Swedish Growth Companies With High Insider Ownership In October 2024

In October 2024, the Swedish market is navigating a complex global landscape, with European indices showing caution amid escalating Middle East tensions and potential monetary policy shifts by the ECB. As investors seek stability and growth opportunities in this uncertain environment, companies with high insider ownership often stand out due to their potential alignment of management interests with shareholders. In such times, identifying growth companies where insiders have significant stakes can be particularly appealing as it suggests confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Truecaller (OM:TRUE B) | 29.6% | 21.6% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

BioArctic (OM:BIOA B) | 34% | 98.4% |

KebNi (OM:KEBNI B) | 36.3% | 86.1% |

Yubico (OM:YUBICO) | 37.5% | 42.3% |

InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

C-Rad (OM:CRAD B) | 16.1% | 33.9% |

OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's take a closer look at a couple of our picks from the screened companies.

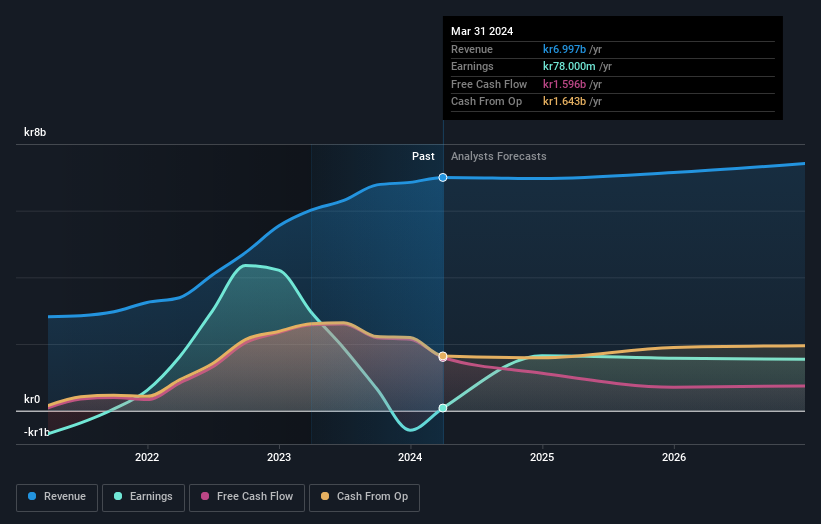

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties worldwide with a market cap of SEK40.77 billion.

Operations: Pandox generates revenue through its Own Operation segment, amounting to SEK3.27 billion, and Rental Agreement segment, totaling SEK3.82 billion.

Insider Ownership: 10.3%

Pandox AB is experiencing significant growth, with earnings forecasted to grow 27% annually, surpassing the Swedish market average. The recent SEK 2 billion equity offering and acquisition of DoubleTree by Hilton Edinburgh City Centre highlight its expansion strategy. However, insider selling has been substantial recently, and interest payments are not well covered by earnings. Despite these challenges, Pandox's revenue growth outpaces the market at 6.5% annually, though profit margins have decreased from last year.

Delve into the full analysis future growth report here for a deeper understanding of Pandox.

Our expertly prepared valuation report Pandox implies its share price may be too high.

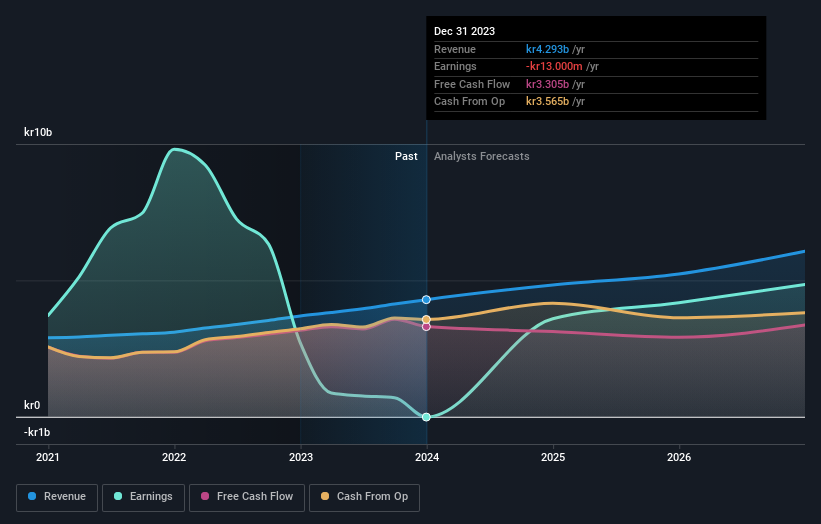

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK100.57 billion.

Operations: The company's revenue primarily comes from its real estate rental segment, which generated SEK4.63 billion.

Insider Ownership: 28.6%

AB Sagax shows strong growth potential, with earnings forecasted to rise 29.1% annually, outpacing the Swedish market. Recent results reflect this momentum, reporting a net income surge to SEK 978 million in Q2 from SEK 53 million a year prior. However, shareholder dilution occurred last year and debt coverage by operating cash flow remains inadequate. Despite these challenges, revenue is expected to grow at 9.3% per year, faster than the market average of 1.4%.

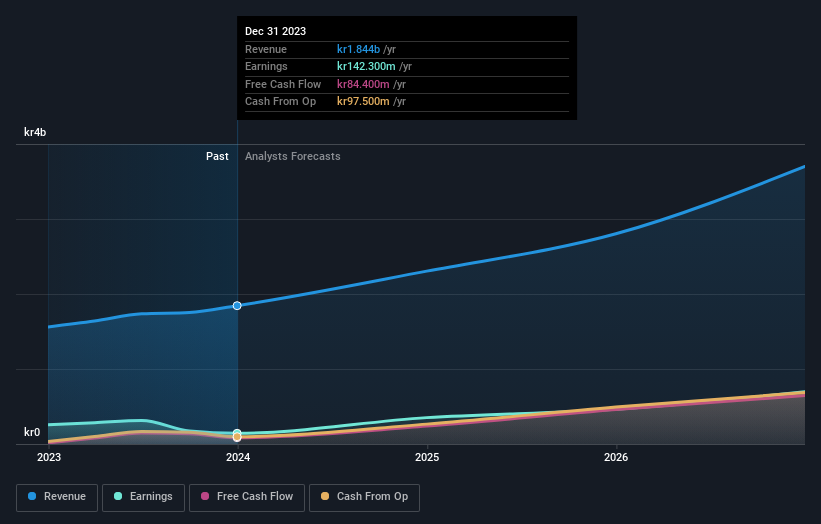

Yubico

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK23.51 billion.

Operations: The company generates revenue from its Security Software & Services segment, amounting to SEK2.09 billion.

Insider Ownership: 37.5%

Yubico is experiencing robust growth, with earnings projected to rise 42.3% annually, significantly outpacing the Swedish market. Recent partnerships, such as with PKO Bank Polski for secure authentication using YubiKeys, highlight its expanding influence in cybersecurity. Despite a volatile share price and reduced profit margins from last year, revenue grew by 21.2%, and the company trades slightly below its estimated fair value. High insider ownership aligns stakeholders' interests with shareholders'.

Next Steps

Embark on your investment journey to our 79 Fast Growing Swedish Companies With High Insider Ownership selection here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:PNDX B OM:SAGA A and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]