Tesla 4Q earnings top expectations, company sees 500K+ deliveries in 2020

Tesla’s (TSLA) stock surged after the company posted fourth-quarter results that handily topped consensus expectations, which came in the wake of a faster-than-expected launch of local production in China and record deliveries at the end of last year.

Here were the main metrics from the Tesla’s fourth-quarter 2019 report, compared to consensus expectations compiled by Bloomberg:

Revenue: $7.38 billion vs. $7.06 billion expected

Adjusted earnings per share: $2.14 vs. $1.74 expected

The stock, up more than 10% in after-hours trading Wednesday, held onto most of these gains into market open Thursday. Tesla’s shares hit a fresh record high Thursday, soaring 10% to $639 per share shortly after market open.

Tesla also guided toward an increase in deliveries over last year and said vehicle deliveries “should comfortably exceed 500,000 units” in 2020. Tesla handed over about 367,500 units in 2019, or a level consistent with the company’s prior guidance range. Fourth-quarter deliveries totaled around 112,000.

“Due to ramp of Model 3 in Shanghai and Model Y in Fremont, production will likely outpace deliveries this year,” the company said in a statement Wednesday. “Both solar and storage deployments should grow at least 50% in 2020.”

First-quarter results could be temporarily impacted by the coronavirus outbreak, Tesla CFO Zachary Kirkhorn told investors during an earnings call Wednesday. Tesla anticipates a one to one-and-a-half week delay to its ramp of Shanghai-built Model 3 units due to a government required factory shutdown in the region, he said. Kirkhorn said the company is also monitoring for supply chain interruptions for cars built in Fremont, but so far is “not aware of anything material.”

In its earnings release, Tesla said it expected production for its Model Y vehicle would begin at its newly opened Shanghai Gigafactory in 2021. Tesla’s Fremont factory has already begun ramping production for the Model Y this month, or ahead of schedule, the company said, and Model Y deliveries will begin by the end of the current quarter.

Tesla said installed production capacity for the Model 3 and Model Y combined is now 400,000 units per year, and that it is adding machinery across its factories to boost that level to 500,000 units per year.

The company’s cash position also improved during the fourth quarter, further assuaging cash balance concerns that had once been a point of scrutiny. Cash and cash equivalents improved by $930 million to a record $6.3 billion during the quarter, which Tesla said was driven “through persistent cost control across the business.”

Automotive gross margin, a closely watched measure for Tesla, narrowed to 22.5% in the fourth quarter from 22.8% last quarter and 24.3% in the same period last year. Tesla attributed this to a higher proportion of lower-margin Model 3 vehicles being sold, as well as various reductions to vehicle prices.

“We do not expect ASP (average selling price) to change significantly in the near term, which means volume growth and revenue growth should correlate more closely this year,” Tesla said. The company also said it expects positive GAAP net income going forward, except in certain cases including around the launch and ramp of new products.

“Continuous volume growth, capacity expansion and cash generation remain the main focus,” it said.

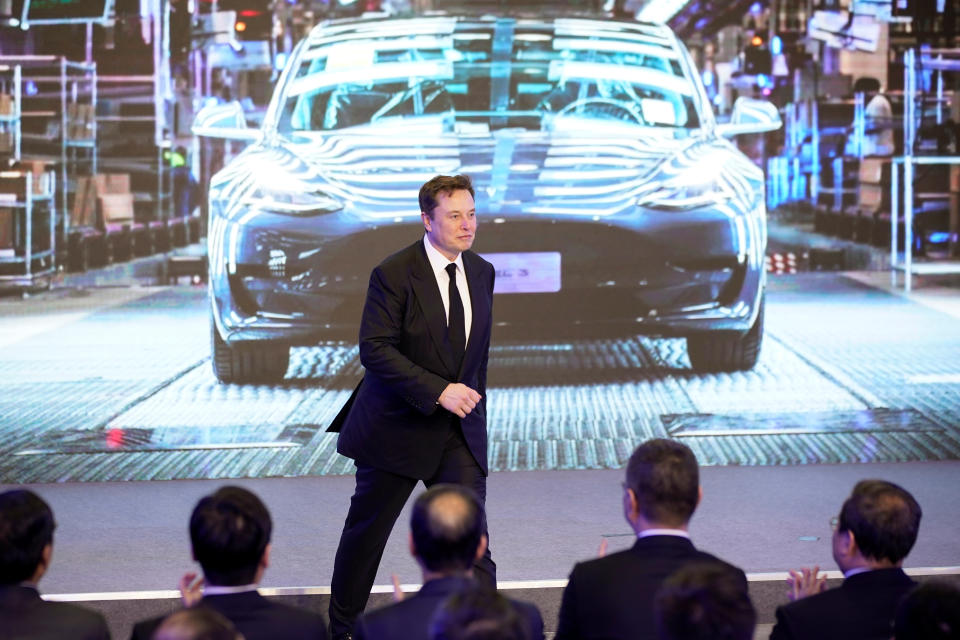

Tesla’s latest earnings report comes on the heels of a soaring performance for its stock. The stock has more than doubled since its third-quarter earnings results in October, surging well above the $420 per-share level CEO Elon Musk once considered in a dropped plan to take the company private. That’s brought the company’s market capitalization to more than $100 billion, or more than that of General Motors and Ford combined.

The stock closed at a then-record of $580.99 per share on Wednesday, and jumped above the $650 per-share level after market close.

Those share gains coincided with a surprise third-quarter profit, record-breaking delivery results in the last three months of the year and a faster-than-expected completion of the company’s Shanghai Gigafactory.

Tesla delivered its first cars built at its Shanghai Gigafactory to local Chinese customers earlier this month, having ramped up production to 1,000 cars per week in China less than a year after breaking ground on the facility.

Updates with opening share prices Thursday, Jan. 30.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Bridgewater: Stocks are more expensive in the U.S. than anywhere else in the world

Netflix 4Q subscriber growth tops expectations, but guidance disappoints

Tesla has a ‘key advantage’ over other automakers, analyst says

Why traders playing oil like it’s 2010 are ‘getting their heads handed to them’

Valuations aren’t overstretched after record year for stocks, strategist says

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news