Symetryx Today Issues Open Letter to Shareholders In Regard to the Upcoming Annual General Meeting

Recommends Fellow Shareholders Vote AGAINST Keystone Transaction & the Check-Cap Board Nominees - Further Recommends a Vote FOR the Symetryx Slate of Director Candidates

Cites Unrealistic and Aggressive Valuation of Keystone Used to Justify the Merger and Troubling Cash Burn by Check-Cap Board & Management

TORONTO, Nov. 28, 2023 /CNW/ - Symetryx, a holder of 5.6% of Check-Cap Ltd. (NASDAQ: CHEK) shares, today issued the following open letter to shareholders. In the letter Symetryx cites, among other items, its serious concerns and reason for voting AGAINST the proposed transaction with Keystone Dental. Symetryx discusses its concerns around the actions of the Board in its evaluation and approval of the transaction, including the highly questionable valuation of Keystone Dental. Further, Symetryx urges all shareholders to support and vote FOR its five highly qualified, experienced and independent director nominees who will bring accountability back to CHEK and find a more suitable merger partner. One that will not cause the alarmingly high level of dilution to the shareholders that the Keystone transaction, if approved, would entail. The full text of Symetryx's letter follows:

November 28th, 2023

Dear Fellow Check-Cap Shareholder,

We are writing to you today on behalf of Symetryx Corporation ("Symetryx"), a now 5.6% holder of Check-Cap Ltd. ("Check-Cap"), with regards to the notice of Annual General Meeting of Shareholders filed on November 13th, 2023, by the Company. See 425 (sec.gov). Symetryx is a very diverse private venture capital and investment company that is invested in a variety of assets, including computer, technology, and cyber-security, agricultural technology, real-estate and senior living-care, AI, gold, lithium and copper mining and audio technology.

The upcoming Check-Cap Annual General Meeting is scheduled to be held on Monday December 18th, 2023, at 2 PM local time at the offices of Check-Cap's legal counsel, FISCHER (FBC & Co.), located at 146 Menachem Begin Rd., Tel Aviv 6492103, Israel. A Proxy Statement and proxy card or vote instruction form should have been mailed or emailed to you. According to the Company's proxy materials, you may vote by mail or by internet.

The Proxy statement is very lengthy and may be quite confusing. We have attempted to distill down the hundreds of pages in the proxy statement to the most concerning and salient points below. In essence, Symetryx's position, how we intend to vote, and our recommendations to our fellow Check-Cap shareholders is to vote your shares as follows on the various resolutions:

Our position on Proposal 1- vote AGAINST the Keystone Merger Proposal

As one of the largest Check-Cap shareholders (currently 5.6%) we're at a loss to understand how the proposal to merge Check-Cap with Keystone Dental, a manufacturer of dental appliances ("Keystone Merger") could be value-enhancing to ALL shareholders.

In spite of the length of the proxy materials, based upon the review of the limited information thus far provided to shareholders regarding the Keystone Merger, we believe that there are several problematic issues which compel us not to support this value-destructive and dilutive transaction:Valuation: It isn't clear how all the IP that Check-Cap shareholders have invested in is being valued or considered under the combined entity. The valuation of Keystone at $225M seems elevated, for a traditional manufacturing company- that would mean that the EBTIDA for Keystone would be $37m, which seems highly unlikely based -on its revenue of $61m for F'22 (or $66M for F'23).

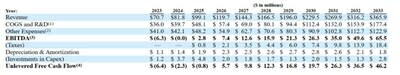

The following chart is a summary of Keystone's cashflow projection for the next 10 years, according to the Proxy statement (page 35):

As you can see above, Keystone is not even projected to be profitable until 2026 with an unlevered cash flow of only $5.7 million. Keystone's EBITA (earnings before interest, taxes, and amortization) for 2025 is projected to be $2.8 million. Manufacturing companies such as Keystone Dental are typically valued at 4 x EBITA, i.e. $11.2 million. See Valuation Multiples for a Manufacturing Business - Peak Business Valuation

Notwithstanding this, the Check-Cap proxy (on page 31) values Keystone Dental at a staggering $264.7 million, which is an incredible 94 x EBITA, which we believe is completely unreasonable and inflated to a degree that defies reality.

If such a ridiculously high multiple isn't enough cause for concern, based on our analysis of the information, page 31 of the Proxy statement highlights Keystone's significant history of losses and its expectations that it will continue to lose money for the foreseeable future.

The Prospectus for the merged company states on page 20, Summary Risk Factors, a litany of potential concerns around the combined company. Most striking is the section that states: "Some of Keystone's and Check-Cap's directors and officers may have interests that are different from yours, which may influence them to support or approve the Business Combination and the issuance of shares of New Parent common stock." Shareholders should rightly question what these different interests might be and how they have influenced the selection of Keystone as a merger partner. We urge shareholders to read this section in its entirety.

The Prospectus for the merged company states on page 29 states:

The lack of a public market for New Parent common stock makes it more difficult to evaluate the fairness of the Business Combination.

The Prospectus for the merged company states on page 31 states:

Risks Related to Keystone and Ownership of New Parent Common Stock Following the Business Combination:

Keystone is a company with a history of significant net losses, it expects to continue to incur operating losses for the foreseeable future and it may not be able to achieve or sustain profitability.

There is substantial doubt about Keystone's ability to continue as a going concern and, while this condition is expected to be alleviated by the consummation of the Business Combination, there is no assurance that Keystone will have sufficient resources to fund its operations in the future.

As a result of Keystone's losses, along with Keystone's current cash and working capital position, Keystone currently does not have sufficient current resources to fund its planned operations for the next twelve months.

How can the valuation of Keystone be justified considering the foregoing statement? We urge all shareholders to pose this question to the Board and management of Check-Cap.

Though Check-Cap issued a press release representing Keystone as an AI company, however, in accordance with the public record, this is far from true. The complexities of AI are vast and don't seem well represented by Keystone at all. Where is the disruptive technology that the shareholders of Check-Cap should expect from the use of funds that they have invested? It appears these funds are to be used to support a transaction with a focus on the traditional manufacturing operations of Keystone, which does not seem to be particularly disruptive - or in any way related to AI - in its already crowded industry. There is limited growth potential with minimal growth demonstrated in F'23.

The total available market in which Keystone is a part is quite small and limited by the fact that many people in the U.S do not have access to dental insurance. Thus, the Keystone product does not, and will not likely in the future, have a large market saturation. The dental implant industry seems crowded with big and better competitors such as Sinclair, BioHorizonz, NDX and DFL. Post-merger, the combined entity would be a small fish in an even smaller pond.

Furthermore, this should create greater concern to shareholders regarding the disclosure in the proxy stating that the lack of public market making it hard to evaluate the fairness of the deal potentially resulting in shareholders receiving less than fair value for their current CHEK shares.

The Keystone Merger prospectus discusses management and board strength and their public company readiness, without providing information to help assess what are the specific strengths which will assist them to run a NASDAQ listed company. Curious how this group of nominees is public-ready when it has taken several months to produce financial statements, an exercise that for a private company is much less rigorous than for a publicly traded entity.

As Symetryx announced in its press release date September 9th, 2023, we believe the Keystone Merger doesn't maximize shareholder value in any meaningful way. In fact, we see this as an extremely value destructive and dilutive transaction. An over aggressive valuation such as this brings into question the intentions and motivations of the board, given the disclosures on page 28 of the proxy statement.

Without Check-Cap providing full disclosure related to Keystone of all the financial data within a time frame that is reasonable prior to the Shareholder Meeting and the deadline for shareholders to vote, it is impossible for shareholders to accurately assess the validity of the Keystone Merger or determine that such merger is indeed in the best interests of ALL Check-Cap shareholders.

Ongoing Operational Concerns: On November 6, 2023, after the merger was suggested to shareholders by the Board, Keystone revealed that it received what they referred to as a "deficiency letter" from the FDA regarding some of their marketed products which could cause a need for them to "cease marketing and withdraw or recall the product" which could further worsen the financial conditions of what we believe to be an already bloated, The Prospectus for Capstone the merged company states on page 58 states:

Some of Keystone's marketed devices are subject to risks related to a deficiency letter received from the FDA in connection with a pending 510(k) notification for the Paltop Short Implants… This could harm Keystone's business, financial condition and results of operations.

We see the Keystone Merger as highly value destructive and dilutive to ALL Check-Cap shareholders.

2. Our Position on Proposal 2- vote FOR the reappointment of Brightman Almagor Zohar & Co., Certified Public Accountants, a firm in the Deloitte Global Network, as our independent auditor for the year ending December 31, 2023, and for such additional period until our next annual general meeting of shareholders.

3. Our Position on Proposal 3- vote AGAINST the approval of an amended and restated Compensation Policy for Executive Officers and Directors. We believe the conduct of the current executive officers and directors of Check-Cap has not been aligned with the best interests of all the shareholders.

4. Our Position on Proposal 4- vote AGAINST the reverse share split of the Company's ordinary shares within a range of 1 for 2 to 1 for 5, the exact ratio to be determined by further action of our Board of Directors, to be effective on a date to be determined by our Board of Directors and announced by the Company, and to amend our Articles of Association accordingly. Page 49 of the Prospectus states the numerous risks associated with a reverse split.

5. Our Position on Proposal 5

i. vote AGAINST the re-appointment of each of Company Directors Nominees: Mr. Steven Hanley, Ms. Clara Ezed, Dr. Mary Jo Gorman, Mr. XiangQian (XQ) Lin and Mr. Yuval Yanai; and

ii. vote FOR the election of each of Independent Shareholder Director Nominees proposed by Symetryx: Mr. William Vozzolo, Ms. Avital Shafran, Mrs. Lilian Malczewski, Mr. Jordan Lipton and Mr. Idan Ben Shitrit.

As a shareholder, based upon the review of the limited information thus far provided to shareholders regarding the company's activities and decision-making process regarding the Keystone transaction, we believe that the current Check-Cap Board is not acting in the best interest of Check-Cap shareholders:

Although Symetryx is one of the largest shareholders of Check-Cap, the current Check-Cap Board has refused to discuss any initiatives proposed by Symetryx, including at least two possible takeover offers.

The Check-Cap directors claimed in their press release of August 16th, 2023, that they met with over 150 (unspecified) merger candidates yet refused to consider any of Symetryx's candidates.

After numerous press releases and attempts to engage with the Check-Cap Board with no success, Check-Cap announced the Keystone Merger with very little detail and did not disclose any financial statements to justify the validity of this merger and the further massive dilution of the ownership interests of the current Check-Cap shareholders in the pro-forma company.

As part of the Keystone merger agreement, Check-Cap directors have agreed to pay an absurd amount of $1.5 million termination fee (plus up to $1.5 million of expenses) payable by Check-Cap to Keystone upon the occurrence of certain events and the potential effect of such a high termination fee is to deter other potential acquirers from proposing an alternative transaction that may be more advantageous to Check-Cap shareholders.

We believe the transaction and its structure, along with the Board's behavior, is in direct contradiction to the Check-Cap Board's fiduciary duties to make decisions in the best interest of the company and ALL its shareholders.

As a shareholder, we continue to question how Check-Cap board are comfortable that upon the Keystone Merger's consummation, there will be only $22,000,000 left in cash for Check-Cap, or $3.76/share, even though 2023 started with $42,000,000, or $7.18 per share. This cash burn occurred while Check-Cap has had very limited operations, and its employees were nearly all terminated earlier this year. This is a shameful waste of Company resources. An explanation to the shareholders is required immediately, well ahead of the vote deadline for the Keystone transaction.

Symetryx press releases of September 9th, 2023, Symetryx explained its concern that the current Check-Cap directors were burning through the Check-Cap cash reserve at an alarming rate. As one of the largest Check-Cap shareholders, we are extremely concerned that Check-Cap's cash is being burnt through so quickly, notwithstanding that it does not currently have any true ongoing operations nor staff. We believe this cash burn is emblematic of a management and Board that do not truly respect their fiduciary duties and certainly are not acting in the interest of ALL shareholders.

Although Check-Cap is currently an inactive company with no revenues, their directors have spent several millions of dollars without any financial transparency and refuse to provide shareholders with full financial disclosure.

For these reasons we encourage all shareholders TO VOTE FOR the following five (5) Symetryx Independent Shareholder Director Nominees:

Jordan Lipton

Avital Shafran

Idan Ben Shitrit

William Vozzolo

Dr. Liliane Malczewski

The full biographies of our nominees can be found at Symetryx Independent Shareholder Director Nominees.pdf

Notwithstanding that the proposed directors are exceptionally talented individuals, Check-Cap in their Proxy (page 56) states: "The Shareholder Director Nominees predominantly have no listed company experience and bring no proven management experience to deliver long-term value for Check-Cap shareholders". The statement is not only untrue, but is, in our opinion, libelous and actionable. As their biographies detail, our independent nominees are well experienced and ready to sit on a public company board of directors.

