Women are at a crucial disadvantage when it comes to student loans

A recent study by student loan refinancing company Laurel Road reveals that when it came down to exactly how these loans worked, women were nearly twice as likely as men to be fuzzy on the details.

Researchers surveyed 1,000 college-educated adults across America and found that 37% of women did not understand the basics of student loans — which are things like timelines, monthly payments, interest rates, tax implications, refinancing and evaluating lenders, before they borrowed — versus only 20% of men.

“One of the factors contributing to this divide is the education gap between men and women,” Laurel Road SVP of Capital Markets Noah Cooper told Yahoo Finance. “Men were more likely to understand common finance terminology, retirement savings, and the ins and outs of investing.”

The survey was conducted between January 31 and February 11, 2019, using an email invitation and an online survey.

‘Consumers are still struggling with this concept’

Overall, less than half of millennials (44%) surveyed fully understood when and how they needed to repay their student loans before taking on the debt and more than a third admitted that they didn’t comprehend the basics of student debt.

The results are consistent with other studies also point to the fact that there was considerable confusion over how borrowers should repay their student loans.

“Unlike any other asset that you might buy, like a home or a car, where you would payment shop, most consumers don’t payment shop when they’re shopping for education,” LendKey Technologies CEO Vince Passione previously told Yahoo Finance. “Consumers are still struggling with this concept.”

In the United States, women hold nearly two-thirds of the outstanding student debt at around $930 billion, compared to the $531 billion held by men, according to a report by the American Association of University Women (AAUW). Female graduates owe almost $22,000 in student debt compared to $18,880 owed by men.

Cooper noted that women saw themselves finishing student debt repayments at 50 years of age. Men estimated that they’d be done by 48.5.

And while valiant efforts have been made to close the gender pay gap that adds to this student loan repayment burden, they haven’t made sufficient progress, experts argue.

“Women college graduates working full-time are paid 18% less than their male peers one year after graduation,” the AAUW found. And four years after graduation, that gap widens to 20%. “Lower pay means less income to devote to debt repayment,” the report added.

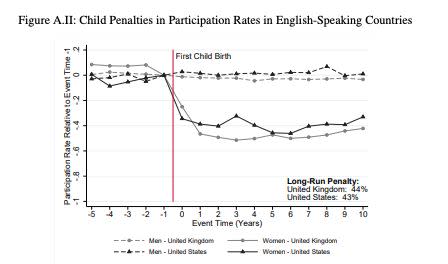

Baby penalty

And while the United States faces declining birth rates, there’s also a wage penalty on mothers that perpetuates the gender pay gap, according to an NBER report.

In the report, it was found that after childbirth, mothers experienced a “large, immediate and persistent drop in earnings after the birth of their first child, while men are essentially unaffected.”

Even after 10 years, according to the NBER report, the numbers hadn’t recovered.

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

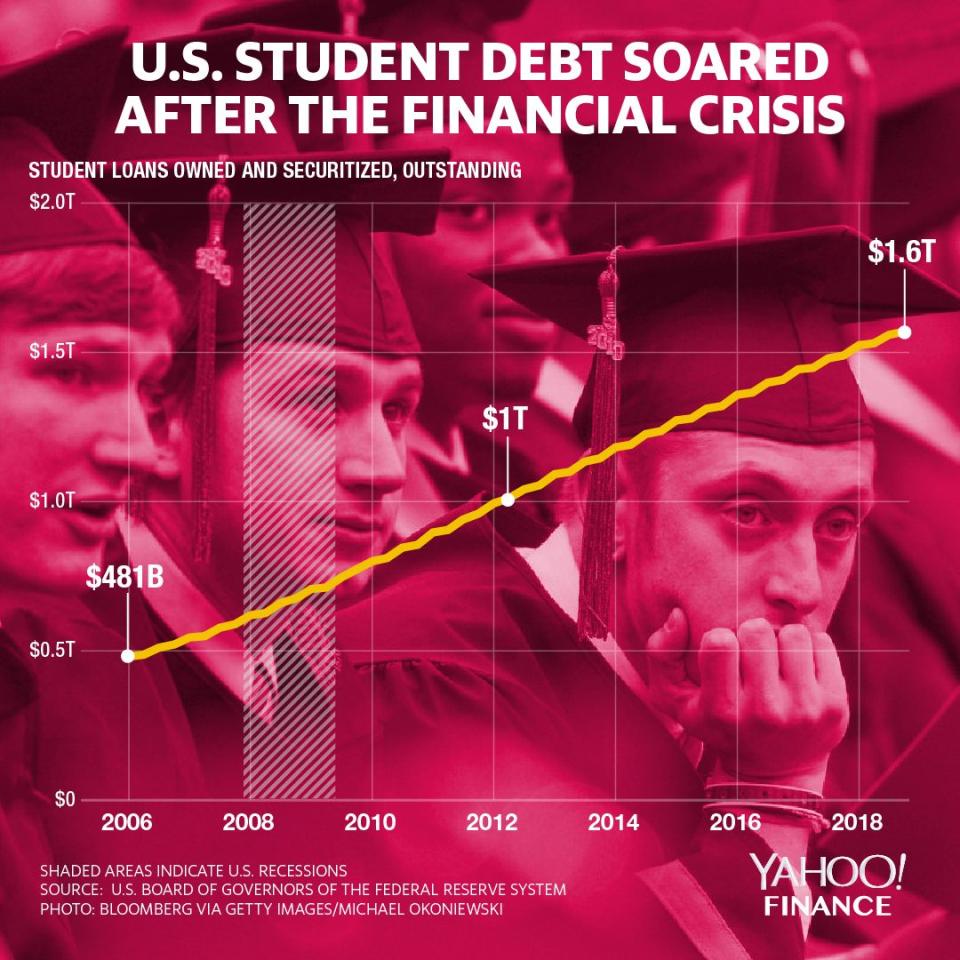

Amid student debt surge, a debate over whether $1.5T is a crisis or 'peanuts'

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.