Tenaris SA's Dividend Analysis

An In-depth Look at Upcoming Dividends and Historical Performance

Tenaris SA (NYSE:TS) recently announced a dividend of $0.8 per share, payable on 2024-05-22, with the ex-dividend date set for 2024-05-20. As investors eagerly anticipate this upcoming payment, it's crucial to delve into the company's dividend history, yield, and growth rates. This analysis, using comprehensive data from GuruFocus, aims to evaluate the sustainability and attractiveness of Tenaris SA's dividends.

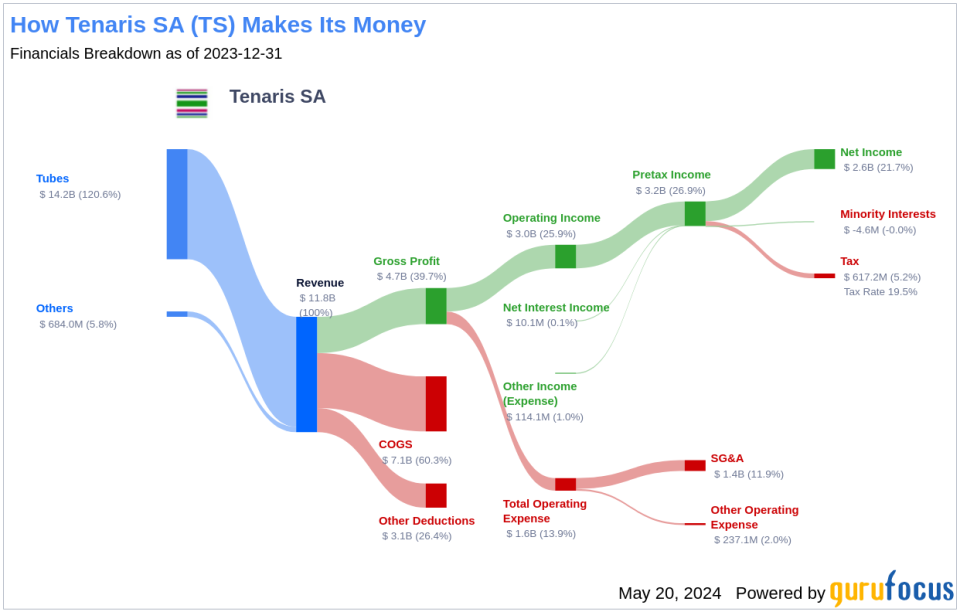

Understanding Tenaris SA's Business Model

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Tenaris SA is a leading global manufacturer of oil country tubular goods (OCTG), essential for constructing oil and gas wells. The company boasts production facilities primarily in the U.S., Argentina, Mexico, and Italy. Known for its premium OCTG products, Tenaris SA is highly regarded by oil companies for applications in challenging environments such as deep-water offshore and horizontal shale wells.

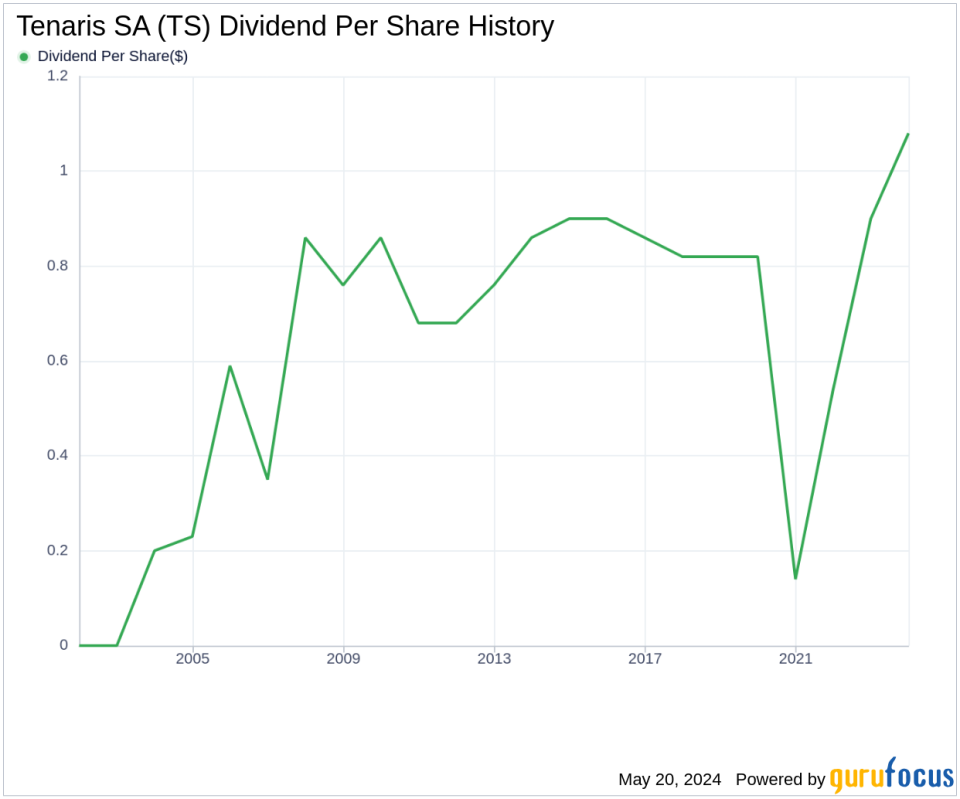

A Look at Tenaris SA's Dividend History

Since 2003, Tenaris SA has maintained a consistent dividend payment record, with distributions currently made on a bi-annual basis. Below is a chart depicting the annual Dividends Per Share to track historical trends.

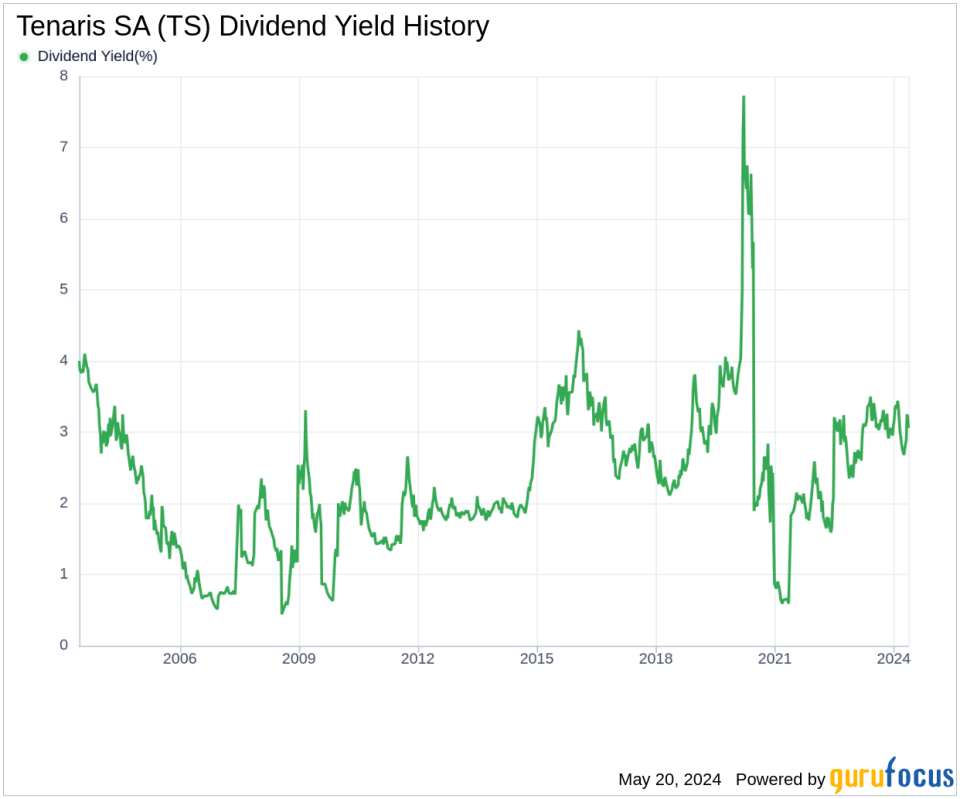

Examining Tenaris SA's Dividend Yield and Growth

Currently, Tenaris SA boasts a 12-month trailing dividend yield of 3.08% and a 12-month forward dividend yield of 3.42%, indicating anticipated growth in dividend payments over the next year. Over the past three years, the company's annual dividend growth rate was an impressive 104.40%, though it moderated to 10.30% per annum over five years. Over the past decade, the growth rate has been -2.30% annually. The 5-year yield on cost for Tenaris SA stock as of today is approximately 5.03%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of Tenaris SA's dividends can be gauged by examining its dividend payout ratio, which stands at 0.19 as of 2024-03-31. This low ratio indicates that the company retains a substantial portion of its earnings, bolstering funds for future growth and resilience against downturns. Furthermore, Tenaris SA's profitability rank is 7 out of 10, reflecting solid earnings capability. The company has reported net profit in 8 of the past 10 years.

Future Growth Prospects

To sustain dividends, a company needs robust growth metrics. Tenaris SA's growth rank of 7 suggests a promising growth trajectory. The company's revenue per share and a 3-year revenue growth rate of approximately 47.80% per annum outperform about 90.57% of global competitors, indicating a strong revenue model.

Conclusion

Considering Tenaris SA's consistent dividend payments, robust dividend growth rate, low payout ratio, strong profitability, and promising growth metrics, the company presents an attractive prospect for value investors focused on dividend income. For those interested in exploring further, GuruFocus Premium offers tools like the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.