On October 17th, 2023, Symetryx issued a press release seeking to change the current Check-Cap board. See SYMETRYX SEEKS TO CHANGE BOARD AND MAXIMIZE SHAREHOLDER VALUE (newswire.ca). Symetryx Nominees are independent, experienced and qualified and in our opinion, and will best represent the Company's shareholders and maximize shareholders value.

6. Our Position on Proposal 6- vote FOR the approval of the cash remuneration to be paid to the Director Nominees who are elected to serve as directors at the Meeting under Proposal 5.

7. Our Position on Proposal 7- vote FOR the approval of the Company's entry into indemnification and exculpation agreements and to provide directors' and officers' liability insurance coverage to a Shareholder Director Nominees who is elected to serve at the Meeting under Proposal 5.

Symetryx, which as November 27th, 2023, owned 5.6% of Check-Cap shares issued and outstanding share capital, well exceeding the current shareholdings of the current Check-Cap executives and directors which, in accordance with Check-Cap proxy statement, own approximately 1.2% of the Check-Cap outstanding shares. See the table below. Symetryx may consider buying further shares of CHEK on the open market to strengthen its position.

Thus, Symetryx owns 4.5 times the total shareholdings of all the current eight (8) Check-Cap executives and directors combined. Notwithstanding that the current Check-Cap executives and directors have only 1.2% ownership and minimal "skin in the game", they nevertheless slander Symetryx on page 56 of their Proxy statement:

Symetryx considers these statements to be false, defamatory, and actionable. According to public information released by Check-Cap, the current Check-Cap executives received over $1,329,560 in compensation in 2022. (See Proxy page 16). See Check-Cap Ltd. (CHEK) Company Profile & Facts – Yahoo Finance

The complete salaries and compensation of all the Check-Cap executives and directors has not been openly disclosed to the shareholders in the Proxy statement as required by law. See 425 (sec.gov)

While Check-Cap unjustly accuses Symetryx of making a cash grab, the opposite in in fact true. Under the Check-Cap watch, over $20 million of shareholders equity has disappeared with no financial transparency. The available cash has decreased in 2023 from $42,000,000, or $7.18 per share, to $22,000,000 or $3.76/share post transaction close, even though Check-Cap has extremely limited operations. This is shameful. Again, an explanation to the shareholders is required.

The current Check Cap executives and directors accuse Symetryx of having no strategic plan or vision for its future (Proxy page 56). This is false. In fact, Symetryx has several merger candidates it would like the newly constituted Check Cap board to consider, which is far more profitable and less dilutive than Keystone Dental and will increase shareholder value. Notwithstanding this, Check-Cap refused to consider any of Symetryx's merger candidates, amongst the 150 (undisclosed) candidates it claims to have considered.

Furthermore, Symetryx has spoken to Yoav Kimchy PhD, the Founder and former Chief Technology Officer of Check-Cap, who has confirmed that there is still value in the Intellectual Property (IP) created over the years, that should not be discarded. A newly constituted Board comprised of Symetryx's highly qualified independent director nominees will seriously examine the potential utilization of the existing IP created by Check Cap to further maximize value to the shareholders.

In summary, we believe the current Check-Cap Board are behaving in an arbitrary and high-handed manner, to maximize their own self-interests to the detriment of all other shareholders. For this reason, we urge you to vote Against the Keystone merger (Proxy Proposal 1), and For the replacement of the current Board with the suggested highly qualified independent Symetryx candidates listed above.

Symetryx has engaged Mackenzie Partners, Inc. to act as an advisor in this matter, we welcome shareholders to reach out to share their views or should they seek clarification on our own. Mackenzie Partners can be reached at 1-800-322-2885 or [email protected].

Sincerely,

Symetryx Corporation

View original content to download multimedia:https://www.prnewswire.com/news-releases/symetryx-today-issues-open-letter-to-shareholders-in-regard-to-the-upcoming-annual-general-meeting-301999528.html

SOURCE Symetryx Corp

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2023/28/c2105.html