'Severely derogatory': U.S. student debt defaults have 'grown stunningly'

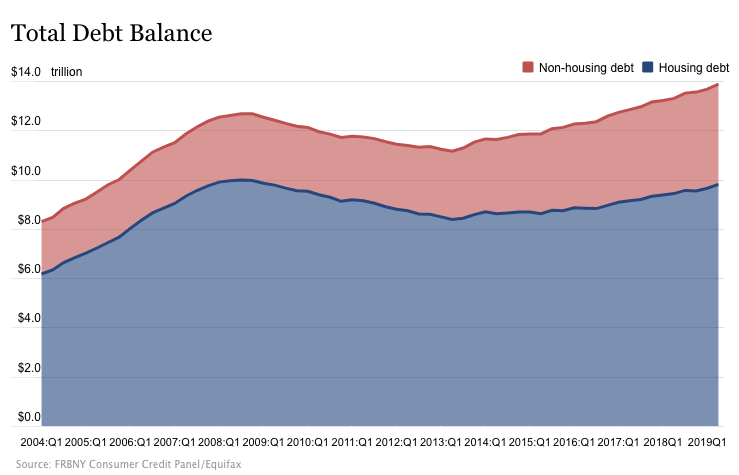

Total U.S. household debt increased for the 20th consecutive quarter this year, rising by $192 billion to $13.86 trillion, according to the New York Fed.

And the data reveals an unsettling truth about student loan balances, which are at alarming levels of missed payments.

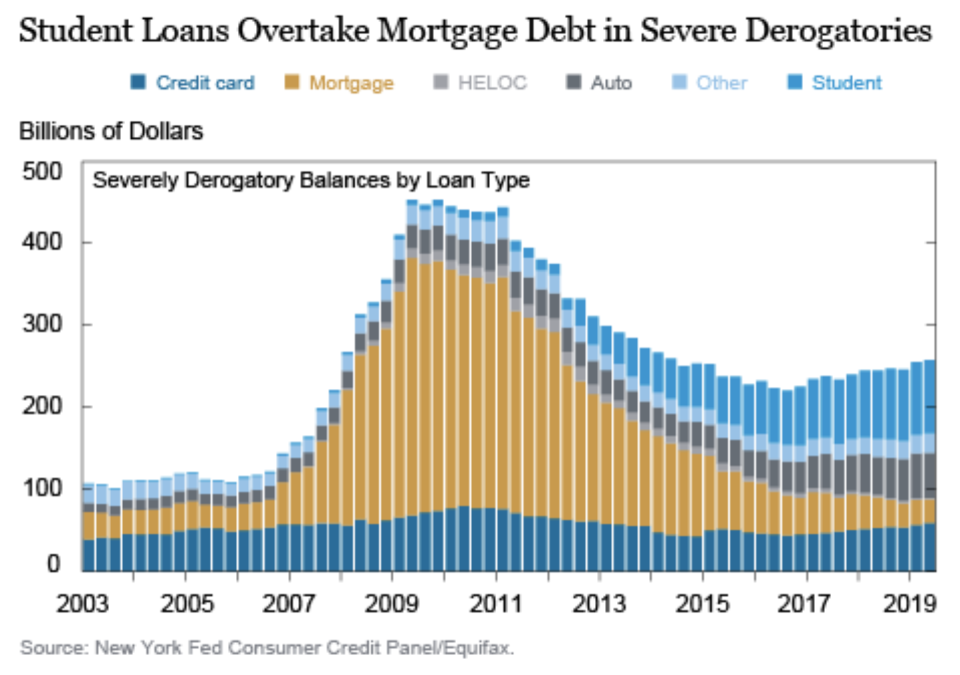

Fed researchers noted that “in the second quarter of this year, the outstanding severely derogatory balance is comprised of 35 percent defaulted student loans, which have grown stunningly since 2012.”

Severely derogatory refers to “any stage of delinquency paired with a repossession, foreclosure, or ‘charge of’” (meaning that the lender has removed the debt from its books),” the report explained.

