Key swing states are among hardest hit by China’s tariffs

Last week, President Trump moved to raise tariffs on $200 billion of Chinese imports. Now, China said it is retaliating by hiking tariffs on $60 billion of U.S. goods, to take effect June 1.

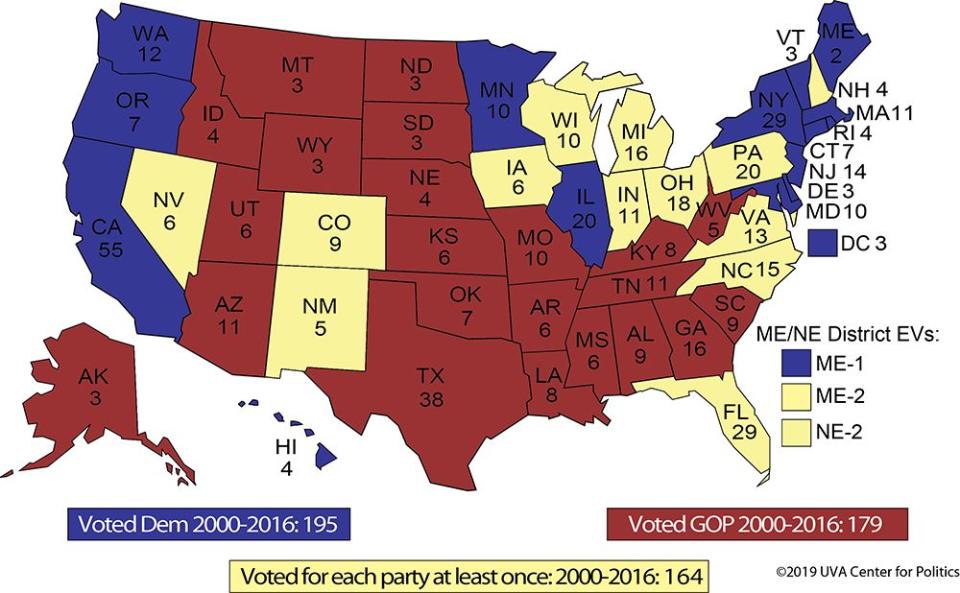

A new Deutsche Bank report looked at the impact of the current Chinese tariffs on U.S. soybean exports — China’s top agricultural import from the U.S. — and found that several potential swing states crucial to the 2020 presidential election are among those hit hardest by the tariffs.

