Economist explains why Americans shouldn't claim Social Security at age 62

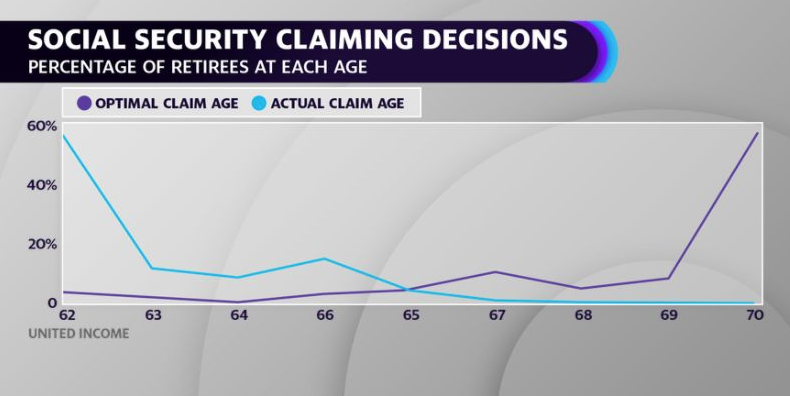

A new study finds 96% of retirees choose the wrong year to claim Social Security. And money management firm United Income estimates they could miss out on a collective $3.4 trillion in benefits because of it.

“Most people continue to get into Social Security at the early retirement age of 62. And there are clear benefits to waiting. You get a higher benefit each month you defer and for most people the combination of that higher benefit and the additional earnings they get as they continue to work really pushes them into a much more secure position in retirement,” Douglas Holtz-Eakin, American Action Forum President, tells Yahoo Finance’s “YFi PM.”

The study also highlights how patience can pay off. For example, a person eligible for a $725 monthly check at 62 years old could receive nearly $1,300 if they postponed benefits until 70 years old. But only 4% of retirees are waiting for the financially optimal age.

Retirement planning pitfalls are also a concern for Gen Xers. A study by the Employee Benefit Research Institute refers to this demographic as the “sandwich generation,” because many are paying for their kids’ expenses while caring for their parents at the same time.

But Holtz-Eakin explains that’s the new normal. “The baby boom is not the proverbial pig in the python. It’s a shift in the structure of our population. We will permanently have more older people relative to young, working-age individuals. If we don’t change the way these systems work — those younger workers will have simultaneously the care of their parents and their own retirement to pay for,” Holtz-Eakin said.

McKenzie Stratigopoulos is a producer at Yahoo Finance. Follow her on Twitter: @McKenzieBeehler

Read more:

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.