Analyst: Tesla is like ‘Blackberry when the iPhone came out’

Some (but not all) analysts view Tesla’s (TSLA) latest earnings beat — a rare win for a vehicle manufacturer with a wobbly production and delivery track record, sparse history of profitability, and an erratic chief executive — as a fluke.

And one bearish analyst argues that with looming luxury electric vehicle competition from other automakers means that Tesla’s prospects are more uncertain than ever.

“Tesla is … like Palm Pilot when the Blackberry [BB] came out, or it’s like Blackberry when the iPhone [APPL] came out,” Mark B. Spiegel, a managing member of Tesla-shorting Stanphyl Capital, told Yahoo Finance’s Final Round on Thursday. “It was a first gen product, and these other products are better built and are nicer inside too.”

‘Massive competition in every aspect’

Tesla may be “the biggest single stock bubble in this whole bubble market,” Spiegel wrote in an upcoming note to investors. Tesla carries a troubled balance sheet even in the absence of direct competitors, “but will soon be confronted with massive competition in every aspect of its business,” he added. Tesla has about $3 billion in cash on hand and burned through about $1.8 billion in cash in the first half of 2018.

Spiegel cited upcoming electric vehicle offerings from Jaguar and Volkswagen as sources of concern for Tesla in the luxury EV space. Jaguar’s (TTM) first all-electric vehicle, the I-Pace, hits US dealer lots in November, and the model has been deemed “legitimate competition” to Tesla for its comparable price points and similar goal of targeting the luxury EV market. The Audi (NSU.DE) E tron and the Porsche (PAH3.DE) Taycan, both electric vehicles, are also slated to enter the playing field in the coming months.

Likewise, Volkswagen CEO Herbert Diess recently said the company will come out with vehicles “that can do anything like Tesla” at half the price in 2020, according to a report by electric vehicle blog Electrek. Volkswagen plans to partner with Korean company SK Innovation for a Gigafactory to build battery cells, according to reports from German publication Manager Magazin. During Tesla’s third-quarter earnings call with investors, CEO Elon Musk said that Tesla’s investment in its Gigafactory a major competitive edge.

“The fact of the matter is we made the investment in the Gigafactory and other companies didn’t…but I’m sure they will over time,” Musk said. “But that’s what has put us in quite a strong competitive position right now.”

‘A busted growth story’

In the wake of the competition, Spiegel doesn’t think Tesla will be able to keep pace.

“I thought there was some chance that we’d see a near-term bankruptcy on Tesla – that’s probably off the table,” Spiegel said. “So now what we basically have is a busted growth story.”

Spiegel isn’t alone in his skepticism of the stock following Tesla’s blowout quarterly results, which sent shares soaring.

“We question if this is not as good as it gets for a near-term upside surprise for shares,” Goldman Sachs analyst David Tamberrino wrote in a note Thursday.

Tamberrino added that the company’s exposure to China tariffs on imported components will pose headwinds, and gross margins will “likely compress sequentially” into the fourth-quarter as the company lowers the price points on its vehicles. He rates the stock a Sell but raised his 12-month price target to $225 from $200 on account of the company’s near-term execution.

Others question Musk’s promises for sustained profitability and positive cash flow. UBS analyst Colin Langan, who rates Tesla a Sell with a price target of $190, noted the company will eventually need additional outside funding due to “limited Model 3 profitability, infrastructure expansion needs [and] Model Y capacity build.” Musk, however, reiterated Wednesday that Tesla is not seeking an additional debt or equity raise during a call with investors.

Tesla’s recent performance as of late did convert at least a few skeptics. Wolfe Research upgraded Tesla’s stock to Outperform from Peerperform after the company’s quarterly results. Earlier this week, noted short seller Andrew Left of Citron Research changed his position and bet on the stock, calling the Model 3 “a proven hit.”

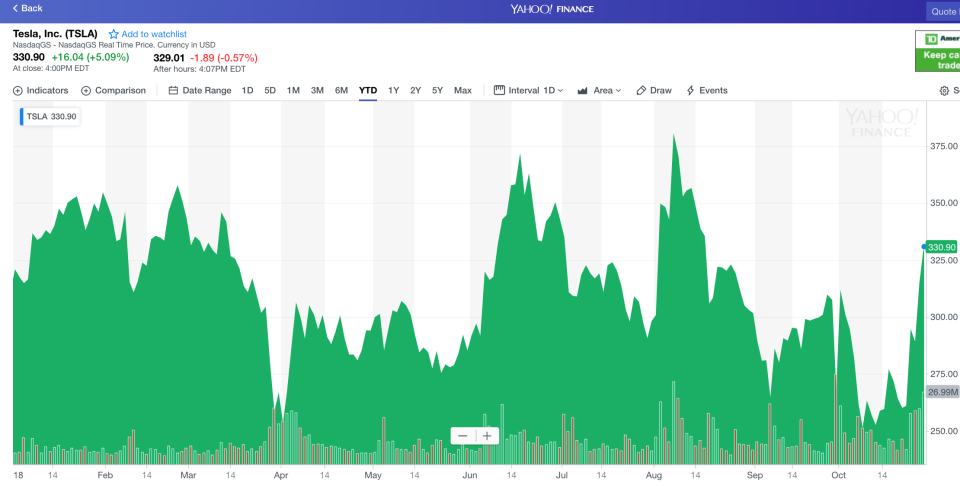

Tesla’s stock is up 27% this week as of market close Friday but is down 15% from its year-to-date intraday high of $387.46. The stock pared gains during intraday trading Friday after the Wall Street Journal reported that the FBI escalated a criminal probe into whether Tesla misstated information about vehicle production and business operations.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more about Tesla:

Tesla reports surprise profit, stock surges

Tesla bull explains why the profitable trend is ‘long-term sustainable’