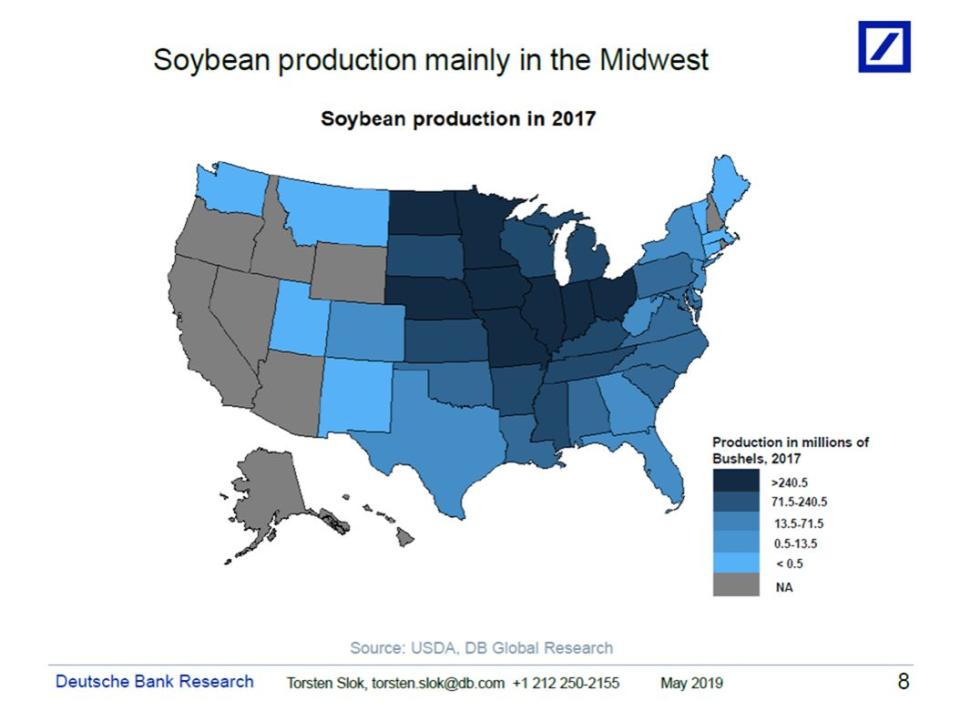

“Up until this point, the retaliation has been on agricultural producers and agriculture products, which happen to be in swing states,” said Deutsche Bank’s chief international economist Torsten Slok. “So several of these charts show you the importance of the swing states and the importance of the heartland in terms of agricultural production.”

According to the USDA, U.S. agricultural exports to China reached $23.8 billion in 2017 – good for 17% of total U.S. agricultural exports.

Soybeans rule

Soybeans are China’s top agricultural import from the U.S., comprising 52% of all U.S. agricultural exports to China.

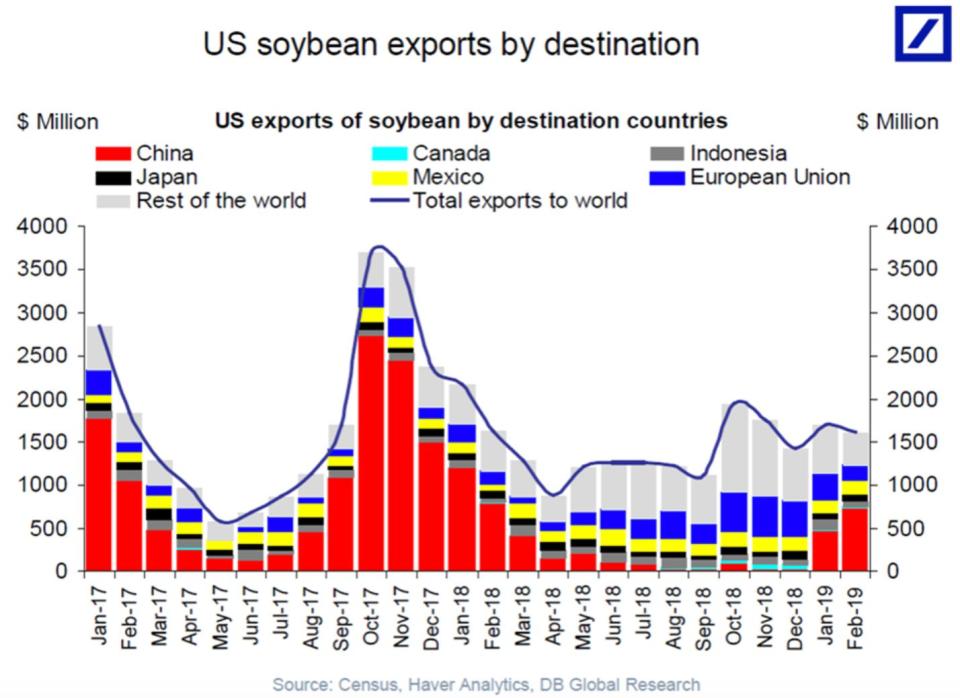

And the trade dispute has hit U.S. soybean exports hard. U.S. soybean exports to China were down $8.7 billion (82%) from August 2018 to March 2019, compared with a year earlier, according to the Department of Agriculture.

Last August Trump announced a plan to increase tariffs on $200 billion of Chinese imports to 25% from 10% (which are the tariffs that went into effect last Friday). The move led to retaliation by China, which imposed 25% tariffs on $16 billion of U.S. goods.

And as a result, U.S. soybean exports to China plummeted from August to January. The period of truce in January and February saw U.S. soybean exports to China rise to $550 million. However, soybean exports to China could drop again if China chooses to retaliate against Trump’s newly imposed tariffs on Friday.

