Target, Cisco earnings — What you need to know in markets on Wednesday

After a day that once again saw the Nasdaq hit an all-time high while the political headlines were numerous and chaotic, markets will face a lighter calendar on Wednesday.

Save for the weekly report on mortgage applications in the morning, no major economic data is set for release. The earnings highlights are expected to include reports from retailer Target (TGT) and tech giant Cisco (CSCO).

On Tuesday, homebuilding retailer Home Depot (HD) reported sales that topped expectations and analysts at UBS — which has a “Buy” rating at $173 price target on the stock — said, “We think [Home Depot] should be a core holding as the housing cycle unfolds.”

Shares of Home Depot gained about 0.6% to close at $158.26 on Tuesday.

Stocks overvalued?

Bank of America Merrill Lynch’s latest fund manager survey indicates that people are worried about stock prices.

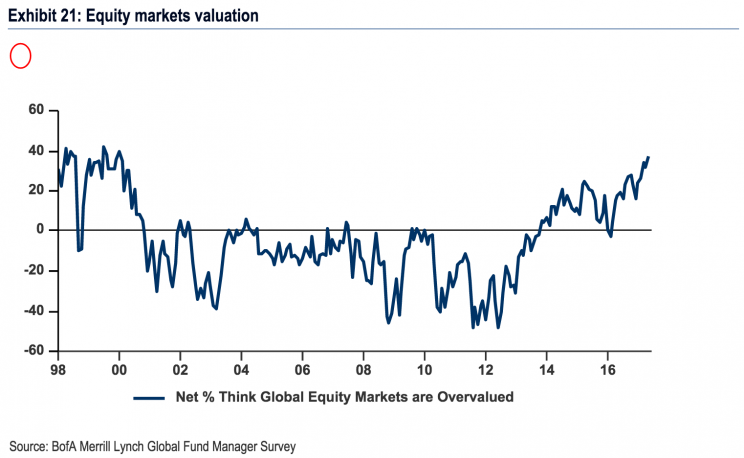

According to the firm’s latest figures, 37% of fund managers surveyed by the firm think global stocks are overvalued, the highest since January 2000. And as with any numbers from this era, those who know markets history know how that market ended: the tech crash.

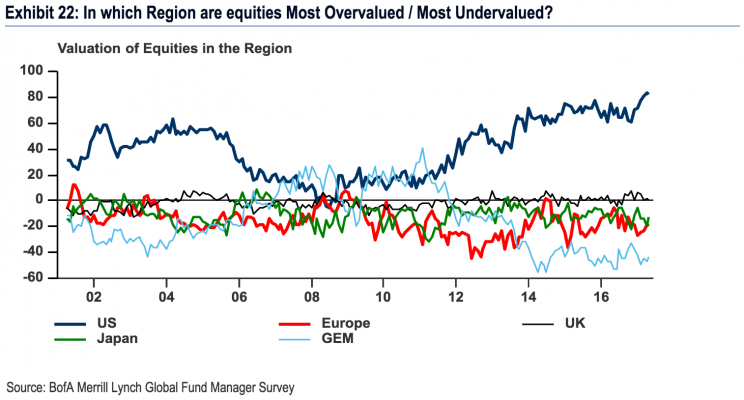

But what’s also notable about this number is how this breaks down by region.

U.S. stocks, according to BAML, are seen as the most overvalued with about 80% of fund managers characterizing the U.S. market in this way.

Meanwhile, 20% of managers think European stocks are undervalued. Which is notable because one of the most crowded trades right now, according to the survey, is going long European stocks. Fund managers, in other words, are betting European stocks are going up because European stocks are seen as cheap.

Which really brings out what this survey reveals each month: career risk and herding.

On Wall Street — as in other walks of life — it is okay to be wrong as long as you are wrong like everyone else. Or as John Maynard Keynes once said, “Worldy wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

What the fund managers’ survey expresses, then, is not so much what people think will happen or is happening, but which calls they are willing to be wrong about.

We’ve written in the past that some investors believe we are just at the beginning of a bull market in the U.S. that started not with the March 2009 bottom but the nearly 25% rally to new highs we saw in 2013. A broader, and clearly safer, call, however, is to note that U.S. stock market valuation measures are among the highest they’ve been in history. This, in turn, would indicate that while gains since the financial crisis have been stellar, gains going forward appeared more tempered.

Money manager GMO, for example, forecasts U.S. large cap stocks will earn annual real returns of -4% for the next seven years. Historically, U.S. stocks have returned closer to 7% per year.

But investors, by saying they view U.S. stocks as overvalued, are indicating not so much a preference away from U.S. stocks so much as they are making clear they are comfortable getting that call wrong if U.S. stocks keep going up.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: