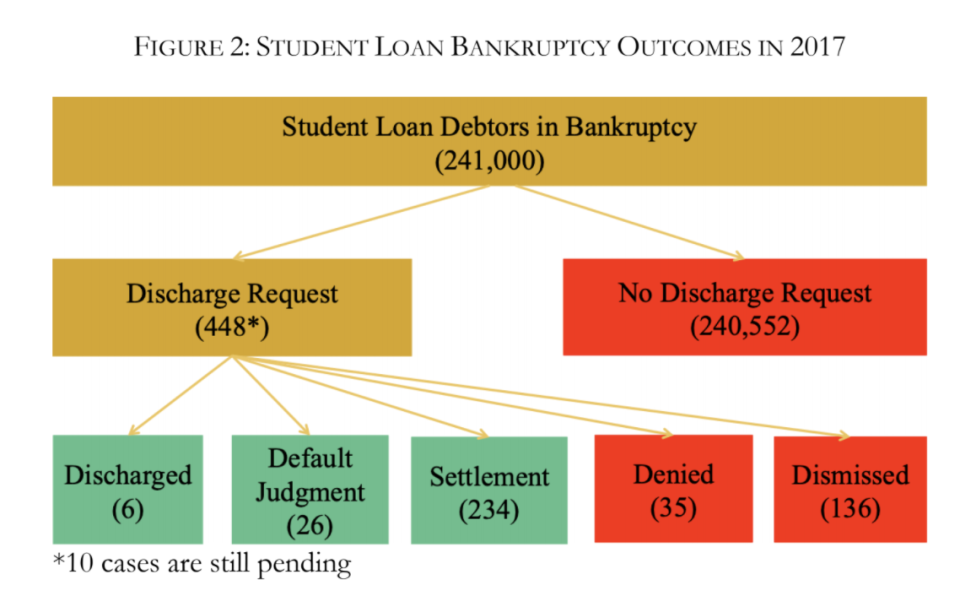

Many of those who did file an adversary proceeding saw a positive result. In 2017, for example, 241,000 student loan debtors filed for bankruptcy, and 447 of those filed an adversary proceeding.

Of that 447, 61% saw at least some of their debt erased.

Looking at the data more closely, Iuliano found that only six of those borrowers ended up having all of their debt discharged via a judicial ruling on the merits.

One of them is a former Navy veteran from upstate New York who saw $220,000 in student debt erased under undue hardship. (The case is being appealed.)

Another 234 cases involving an adversary proceeding were settled and some of the student debt was discharged.

And 26 cases ended with a “default judgment,” which means that the lender didn’t even respond to the borrower’s request and hence got total relief from the court.

Ten cases are still pending.

The findings suggest that student loan borrowers who filed for personal bankruptcy and fought for their debt to be canceled are often successful, further busting the myth of non-dischargeability and tightening the Student Loan Bankruptcy Gap.

The Student Loan Bankruptcy Gap “harmed millions of members of Generation X,” Iuliano added, “is harming millions of millennials, and will harm millions in Generation Z — unless something changes.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Read more:

New Jersey AG files suit accusing student loan giant Navient of 'unconscionable' practices

Internal memo highlights Navient's alleged hidden agenda with student loan borrowers

'The federal government is AWOL’ on student loan protections, California attorney general says

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.