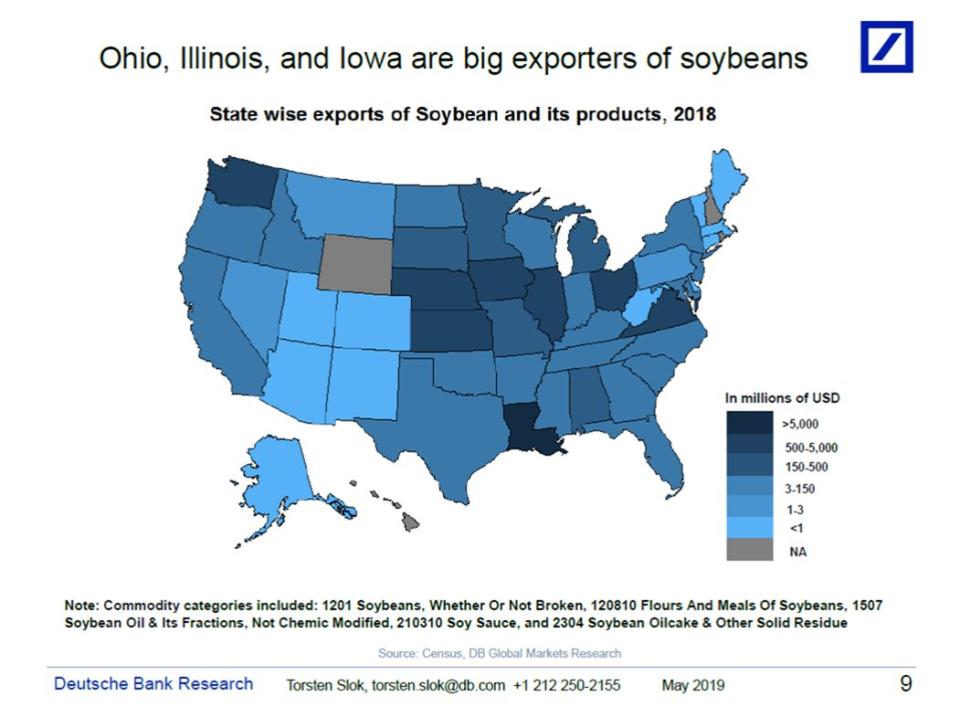

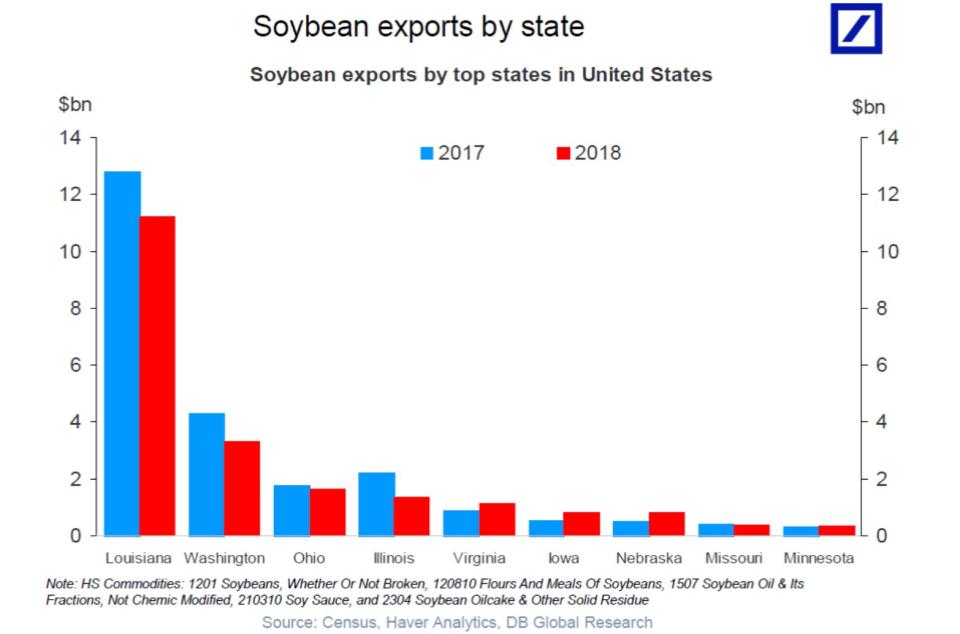

Among swing states – increasingly critical in presidential elections – Ohio saw the most significant impact. In 2018, exports fell to $1.66 billion, from $1.79 billion in 2017. Deutsche highlighted how Ohio — along with swing states Iowa, Indiana, Michigan, Wisconsin — produce and export notable amounts of soybeans.

