Swedish Growth Companies With High Insider Ownership In August 2024

As global markets navigate through a period of volatility and mixed economic signals, the Swedish market has shown resilience amid broader concerns about growth and consumer demand. In this environment, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those closest to the business. Investors may find these stocks appealing due to their potential for robust performance driven by insider commitment and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

Biovica International (OM:BIOVIC B) | 18.8% | 73.8% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

BioArctic (OM:BIOA B) | 34% | 102.8% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 12.7% | 54.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

edyoutec (NGM:EDYOU) | 13.4% | 63.1% |

Let's review some notable picks from our screened stocks.

EQT

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK384.89 billion.

Operations: The company's revenue segments include Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

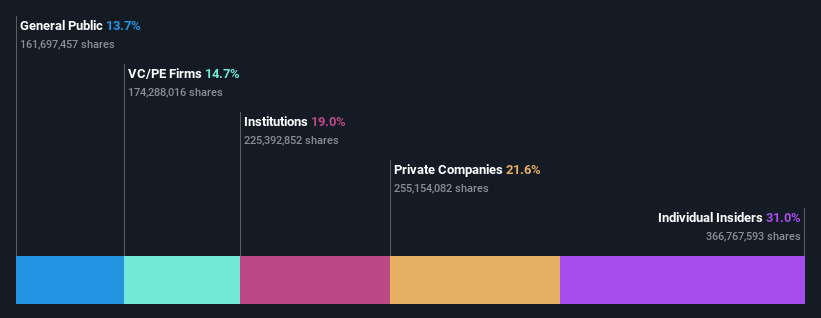

Insider Ownership: 31%

EQT AB is a prominent growth company in Sweden with significant insider ownership. Its earnings are forecast to grow at 56.8% annually, outpacing the Swedish market's 15.6%. Despite some substantial insider selling recently, EQT continues to attract attention due to its aggressive M&A activities, including potential bids for Compass Education and Keywords Studios. Additionally, EQT's recent share repurchase program further underscores its commitment to enhancing shareholder value while maintaining high-quality earnings despite large one-off items impacting financial results.

Click here and access our complete growth analysis report to understand the dynamics of EQT.

Our expertly prepared valuation report EQT implies its share price may be too high.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK95.38 billion.

Operations: Revenue segments (in millions of SEK): Real Estate - Rental: 4633

Insider Ownership: 28.6%

AB Sagax, a Swedish real estate company with significant insider ownership, has shown strong financial performance. For the second quarter of 2024, it reported SEK 1.20 billion in sales and SEK 978 million in net income. The company forecasts profit from property management to reach SEK 4.30 billion for the full year. Despite past shareholder dilution and debt concerns, its earnings are expected to grow at an annual rate of 30.7%, significantly outpacing the Swedish market's growth rate of 15.6%.

Delve into the full analysis future growth report here for a deeper understanding of AB Sagax.

Our valuation report unveils the possibility AB Sagax's shares may be trading at a premium.

Yubico

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB provides authentication solutions for computers, networks, and online services, with a market cap of SEK25.88 billion.

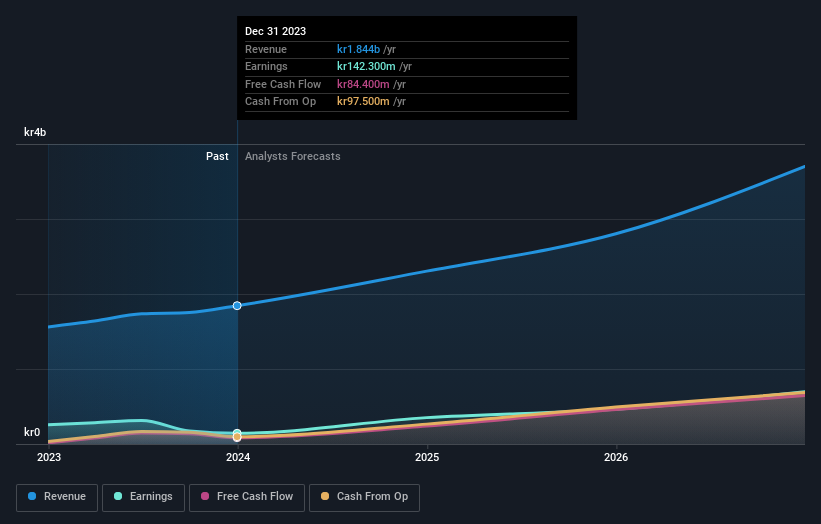

Operations: The company generates SEK1.93 billion in revenue from its Security Software & Services segment.

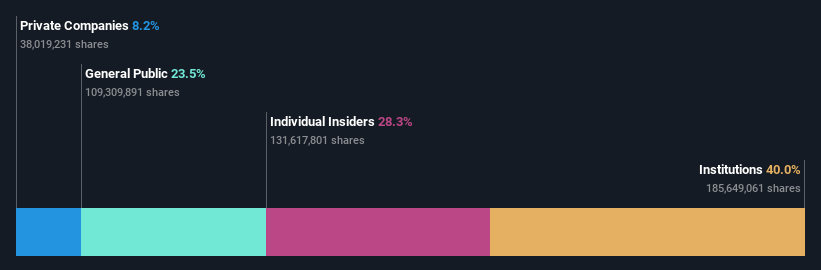

Insider Ownership: 37.5%

Yubico AB, known for its high insider ownership, has demonstrated robust growth with recent Q2 2024 earnings showing SEK 614.4 million in sales and SEK 103.6 million in net income. Despite significant insider selling over the past quarter and shareholder dilution last year, the company's revenue is forecast to grow at an impressive annual rate of 22.9%, outpacing the Swedish market's growth rate of 1%. Additionally, Yubico's earnings are expected to increase by 43.8% annually over the next three years.

Taking Advantage

Unlock our comprehensive list of 89 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:EQT OM:SAGA A and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]