The 2 most horrific stats from Wells Fargo’s disastrous September

Wells Fargo (WFC) saw a sharp drop in new account openings in September, a month during which the bank made national headlines for defrauding its customers.

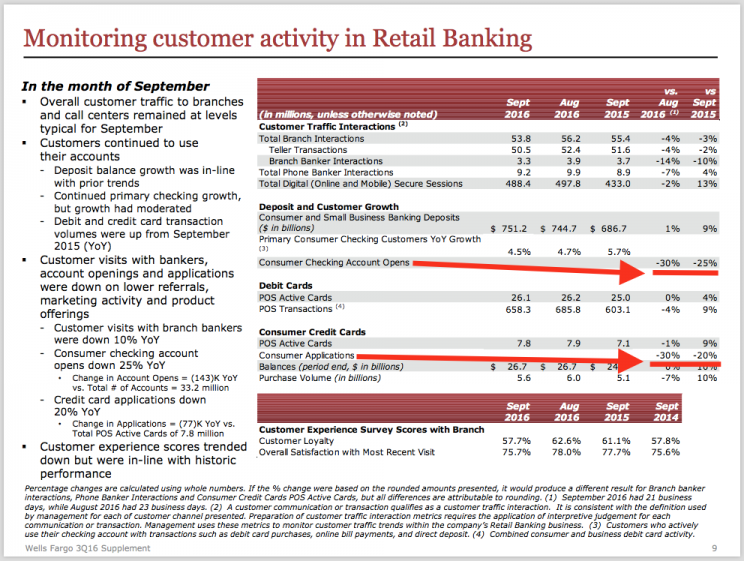

On Thursday, the company announced earnings declined from a year ago. But its earnings presentation was a little different this year, with a giant section finally painting the bank’s fraudulent account openings in great detail. The fallout from the cross-selling scandal that stemmed from its draconian sales goals that led to 5,300 lower-level employees being fired echoed through the presentation’s slides, but perhaps nowhere worse than in the number of account openings.

The news broke on September 8th, as the bank settled with the Consumer Financial Protection Bureau for a $100 million fine, the largest in its brief history. The bank also settled with the City of Los Angeles and the Office of the Controller of the Currency for another $85 million. The news percolated up in the news cycle until September 20th, when it reached the front page after a Pacino-esque grilling from Massachusetts Senator Elizabeth Warren that went viral and got the public truly angry in the following days.

Even though Wells Fargo’s worst days in terms of PR cleanup came in the final 10 days in September, two numbers indicate just how horrible consumers saw the 565,000 credit cards without permission.

Compared to August, consumers decided to apply for 30% fewer credit cards. And compared to last September, 25% fewer. For a financial industry that usually talks in “bips,”—increments of 0.01%—this is a massive number.

For the other aspect of the scandal, the deposit side, the numbers paint an equally grim picture of consumer sentiment.

Consumer checking account openings, which like credit cards, had enjoyed a good run in the black, took enormous stumbles as well. Year-over-year, the bank saw 25% fewer checking accounts opened and a whopping 30% fewer in comparison to August.

These numbers are only the beginning. Considering that much of the public hadn’t paid particularly close attention until the viral videos of CEO John Stumpf’s grilling by the Senate Banking Committee—and then the House Financial Services Committee. The public won’t see really the extent of the damage until the Q4 call happens on January 13th.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumerism, tech, and personal finance. Follow him on Twitter @ewolffmann.

Read more:

Amazon’s free stuff policy wrecks its reviews

Where is the $60 million Wells Fargo clawed back from its executives going?

Basic math shows why chip cards are sending ripples through retail

How Elizabeth Warren used a new Congressional Power to punish Wells Fargo