Responding to U.S. farmers’ pain, Trump said on Monday his administration plans to provide about $15 billion in aid to help farmers whose products may be targeted with tariffs by China. (That follows billions in aid sent to farmers earlier this year.)

STATES HIT MOST BY TARIFFS

Louisiana has been the state hardest hit by the drop in soybean exports – soybean exports fell from $12.8 billion in 2017 to $11.2 billion (or more than 12%) in 2018, according to Deutsche Bank.

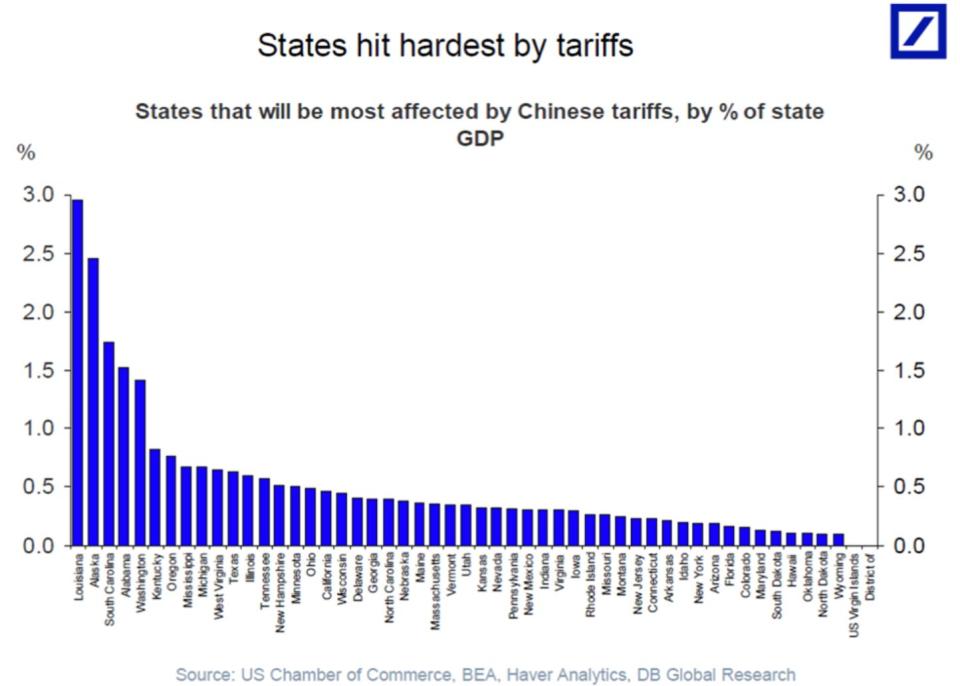

And the tariffs hit nearly 3% of Louisiana’s GDP, while swing states including Michigan, New Hampshire, and Ohio seeing about 0.5% of their GDP impacted.

Slok says economists and investors are now questioning whether more soybean tariffs by China are coming and which states will be impacted.

“Soybean exports from the U.S. have gone down,” Slok said. “Soybean producers are located in the heartland, in the Midwest and in many swing states. That’s why soybean and agricultural products are an important part of this debate about what kind of retaliation is coming from China.”

If China follows the same pattern, “the probability is we might see also more retaliation coming exactly on this area [soybean exports],” Slok said.

Farmers are not optimistic that the soybean trade dispute will be resolved anytime soon. 70% of farmers say it’s unlikely the soybean trade dispute will be settled by July 1, according to Deutsche Bank.

Follow Sibile Marcellus on @SibileTV

More from Sibile:

All the billionaires who are sounding off on income inequality

Housing costs are growing fastest for lower-income families

Netflix comic Minhaj jokes: Do as much controversial work as possible to succeed

$1.5 trillion student debt crisis: Many borrowers still don’t understand the costs