The Fed has a little-known tool to address economic inequality

The Federal Reserve’s efforts to backstop financial markets have attracted criticism for boosting asset prices while America’s low-earners continue to struggle to make ends meet. But the Fed has a potent, lesser-known tool to address inequality: the Community Reinvestment Act.

“The Community Reinvestment Act (CRA) is one of the most powerful tools we have for addressing systemic inequities in credit access for minority individuals and communities,” Fed Governor Lael Brainard said on October 15.

The CRA, passed by Congress over 40 years ago, broadly requires banks to lend and invest in low- and moderate-income communities where the bank has physical branch locations. The idea: to ensure that banks are not discriminating against poorer communities, offering them the same access to credit as wealthier communities.

A poor score on a CRA assessment can have enormous consequences, such as slowing merger deals or sinking plans for new branches.

The Fed has become increasingly mindful of the wealth and income gap in the United States, observing in 2019 that extended periods of low interest rates had the effect of pulling in lower-income and minority workers without any inflationary consequences.

The murder of George Floyd in May appeared to weigh on Fed Chairman Jerome Powell, who kicked off his June press conference by acknowledging “issues of racial equality” — a notable development for an institution that tends to shy away from commenting on social issues.

Jesse Van Tol, CEO of the advocacy group National Community Reinvestment Coalition, has liaised with the Fed on CRA-related issues over the course of his 14 years with the organization. He notes that there has been a change in tone under the leadership of former Fed Chair Janet Yellen, and now Powell.

“They are more focused than they ever have before on racial income inequality,” Van Tol told Yahoo Finance.

The racial wealth gap

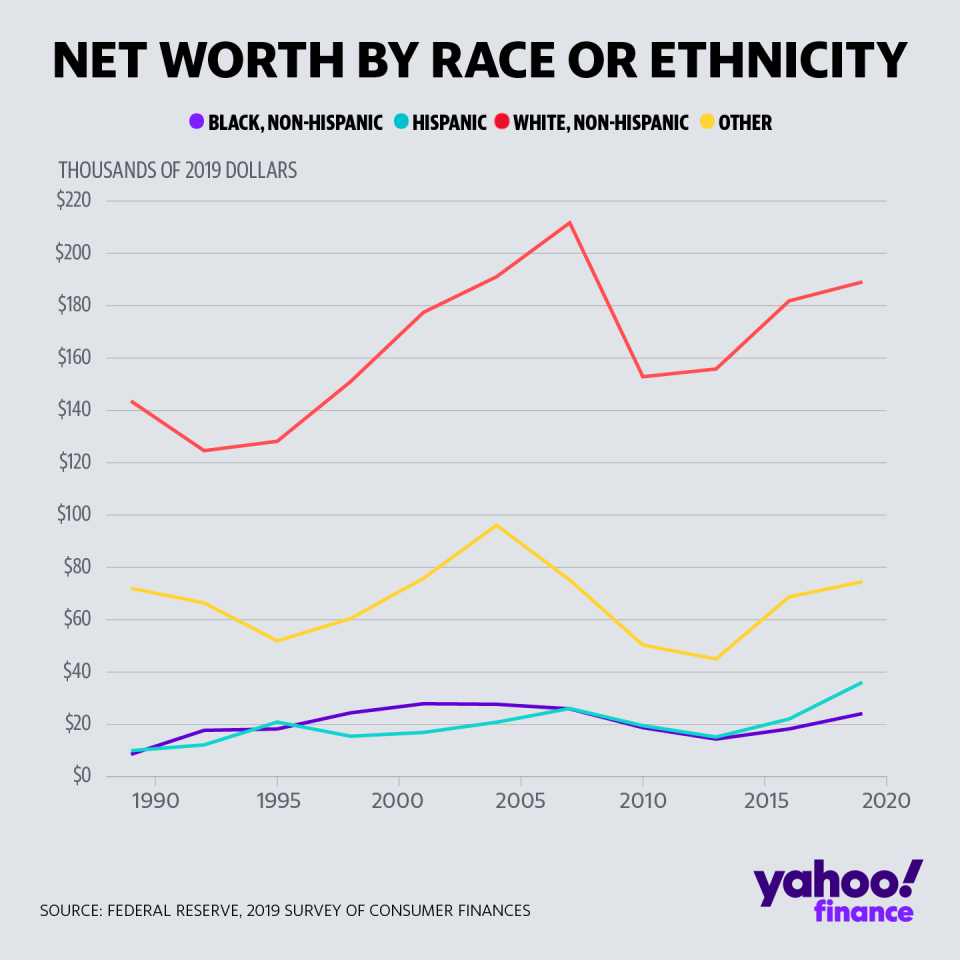

Data from the Fed’s Survey of Consumer Finances illustrates the enormous racial wealth gap; the median white family in 2019 had a net worth of $189,100, almost eight times the median Black family’s net worth of $24,100.

With no Congressional mandate to target specific metrics like the Black unemployment rate, Fed officials have countered that monetary policy tools like interest rates and quantitative easing are “blunt” instruments that cannot be localized.

Fed officials are championing a new approach to low interest rates as a way to pay greater mind to employment among lower wage earners. Still, those inside the Fed have acknowledged that monetary policy doesn’t translate easily to America’s average worker.

“If you can’t pay your rent, what is the Fed doing more QE going to do for you?” Minneapolis Fed President Neel Kashkari said on October 7.

Change ahead

In September, the Fed unveiled its first attempt at reforming its approach to the CRA. Brainard, the Obama-appointee who headed the CRA efforts, is rumored to be a top candidate for Treasury Secretary or Fed Chair under a Joe Biden administration.

The Fed’s advance notice of proposed rulemaking would assess bank compliance based on a “retail lending” test (consumer, business loans) and a “community development” test (investment and financing of community projects like affordable housing).

The two-test approach differs from a proposal from the Office of the Comptroller of the Currency (OCC), another bank regulator that polices CRA compliance. Under former Comptroller Joseph Otting, the agency raced to finalize a CRA rule in May that uses several pass/fail tests but ultimately a single metric for overall compliance.

The Fed’s proposed rule also includes lengthy detail on the history of the CRA and its purpose — absent from the OCC final rule. The Fed noted the “harmful legacy of redlining,” the discriminatory act of refusing to extend credit in certain communities, and emphasized the need to address “inequities” — a word again absent from the OCC proposal.

The third major banking regulator, the Federal Deposit Insurance Corporation (FDIC), joined the OCC’s original proposal but did not sign onto its final rule. It is highly unusual for the banking agencies not to move in lockstep together.

Fed officials have urged people to comment on the Fed’s proposal, which is open to public feedback through February of next year.

“The work that we have been doing and need to continue to do is not just about removing barriers like redlining, but about promoting inclusion,” San Francisco Fed President Mary Daly told reporters on October 13.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed balance sheet hits new record high as QE takes spotlight

COVID-19 leaves unbanked minority communities behind on savings, credit

Powell: Fed open to private sector collaboration in possible digital dollar

Less-educated Asian Americans among hardest hit by job losses during pandemic

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.