The recession might be over—but the pain isn’t

The recession that officially began in February might have ended in May, which would make it the shortest downturn on record. But it’s not likely to feel that way, with the painful aftermath of coronavirus shutdowns likely to persist for months or years.

The group of economists that officially determines the start and end dates of recessions said on June 8 that the 2020 recession began in February, ending a business cycle expansion that lasted more than 10 years. The same day, economist Mark Zandi of Moody’s Analytics wrote that “the Covid-19 recession is over. Economists on the business cycle dating committee of the National Bureau of Economic Research will peg February 2020 as the peak of the last expansion and May 2020 as the nadir of this recession.” If Zandi is right, the 2020 recession will have been remarkably short—but also profoundly deep.

Recessions are somewhat misunderstood, because the end of a recession doesn’t mean things are suddenly getting better. All it means is economic output has stopped declining. Unemployment often continues to worsen after a recession is over, because of structural damage that takes a long time to heal. The last recession ended in May 2009 but the unemployment rate rose for another 5 months, peaking at 10% in October 2009.

On average, recessions since the end of World War II have lasted 11 months. So a 3-month recession this year would be far shorter than what is typical. But the 2020 blowout is also far deeper, with real GDP, adjusted for inflation, likely to fall around 12% during the short downturn. The last recession lasted for 18 months, yet real GDP fell just 4%, and that was the worst performance since the 1930s.

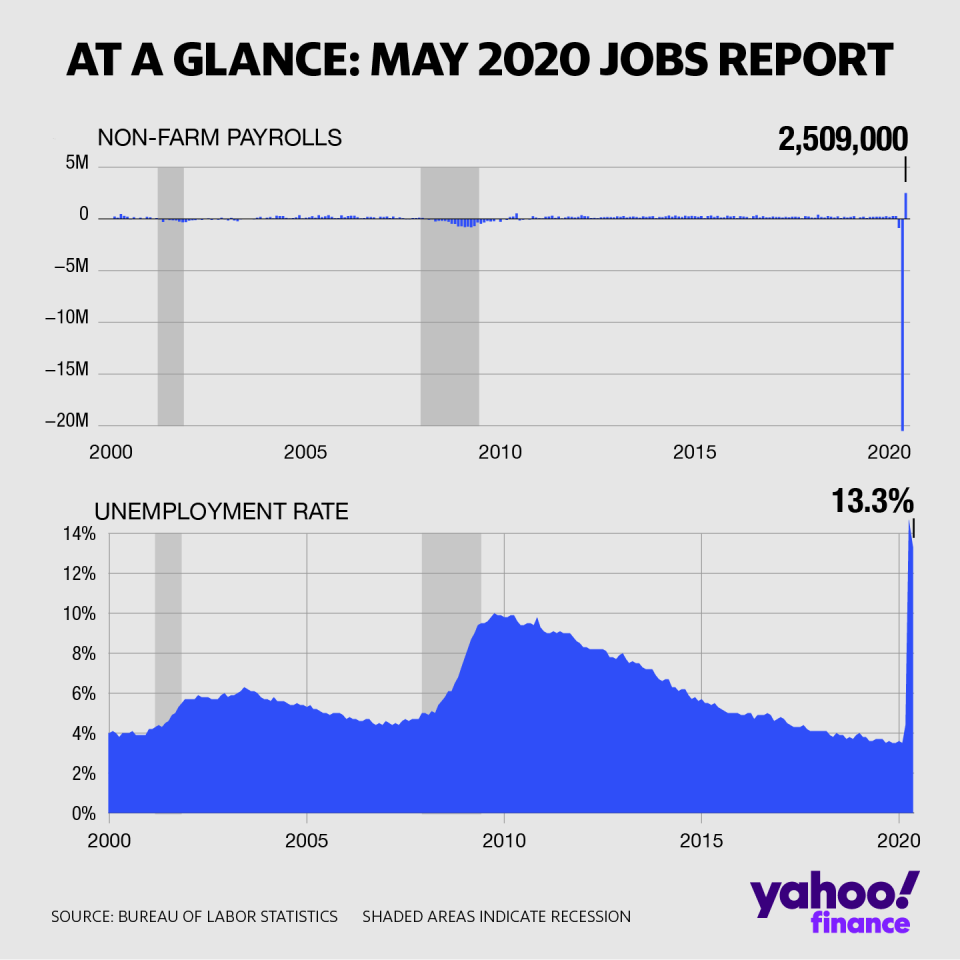

Economists are obviously unsure about how quickly the economy can recover once the recession is officially over. They guessed radically wrong about the labor market in May, forecasting a net loss of 7.5 million jobs, when employers actually added 2.5 million jobs. Part of the problem was a measurement error, however, with the monthly Labor Department survey identifying temporarily furloughed workers as employed and failing to count others who lost their jobs as unemployed. Without those snafus, the unemployment rate would be closer to 19% than to 13.3%, the official figure.

There’s a race against time now to get businesses reopened—and consumers spending money again—before federal stimulus money runs out and some struggling businesses close up for good. As for workers, generous in unemployment benefits are keeping some of the nation’s 21 million unemployed workers above water, but that aid runs out in July. Congress will probably approve more, but some members of Congress also think excessive unemployment aid could create a perverse incentive to remain unemployed instead of going back to work.

President Trump said on June 5 that the economy is recovering like a “rocket ship,” but he’s one of the few who thinks so. Many states allowing businesses to reopen are still limiting capacity at stores and restaurants, and much of the retail sector will be unprofitable at 50% or even 75% of prior business levels. They can’t operate at a loss for long. And the unemployment rolls could swell all over again once the Labor Department sorts out its methodological problems.

Economists think a plunge in second quarter GDP will be followed by a sharp rebound in the third quarter. But the net damage will still be terrible. The Congressional Budget Office told Congress June 9 that the coronavirus recession will slash output by $4 trillion in 2020 and 2021, which is a huge decline in GDP of nearly 9%. CBO expects 0% real growth from the end of 2019 to the end of 2021. So while the economy might improve on a month-to-month basis for the rest of 2020, it will remain far short of where before the coronavirus arrived.

This is an existential threat for Trump’s political career. He has signaled that he’ll play up and exaggerate improvements in the economy, while overlooking high joblessness, falling pay and fading prosperity. In 2014, President Obama kept talking up improvements in economic data as he tried to convince voters his economic plan was succeeding. Voters didn’t feel the improvement Obama saw in the data, and they dealt his Democratic party historic losses in that year’s midterms. By this year’s election in November, Trump will undoubtedly be declaring victory against a recession that might have ended months earlier. But the end of a recession is only the start of the comeback.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: [email protected]. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Get the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.