There’s a new barrier to a fourth stimulus bill

Markets are relieved to have a clear election outcome (and encouraging news on a coronavirus vaccine). But the post-election political landscape diminishes the prospects for another market priority: a big new stimulus bill to counteract the coronavirus recession.

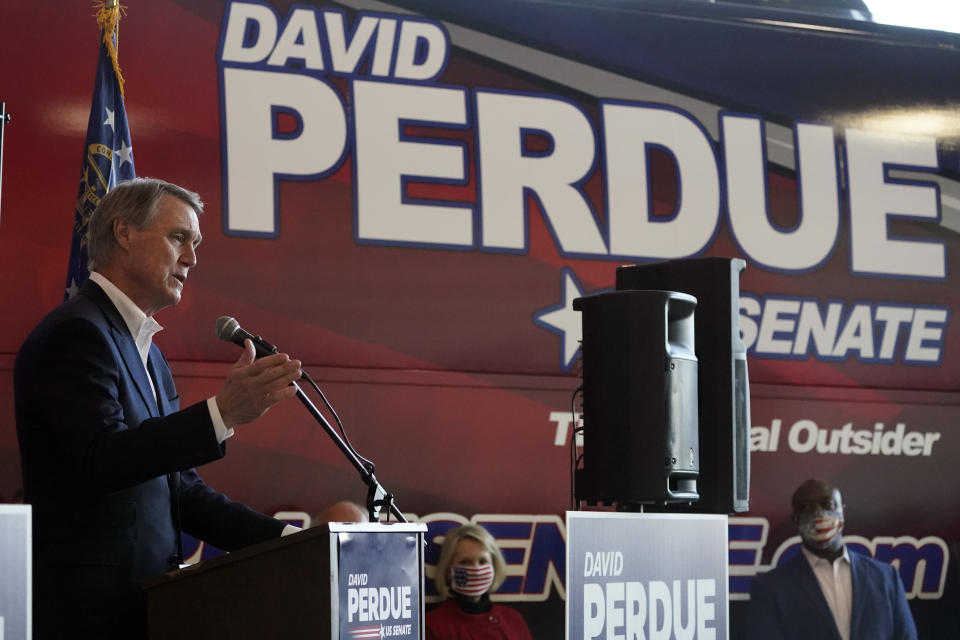

After three months of pretending to try, Democrats and Republicans abandoned stimulus negotiations in late October, with both sides vowing to restart talks after Election Day. Analysts predicted a more earnest legislative effort when neither side would have to posture for electoral advantage. But the posturing continues, since two runoff races for Senate seats in Georgia on Jan. 5 are now set to determine the makeup of the Senate. This new political landscape is likely to push a fourth stimulus bill into 2021 and make it considerably smaller than many investors would like.

House Speaker Nancy Pelosi clearly stalled on a bill prior to the election, hoping Democrats would win the White House and the Senate and gain the leverage to pass a huge spending bill similar to the $2.3 trillion package the House passed in May. She miscalculated. The “blue wave” many polls predicted didn’t materialize and Republicans, for now, still hold a narrow edge in the Senate.

The best Democrats can now hope for is a 50-50 tie if they win both Georgia runoffs. That would give them de facto control, since incoming Vice President Kamala Harris would break tie votes. But odds are Republicans will hold at least one of those seats. And even if Democrats had a 1-vote advantage, they’d still have to appease at least three moderate senators in their party, who hail from purple or red states and are not likely to vote for lavish spending bills.

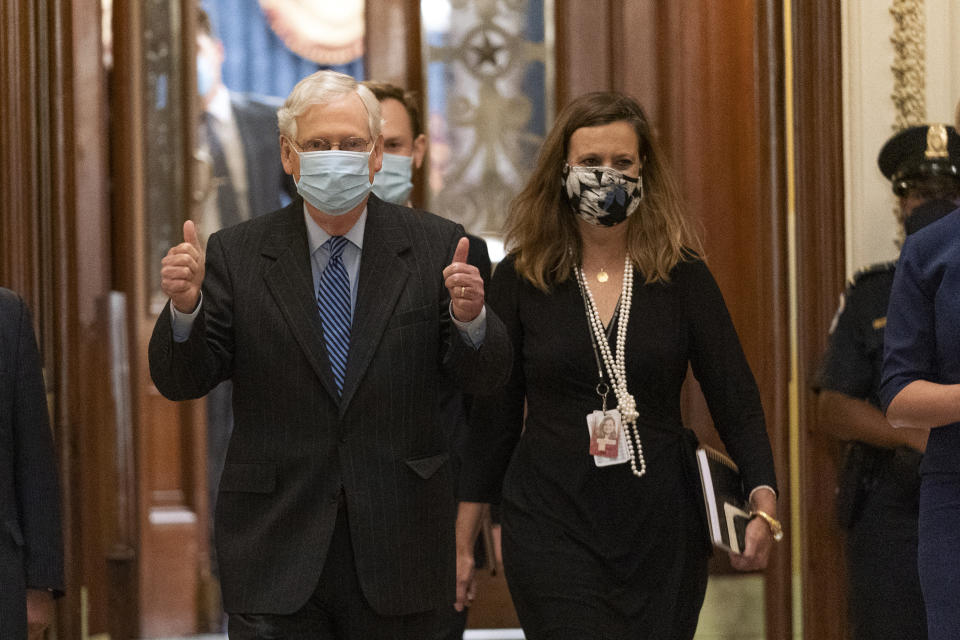

Before the election, Pelosi and the Trump White House were close to agreeing on a deal for close to $2 trillion in new stimulus spending. But Senate Republicans weren’t on board, and Senate Majority Leader Mitch McConnell signaled the upper chamber might only support something in the range of $300 billion to $650 billion. With Trump on his way out, the White House no longer has a political incentive to ink a large deal. So Pelosi and McConnell will now most likely pursue a bill without Trump pushing for a bigger price tag.

‘Distrust in the lame duck’

The current lame-duck Congress still has to pass a funding bill in December to keep the government running, and there will probably be some chatter about Congress passing a stimulus bill as part of that package. But don’t count on it. “It is difficult to see how Washington can claw through the fog of disdain and distrust in the lame duck,” writes Isaac Boltanksy of Compass Point Research & Trading. “We believe that fiscal negotiations will be reset in the new year.”

Both sides will be factoring in the Georgia runoffs as they formulate a new deal. Pelosi could continue holding out for two wins in Georgia and a Democratic Senate majority that would go bigger than McConnell would. But Pelosi also caught some grief for stalling on a stimulus bill in October, and she might not want to continue playing it that way.

McConnell will be careful to offer something prior to the Georgia elections, lest Republicans seem like they’re blocking aid for needy Americans, which could tilt some Georgia voters in the Democrats’ direction. But he’ll also want to appeal to conservatives in Georgia who don’t want another large stimulus bill. The most likely outcome is more talk but little action, with both sides holding out until the outcome in Georgia is clear.

There’s yet another wild card: a coronavirus vaccine. McConnell has already cited the improving job market to buttress his argument for a smaller stimulus bill. And the news that Pfizer’s vaccine—one of several being developed—has succeeded in early tests is one more sign that the end of the coronavirus crisis is coming into view. It will still be months, at best, before a vaccine is widely available. But the impact on stimulus negotiations could come sooner.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: [email protected]. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Get the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.