The increase in overall household debt was “boosted primarily by a $162 billion gain in mortgage installment balances,” the Fed’s Quarterly Report on Household Debt and Credit explained.

While consumer spending has been resilient amid the U.S.-China trade war, two components within household debt are seeing worsening performance.

Student loans

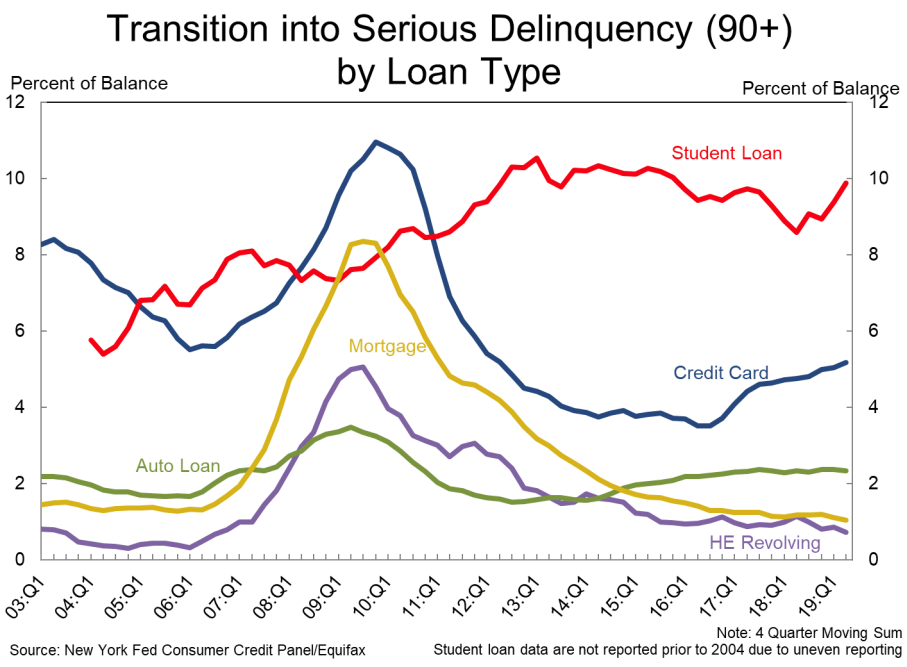

Student loans are the biggest red flag.

While outstanding student debt declined slightly from $1.49 trillion in Q1 to $1.48 trillion this quarter — a “typical change” for the quarter, the report stated — the proportion of student loan borrowers who are unable to pay back their loans has increased rapidly.

And the pressure to repay their student loans — which in many cases exceeds tens of thousands of dollars — affects borrowers in several ways.

A separate study by JPMorgan Chase Institute, which looked at 4.9 million checking accounts, found that some families are spending up to 17% of their annual income as they repay their debts. They’re even putting off “basic necessities,” in some cases, the study noted.

Auto loans

Auto loans were also a component that the Fed highlighted in its report.

Behind student loans, auto loans in Q2 formed 21% of the outstanding severely derogatory balance, which was “a larger share than what we’ve seen historically as the auto loan market has expanded and auto loan delinquencies have been increasing for subprime borrowers in the past five years,” the report stated.

