The post-election jump in consumer confidence is turning into spending

In the wake of Donald Trump’s election win, economic surveys more or less said the same thing: confidence was up.

Whether it was consumer or business confidence, everywhere you turned in the US economy the mood was getting better.

A mix of hopes for lower taxes, less regulation, and increased fiscal spending, boosted both business leaders and consumers alike. Like the election, however, these surveys showed — particularly at the consumer level — a nation divided.

And so it was an open question about whether there’d really be any follow-through from positive surveys, called “soft data” by economists, into actual hard data like increased spending. On Wednesday, it appears the early answer is that stronger soft data is leading to better hard data.

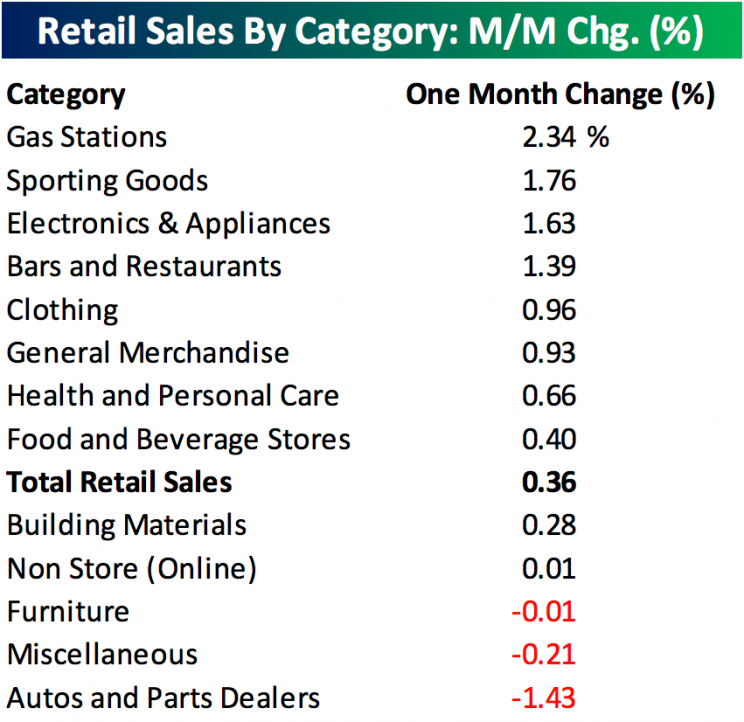

A report out Wednesday from the Census Bureau showed that retail sales in January rose 0.4% over the prior month, more than expected by economists. This is also notable considering that it came against a December report that was revised significantly higher — to 1% sales growth from 0.6% originally.

Sales gains were also strong across the board. “In terms of breadth in this month’s report, just three of the thirteen sectors that make up total Retail Sales showed a [month-on-month] decline in sales in January,” noted analysts at Bespoke Investment Group.

Consumer spending accounts for about 70% of GDP growth, and so continued positive momentum on this front is likely to boost overall economic growth. Over the last 12 months, retail sales are now up 4.9%.

In a note to clients following Wednesday’s retail sales report, Paul Ashworth at Capital Economics wrote that, “The upshot is that the improvement in consumer confidence since President Donald Trump’s election victory now appears to be feeding through into stronger gains in actual spending.”

And so what markets perhaps doubted would come to pass — follow through from better surveys to more spending — has, at least for the time being, played out.

Along with the better-than-expected retail sales numbers, Wednesday morning also featured strong readings on inflation that show an economy which could be close to pressing the Fed to raise rates faster than the market expects.

Headline inflation rose 2.5% over the prior year in January, the most since March 2012. “Core” inflation, which is more closely tracked by economists and the Fed and excludes the prices of food and energy, rose 2.3% over the prior year. The Fed is targeting 2% inflation.

“Net-net, all things consumer show the economy is starting the year off with a bang,” writes Chris Rupkey, chief financial economist at MUFG. “Washington needs to stop talking this economy down.”

Mixed signals

Ian Shepherdson, an economist at Pantheon Macroeconomics, however, cautioned that Wednesday’s numbers aren’t quite as strong as they might appear on first glance.

Shepherdson argues that the consensus numbers for this report were always too low, and that Christmas falling on a Sunday tends to make the December numbers look soft with January showing a big bounce. “Over the two months together, we see little sign that the trend in core sales is accelerating,” Shepherdson writes.

Additionally, Shepherdson’s takeaway from the report is roughly the opposite of how Ashworth and others see these numbers. “In other words, sales are growing at a decent clip,” Shephderson writes, “but the surge in consumers’ confidence since the election is yet to translate into stronger spending.”

Shepherdson also noted that a delay in tax refunds in February should depress this month’s retail sales figure, something Goldman Sachs highlighted in a note out last week.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Why it’s a mistake to get too excited about Trump’s tax cuts

One stock that will reflect the market’s view on US-Mexico relations

The hottest topic during earnings season has not been Donald Trump

For the first time since the recession, America’s biggest companies are shrinking

The stock market’s favorite Trump promise might be a total dud