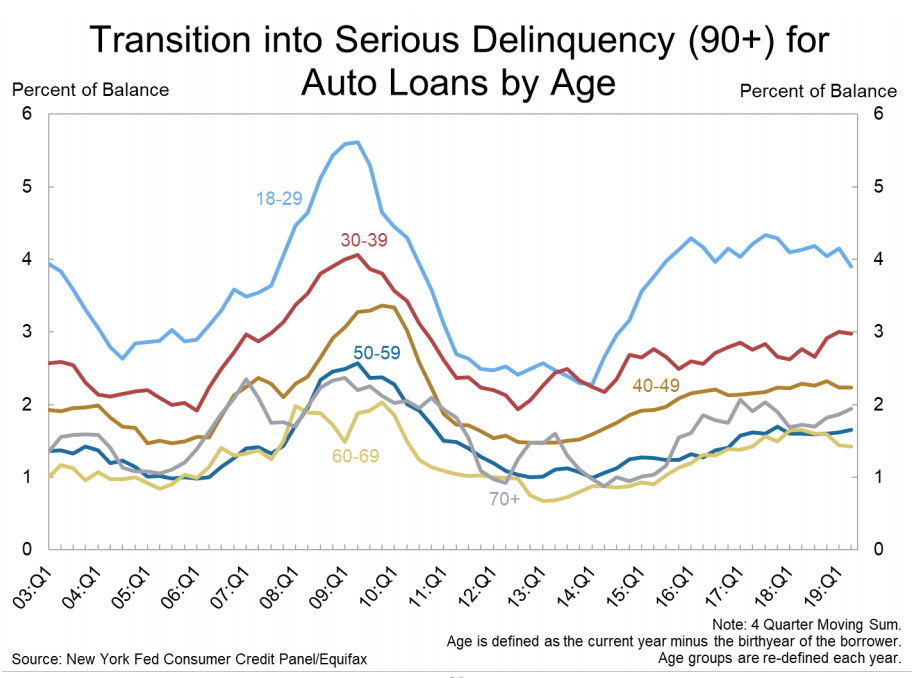

The data also showed that the 18 to 29 demographic has been the demographic that is increasingly missing their auto loan repayments, leading the auto loans that are transitioning into serious delinquency.

The fact that millennials are falling behind on their payments is a trend that Yahoo Finance has noted in the past.

Credit cards

In addition to the two components the Fed flagged, credit card debt — the “most popular and common form of credit used by consumers,” according to the NY Fed — also saw a notable increase.

Overall, credit card balances increased from from $848 billion in Q1 to $868 billion in Q2.

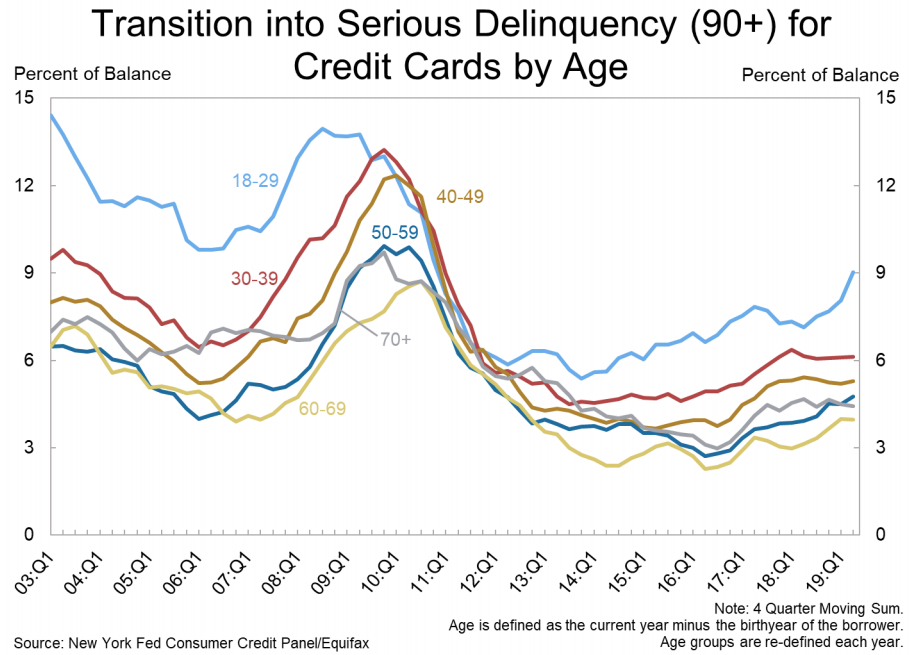

And an increasing number of credit card balances were transitioning into serious delinquency, the report noted, from 5% in Q1 to 5.2% in Q2. That reflects “an upward trend that began in 2017,” stated the report.

The 18 to 29 demographic again, was leading serious delinquencies, the Fed’s data revealed.

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren: 'Betsy DeVos is the worst Secretary of Education' ever

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.